Key Takeaways

- Cabaletta Bio (CABA, Financial) faced a significant 20% drop in premarket trading due to a mixed securities public offering announcement.

- The company's offering includes common stock and warrants, with underwriters having a 30-day option to purchase an additional 15%.

- Analysts are optimistic, with a consensus "Outperform" recommendation and an average price target significantly above the current stock price.

Cabaletta Bio's Recent Market Movement

Cabaletta Bio (CABA) recently saw a 20% decline in premarket trading, which followed their announcement of a mixed securities public offering. This strategic move involves issuing both common stock and warrants, and gives underwriters a 30-day window to consider purchasing an additional 15% of the offering. The completion of this offering is expected by June 12, 2025, assuming all standard conditions are met.

Analyst Forecast and Recommendations

Price Targets

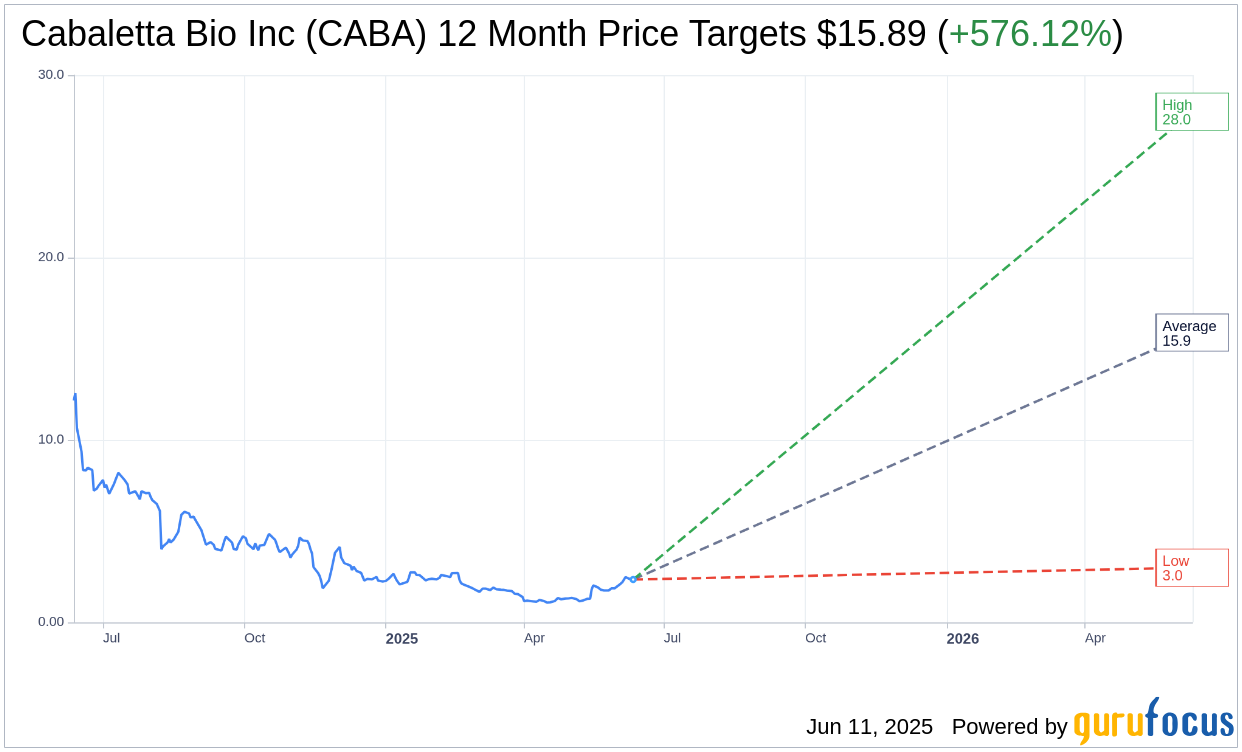

According to price target data from 9 analysts, the average target price for Cabaletta Bio Inc (CABA, Financial) is set at $15.89. Projections show a high estimate of $28.00 and a low estimate of approximately $3.00. Currently priced at $2.35, the average target indicates a potential upside of 576.12%. For more in-depth target estimates, visit the Cabaletta Bio Inc (CABA) Forecast page.

Analyst Ratings

In terms of analyst sentiment, the consensus from 11 brokerage firms gives Cabaletta Bio Inc (CABA, Financial) an average recommendation of 1.8, which falls under the "Outperform" category. This rating is based on a scale from 1 to 5, where a score of 1 indicates a Strong Buy and 5 signifies a Sell.