- Ouster's OS1 digital lidar gains Department of Defense approval, spiking stock prices.

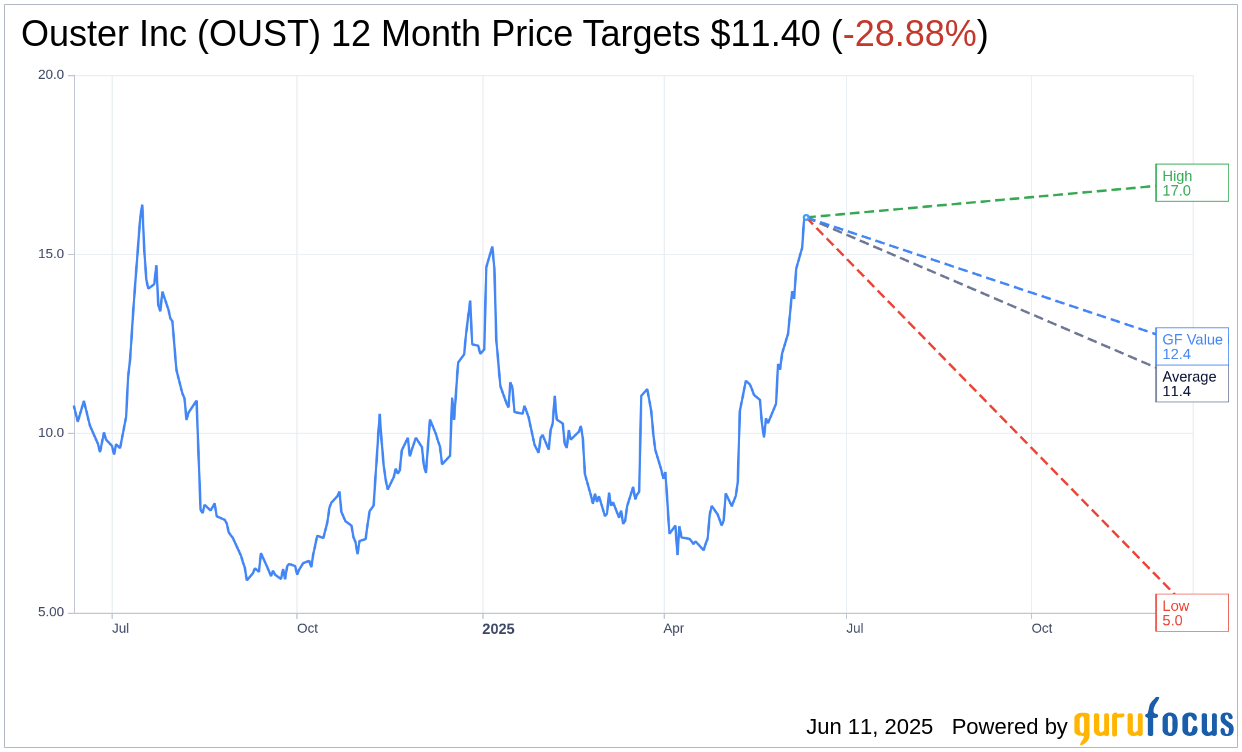

- Analyst projections indicate a potential decline from the current price of $16.03.

- GF Value suggests a significant downside, emphasizing the need for strategic investment decisions.

Ouster Inc. (NYSE: OUST) experienced a remarkable 21% surge in premarket trading on Wednesday. This uptick came on the heels of the Department of Defense (DoD) approving its OS1 digital lidar technology for use in unmanned aerial systems. The OS1 now holds the distinction of being the first high-resolution 3D lidar sensor sanctioned within the Blue UAS Framework, marking a significant milestone for the company.

Wall Street Analysts Forecast

According to insights from five analysts, the forthcoming year presents a mixed outlook for Ouster Inc. (OUST, Financial). The average price forecast is pegged at $11.40, with estimates ranging from a high of $17.00 to a low of $5.00. Given the current trading price of $16.03, this average target suggests a potential downside of 28.88%, urging investors to exercise diligence when considering their positions in the stock.

Consensus among five brokerage firms places Ouster Inc.'s recommendation rating at 2.2, positioning the stock as "Outperform." This rating system, which spans from 1 (Strong Buy) to 5 (Sell), provides a strategic perspective on the stock's performance potential in the market.

Further enhancing the investment narrative, GuruFocus estimates project a one-year GF Value of $12.43 for Ouster Inc. (OUST, Financial). This figure hints at a downside of 22.46% from the current price, underscoring the importance of thorough analysis. The GF Value metric offers a calculated appraisal based on historical trading multiples, previous business growth, and projected future performance metrics. To explore more about these financial estimates, investors are encouraged to visit the Ouster Inc. Summary page.