Viasat (VSAT, Financial) has rolled out its innovative Digital Bus solution, marking a significant advancement in passenger connectivity. Satelite Norte, a prominent transport operator, is the first to implement this new technology, which combines satellite and cellular networks to enhance travel experiences. After a successful trial run, Satelite Norte has started utilizing the solution on its buses operating between Goiania in the state of Goias and Sao Paulo, situated over 500 miles apart in southeastern Brazil.

This cutting-edge solution by Viasat delivers dependable high-speed satellite internet to buses, especially in remote areas where alternatives like rail or air travel are costly or not available. This development is particularly beneficial for travelers in Brazil and other regions where buses serve as the primary mode of long-distance travel. Viasat’s Digital Bus offers a promising option for maintaining connectivity during journeys through regions lacking robust infrastructure.

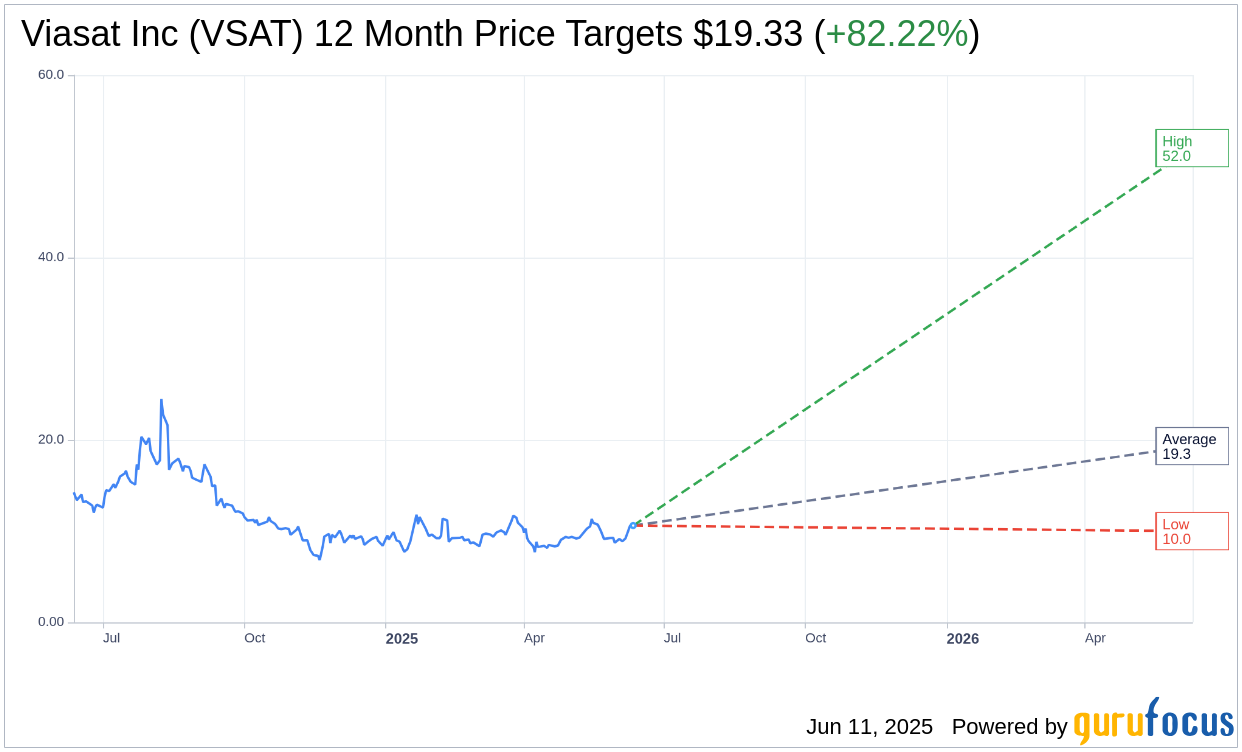

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Viasat Inc (VSAT, Financial) is $19.33 with a high estimate of $52.00 and a low estimate of $10.00. The average target implies an upside of 82.22% from the current price of $10.61. More detailed estimate data can be found on the Viasat Inc (VSAT) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Viasat Inc's (VSAT, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Viasat Inc (VSAT, Financial) in one year is $23.06, suggesting a upside of 117.34% from the current price of $10.61. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Viasat Inc (VSAT) Summary page.

VSAT Key Business Developments

Release Date: May 20, 2025

- Revenue: $1.15 billion for Q4 fiscal 2025; $4.5 billion for the full fiscal year 2025.

- GAAP Net Income: $246 million loss for Q4 fiscal 2025; $575 million loss for the full fiscal year 2025.

- Adjusted EBITDA: $375 million for Q4 fiscal 2025 with a 32.7% margin; $1.55 billion for the full fiscal year 2025 with a 34.2% margin.

- Free Cash Flow: Approximately $50 million for Q4 fiscal 2025.

- CapEx Reduction: Reduced combined fiscal 2025 and 2026 CapEx by close to $300 million.

- Commercial Aviation: 4,030 service aircraft, up 10%; backlog of 1,600, up 18%.

- Business Aviation: More than 2,000 service aircraft, up 12% year over year.

- Maritime Revenue: Down 8% as expected to trough in Q4 fiscal 2025.

- Government SATCOM Revenue: Growth of 16%.

- DAT Revenue: Up 11% for Q4 fiscal 2025 and 17% for the full fiscal year 2025.

- Operating Cash Flow: More than $900 million for fiscal year 2025, over 30% growth from fiscal 2024.

- Debt Management: Redeemed $443 million of '25 notes post-quarter end; plan to pay down $300 million of Inmarsat Term Loan B during fiscal 2026.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Viasat Inc (VSAT, Financial) achieved record new contract awards growth and met or beat its guidance metrics for fiscal 2025.

- The company successfully integrated the first ViaSat-3 F1 into its global network, enhancing user experience and network efficiency.

- Viasat Inc (VSAT) introduced several network optimization innovations, delivering substantial efficiency and user experience gains.

- The company made significant progress on its capital structure, reducing capital intensity and enhancing financial transparency with new reporting segments.

- Viasat Inc (VSAT) reported solid double-digit growth in operating cash flow and reduced capital expenditures by close to $300 million over fiscal 2025 and 2026.

Negative Points

- Viasat Inc (VSAT) reported a GAAP net loss of $575 million for fiscal 2025.

- The company faced challenges in its US fixed broadband revenue due to capacity constraints, resulting in a 19% year-over-year decline in fixed services and other revenue.

- Viasat Inc (VSAT) experienced slower deliveries and backlog in its Commercial Aviation business, impacting growth.

- The company anticipates modest revenue growth with flattish adjusted EBITDA for fiscal 2026, with potential headwinds from macroeconomic factors.

- Viasat Inc (VSAT) is dealing with ongoing legal proceedings related to the Ligado bankruptcy, which could impact future cash payments and financial outlook.