H.C. Wainwright has begun coverage of Travere Therapeutics (TVTX, Financial), recommending a Buy with a price target of $30. A central aspect of their analysis is the launch of Filspari in the United States. This drug stands out as the first fully approved kidney-targeted therapy that does not suppress the immune system. Filspari aims to potentially replace the current standard treatments for kidney issues.

The company sees a significant opportunity in positioning Filspari as an earlier treatment option for IgA nephropathy (IgAN). The move is part of Travere Therapeutics' broader strategy to capitalize on this unique market position. Investors are being advised to consider this development when assessing the company’s growth potential.

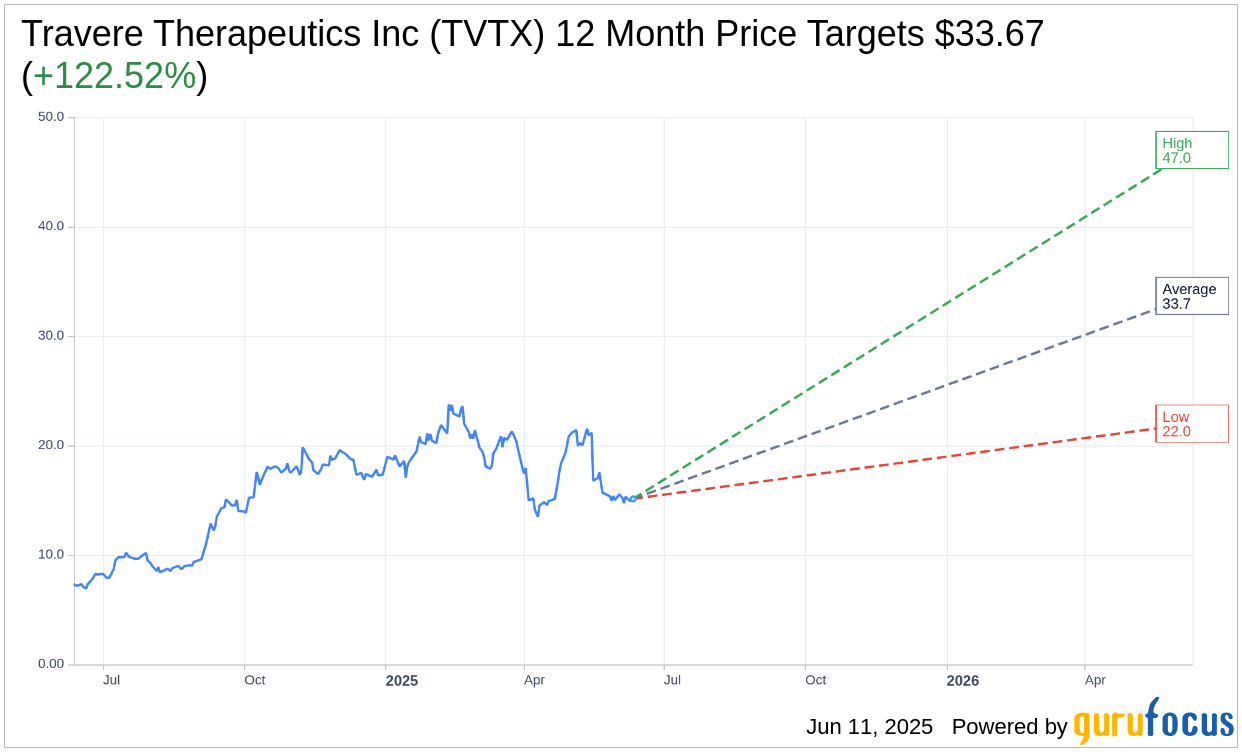

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Travere Therapeutics Inc (TVTX, Financial) is $33.67 with a high estimate of $47.00 and a low estimate of $22.00. The average target implies an upside of 122.52% from the current price of $15.13. More detailed estimate data can be found on the Travere Therapeutics Inc (TVTX) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Travere Therapeutics Inc's (TVTX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Travere Therapeutics Inc (TVTX, Financial) in one year is $38.98, suggesting a upside of 157.63% from the current price of $15.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Travere Therapeutics Inc (TVTX) Summary page.

TVTX Key Business Developments

Release Date: May 01, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Travere Therapeutics Inc (TVTX, Financial) reported a 182% year-over-year growth in net sales, indicating strong demand and uptake for their products.

- The company received full approvals for their product in Europe and the UK, expanding their market reach.

- Travere Therapeutics Inc (TVTX) completed their NDA submission for an FSGS indication, potentially making their product the first approved medication for this condition.

- The company is making progress in their Phase 3 HARMONY study for classical homocystinuria, aiming to restart patient enrollment next year.

- Travere Therapeutics Inc (TVTX) maintains a strong financial position with $322.2 million in cash, cash equivalents, and marketable securities, providing flexibility for future investments.

Negative Points

- Despite strong sales growth, Travere Therapeutics Inc (TVTX) reported a net loss of $41.2 million for the first quarter of 2025.

- The company anticipates increased generic competition for their products, which could impact future sales.

- Higher gross-to-net discounts are expected throughout 2025, potentially affecting profitability.

- Travere Therapeutics Inc (TVTX) faces uncertainties related to legislative developments and geopolitical factors that could impact their operations.

- The company is still awaiting FDA acceptance of their NDA submission for FSGS, which introduces regulatory risk.