Kratos Defense & Security Solutions, identified by the ticker KTOS, has secured a significant task order through the Command and Control System-Consolidated (CCS-C) Sustainment and Resiliency contract. This contract with the U.S. Space Force's Space Systems Command aims to enhance ground system capabilities for the Evolved Strategic Satellite Communications (ESS) system.

The ESS system is designed to deliver resilient and durable satellite communications crucial for the Nuclear Command, Control, and Communications missions across all types of operational environments.

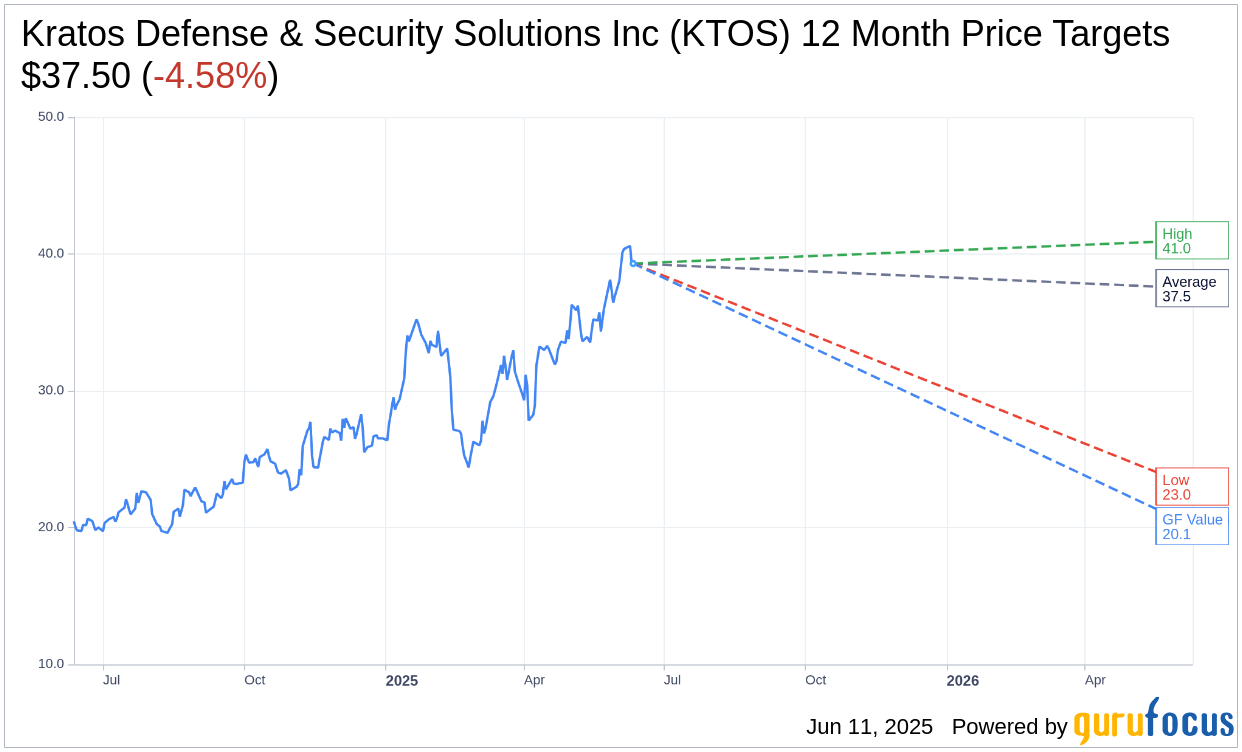

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Kratos Defense & Security Solutions Inc (KTOS, Financial) is $37.50 with a high estimate of $41.00 and a low estimate of $23.00. The average target implies an downside of 4.58% from the current price of $39.30. More detailed estimate data can be found on the Kratos Defense & Security Solutions Inc (KTOS) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Kratos Defense & Security Solutions Inc's (KTOS, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Kratos Defense & Security Solutions Inc (KTOS, Financial) in one year is $20.11, suggesting a downside of 48.83% from the current price of $39.3. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Kratos Defense & Security Solutions Inc (KTOS) Summary page.

KTOS Key Business Developments

Release Date: May 07, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Kratos Defense & Security Solutions Inc (KTOS, Financial) reported a strong Q1 book-to-bill ratio of 1.2 to 1, indicating robust demand and future revenue potential.

- The company's opportunity pipeline stands at an all-time high of approximately $12.6 billion, showcasing significant growth prospects.

- Kratos is seeing increased opportunities in integrated air and missile defense and counter UAS, areas where it is an acknowledged industry leader.

- The hypersonic franchise is expected to be a major growth driver, with operational and in-production systems like Zeus hypersonic rocket motors and Dark Fury hypersonic flyers.

- Kratos' national security-focused space and satellite business continues to receive additional funding and contract awards, contributing to expected increased EBITA margins in 2026.

Negative Points

- The company is facing increased subcontractor and material costs on certain multi-year fixed price contracts, impacting margins.

- Free cash flow used in operations for Q1 was $51.8 million, reflecting significant capital expenditures and working capital requirements.

- Consolidated DSOs increased from 104 days to 109 days, indicating slower collections and potential cash flow challenges.

- The commercial satellite business continues to be adversely impacted by macro-level industry issues, affecting overall margins.

- Kratos is experiencing cost pressures from sole-source suppliers for target drones, leading to increased expenses that cannot be recovered until future contract renewals.