Cabaletta Bio (CABA, Financial) has unveiled promising updates from its ongoing RESET-Myositis, RESET-SLE, and RESET-SSc trials, which are examining the efficacy of rese-cel. These findings are being shared through three presentations at the European Alliance of Associations for Rheumatology (EULAR) 2025 Congress in Barcelona, taking place from June 11-14.

The presented data reveal significant advancements, highlighting that a single, weight-based dose of rese-cel leads to extensive B cell depletion and favorable clinical outcomes in patients with myositis, lupus, and systemic sclerosis. Notably, most patients have been able to discontinue use of immunomodulators and steroids.

From the RESET-Myositis trial, 7 out of 8 participants exhibited clinical responses without immunomodulators, with 3 attaining major clinical improvements. In the RESET-SLE trial, all 7 patients showed responses without glucocorticoids. For RESET-SSc, significant skin score improvements were noted in the severe skin cohort.

Moreover, the rese-cel translational profile demonstrated swift expansion within two weeks post-infusion, with B cell reductions observed within the first month and a subsequent repopulation by month two.

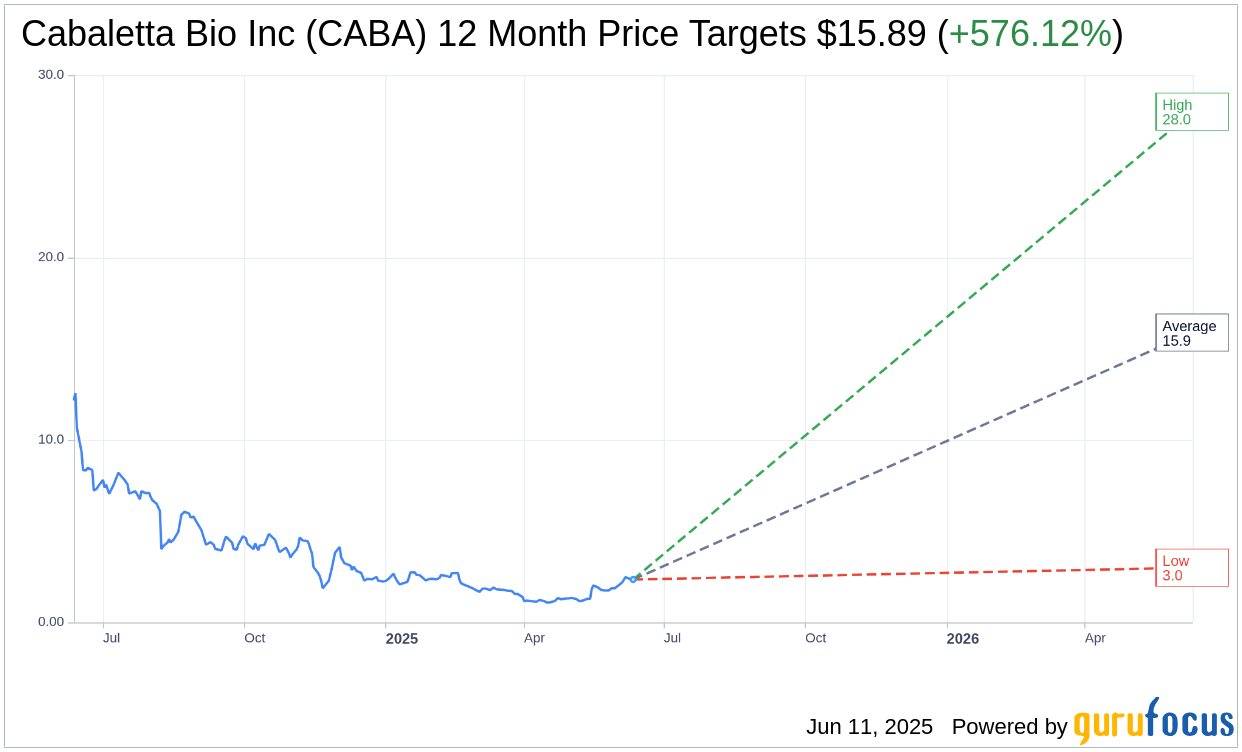

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Cabaletta Bio Inc (CABA, Financial) is $15.89 with a high estimate of $28.00 and a low estimate of $3.00. The average target implies an upside of 576.12% from the current price of $2.35. More detailed estimate data can be found on the Cabaletta Bio Inc (CABA) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Cabaletta Bio Inc's (CABA, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.