- Franklin BSP Realty Trust (FBRT, Financial) maintains a quarterly dividend of $0.355 per share, resulting in a 12.76% yield.

- Analysts predict a potential upside of 36.57% with an average price target of $15.20.

- FBRT is rated "Outperform" by analysts, indicating a positive outlook.

Franklin BSP Realty Trust (FBRT) continues to reward its investors with a consistent dividend payout. The company recently declared a quarterly dividend of $0.355 per share, sustaining its previous levels and promising a compelling forward yield of 12.76%. Shareholders who are recorded by June 30 will see their dividends on July 10. Additionally, investors are eyeing FBRT's strategic acquisition of NewPoint, expected to finalize in the third quarter of 2025.

Insights from Wall Street Analysts

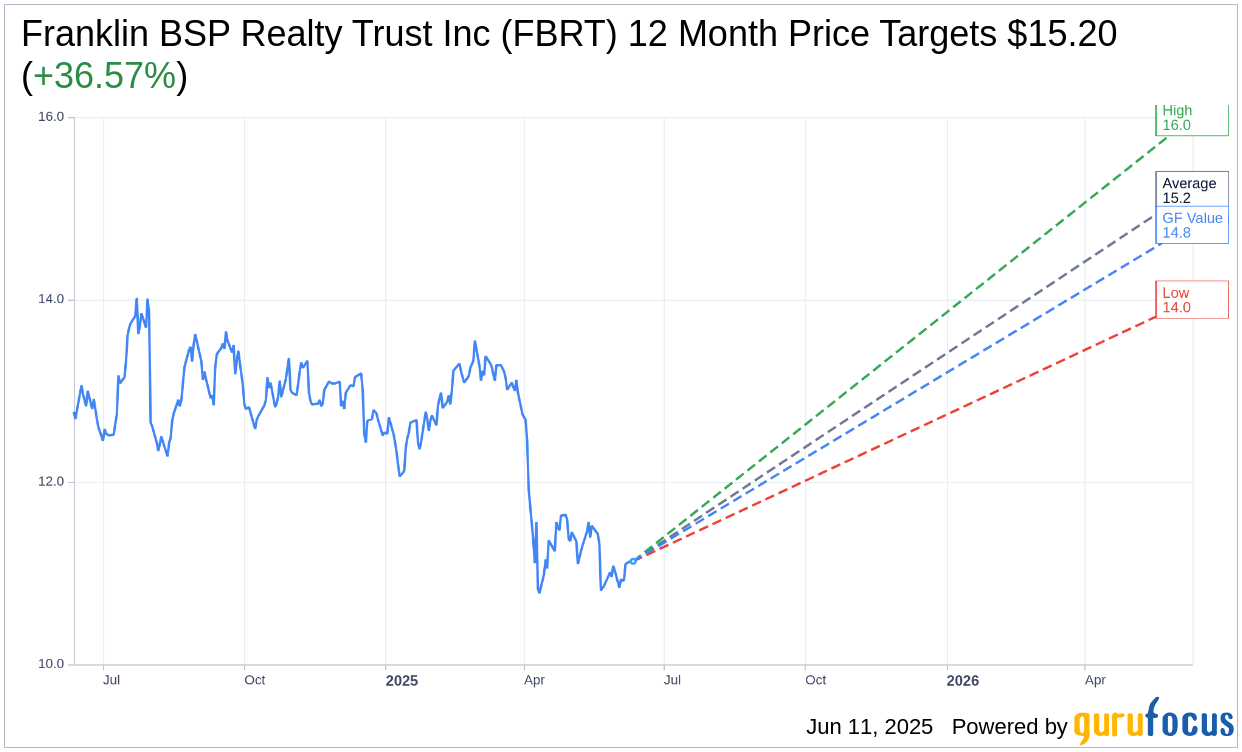

Wall Street analysts have shown a favorable outlook for Franklin BSP Realty Trust Inc (FBRT, Financial). Based on evaluations from 5 analysts, the average 12-month price target for FBRT stands at $15.20, with the highest estimate reaching $16.00 and the lowest at $14.00. This average target price indicates a potential upside of 36.57% from its current trading price of $11.13. For further insights and detailed estimates, visit the Franklin BSP Realty Trust Inc (FBRT) Forecast page.

Moreover, the consensus recommendation from 5 brokerage firms places Franklin BSP Realty Trust Inc's (FBRT, Financial) average rating at 1.6, suggesting an "Outperform" status. The rating scale used ranges from 1 (Strong Buy) to 5 (Sell), reflecting general confidence in FBRT's positive trajectory.

Evaluating the GF Value

According to GuruFocus estimates, the projected GF Value for Franklin BSP Realty Trust Inc (FBRT, Financial) in the next year is $14.82. This estimation suggests a promising 33.15% upside from the current market price of $11.13. The GF Value is a proprietary metric designed to reflect the stock's fair trading value, derived from historic trading multiples, as well as past and future business performance predictions. Interested investors can explore more detailed data on the Franklin BSP Realty Trust Inc (FBRT) Summary page.