- Cloudflare announces a $1.75 billion offering of convertible senior notes due 2030, with a $250 million option.

- Analysts forecast a 15.76% downside from the current stock price of $179.71.

- GuruFocus estimates indicate a 20.57% downside based on GF Value calculations.

Cloudflare (NET, Financial) recently announced a significant financial maneuver—a $1.75 billion private offering of convertible senior notes due by 2030, accompanied by an additional $250 million option. These funds are earmarked for supporting capped call transactions and a diverse range of corporate strategies, potentially including acquisitions. In response to this announcement, Cloudflare's stock experienced a 2% decline in after-hours trading.

Analyst Price Targets and Recommendations

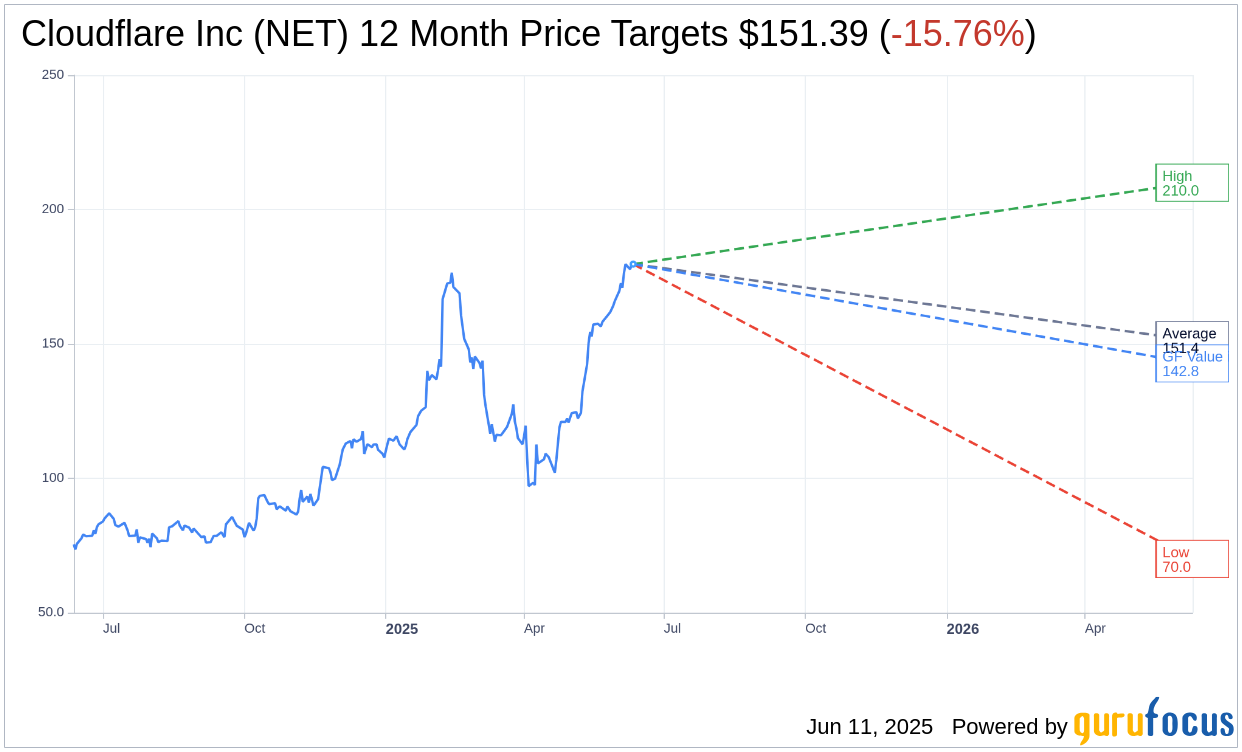

According to projections from 29 industry analysts, Cloudflare Inc (NET, Financial) has an average one-year price target of $151.39. Price expectations vary significantly, with a high forecast of $210.00 and a low estimate of $70.00. These forecasts suggest a potential downside of 15.76% from the current trading price of $179.71. For further insights, visit the Cloudflare Inc (NET) Forecast page.

The brokerage consensus recommendation places Cloudflare Inc (NET, Financial) at a 2.3 rating, translating to an "Outperform" status. This rating, aggregated from 34 brokerage firms, uses a scale from 1 (Strong Buy) to 5 (Sell).

GuruFocus GF Value Estimate

Leveraging GuruFocus proprietary metrics, the anticipated GF Value for Cloudflare in one year is projected at $142.75. This estimate reflects a 20.57% downside from the current market price of $179.71. The GF Value is GuruFocus’ estimation of an equitable stock value, derived from the stock's historical trading multiples, historical business growth, and future performance forecasts. Investors can explore more in-depth information on the Cloudflare Inc (NET, Financial) Summary page.