- Citi places Microsoft (MSFT, Financial) on a 90-day positive catalyst watch due to Azure's promising growth prospects.

- Analysts predict an average price target of $508.65, suggesting a potential upside of 8.01%.

- GuruFocus estimates indicate a fair value for MSFT at $505.29, reflecting a 7.3% upside.

Microsoft (MSFT) has recently gained notable attention as Citi has placed it under a 90-day positive catalyst watch, primarily driven by the robust growth prospects of its Azure platform. Analyst Tyler Radke has increased the price target for Microsoft to $605, foreseeing Azure's growth hitting an impressive 36.1% year-over-year by fiscal 2026.

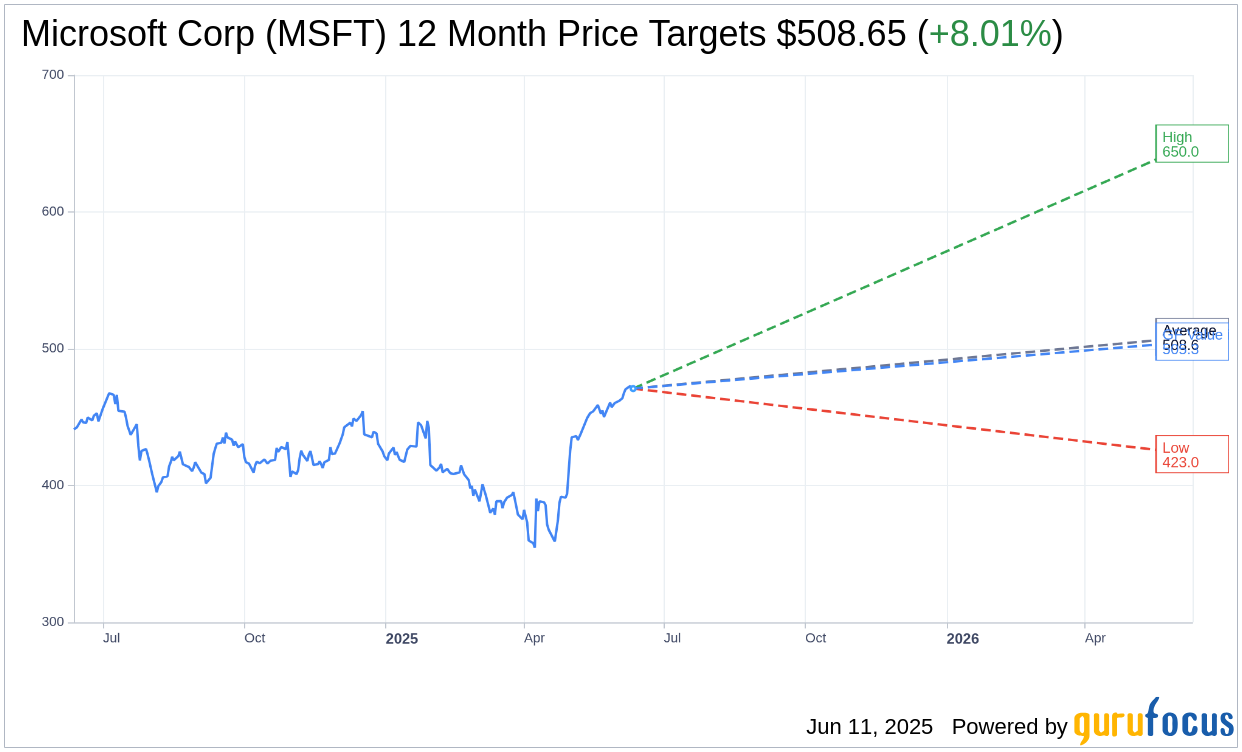

Wall Street Analysts Forecast

Microsoft Corp (MSFT, Financial) has become a focal point for analysts, with 49 experts providing one-year price targets. The average target price stands at $508.65, with estimates ranging from a high of $650.00 to a low of $423.00. This average forecast indicates a potential upside of 8.01% from the current price of $470.92. Investors looking for more comprehensive data can visit the Microsoft Corp (MSFT) Forecast page.

Analyst Recommendations and Market Implications

The consensus recommendation for Microsoft Corp (MSFT, Financial), derived from evaluations by 62 brokerage firms, is currently rated at 1.8, which signifies an "Outperform" status. On this scale, 1 corresponds to a Strong Buy, while 5 represents a Sell. This rating highlights widespread market confidence in the stock's future performance.

GuruFocus Analysis and GF Value

According to GuruFocus estimates, the projected GF Value for Microsoft Corp (MSFT, Financial) in a year is $505.29. This provides an anticipated upside of 7.3% from its current price of $470.92. The GF Value is a proprietary metric from GuruFocus which aims to ascertain the fair trading value of a stock based on historical trading multiples, past business growth, and projected future performance. To explore detailed data, investors are encouraged to visit the Microsoft Corp (MSFT) Summary page.