On June 11, 2025, the investment firm Stephens & Co. initiated coverage on Boyd Group Services (BYD, Financial) with an "Overweight" rating. This marks the firm's first rating on the stock, with no prior rating indicated.

The analyst responsible for the coverage is Thomas Wendler, who set a price target of CAD 240.00 for the stock. Boyd Group Services (BYD, Financial) trades on the Toronto Stock Exchange (TSX).

The announcement reflects Stephens & Co.'s positive outlook on Boyd Group Services (BYD, Financial) as the firm suggests potential growth for the company's stock. The "Overweight" rating indicates that Stephens & Co. believes the stock will outperform the average total return of stocks in the analyst's coverage universe over the next 12 months.

Investors may find this information useful as they evaluate their portfolio strategies concerning Boyd Group Services (BYD, Financial) going forward. The CAD 240.00 price target provides a benchmark for potential value assessments of the stock.

Wall Street Analysts Forecast

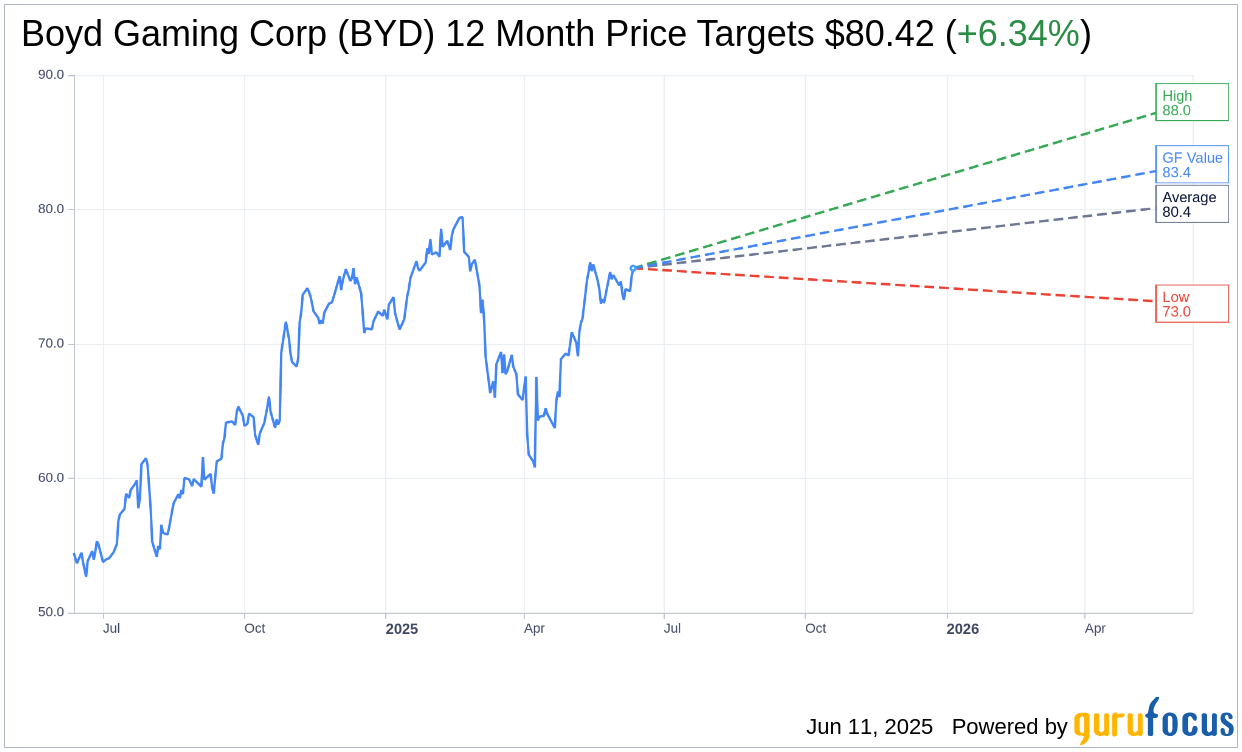

Based on the one-year price targets offered by 12 analysts, the average target price for Boyd Gaming Corp (BYD, Financial) is $80.42 with a high estimate of $88.00 and a low estimate of $73.00. The average target implies an upside of 6.34% from the current price of $75.63. More detailed estimate data can be found on the Boyd Gaming Corp (BYD) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Boyd Gaming Corp's (BYD, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Boyd Gaming Corp (BYD, Financial) in one year is $83.37, suggesting a upside of 10.24% from the current price of $75.625. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Boyd Gaming Corp (BYD) Summary page.