Ouster's (OUST, Financial) OS1 digital lidar has been officially approved by the Department of Defense (DOD) for deployment in unmanned aerial systems (UAS). This decision follows thorough assessments of components and cybersecurity evaluations conducted by the Defense Innovation Unit. Subsequently, the OS1 lidar has been incorporated into the Blue UAS Framework. This framework is a comprehensive strategy designed to expedite the evaluation and expansion of commercial UAS technologies for defense purposes.

The Blue UAS Framework lists approved, interoperable components that comply with the National Defense Authorization Act (NDAA), providing viable options for both government and industry stakeholders. Notably, Ouster's OS1 is the first high-resolution 3D lidar sensor granted approval under this initiative. It distinguishes itself by offering enhanced performance in terms of weight, power efficiency, and dependability in harsh environments compared to existing 2D lidar solutions.

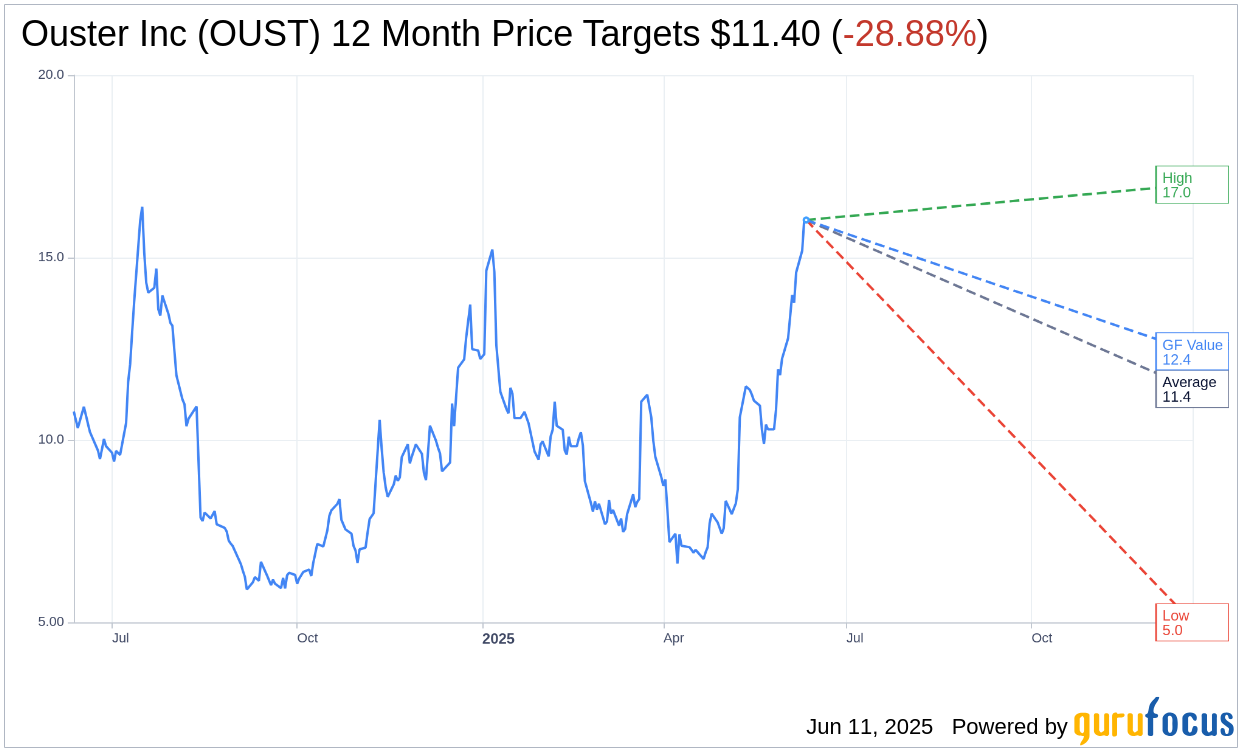

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Ouster Inc (OUST, Financial) is $11.40 with a high estimate of $17.00 and a low estimate of $5.00. The average target implies an downside of 28.88% from the current price of $16.03. More detailed estimate data can be found on the Ouster Inc (OUST) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Ouster Inc's (OUST, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Ouster Inc (OUST, Financial) in one year is $12.43, suggesting a downside of 22.46% from the current price of $16.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Ouster Inc (OUST) Summary page.

OUST Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Ouster Inc (OUST, Financial) reported a strong revenue of $32.6 million and a gross margin of 41% for the first quarter of 2025.

- The company shipped over 4,700 sensors in the first quarter, indicating robust demand across its verticals.

- Ouster Inc (OUST) secured multi-million dollar deals in all four of its verticals, including a significant contract with Komatsu for autonomous mining equipment.

- The company expanded its software-attached business, landing its largest ever contract for software-attached sales in Europe.

- Ouster Inc (OUST) maintains a strong balance sheet with $171 million in cash and equivalents and zero debt, positioning it well for future growth.

Negative Points

- Operating expenses increased by 12% year-over-year, primarily due to higher litigation expenses.

- The company faces uncertainty in the geopolitical and macroeconomic environment, which could impact future demand.

- Ouster Inc (OUST) has not yet broken out the contribution of its software business to gross margins, despite its growth.

- There is ongoing uncertainty regarding the impact of tariffs on costs, although current levels are not significantly affecting the business.

- The competitive landscape remains challenging, with other LIDAR companies potentially entering Ouster Inc (OUST)'s non-automotive markets.