Market Overview

- The stock market experienced a dip on Wednesday, with the S&P 500 reducing its weekly gain to 0.4% after a 0.3% drop, while the Nasdaq saw a 0.5% decrease, also limiting its gain to 0.4%.

- The Dow remained stable, outperforming earlier this week and rising 0.2% since last Friday.

- Initial enthusiasm driven by a cooler-than-expected May CPI report was tempered by profit taking later in the day.

Inflation and Trade Developments

- May's CPI data showed a 0.1% month-over-month increase, slightly below the consensus of 0.2%, with core CPI also up by 0.1%.

- Year-over-year, total CPI rose to 2.4%, while core CPI remained steady at 2.8%.

- U.S.-China trade talks yielded no groundbreaking agreements but reaffirmed earlier commitments.

- The U.S. maintained its 55% tariff on Chinese imports, supported by a Court of Appeals decision.

- Potential trade developments include an interim deal with India and continued negotiations with the European Union and Mexico.

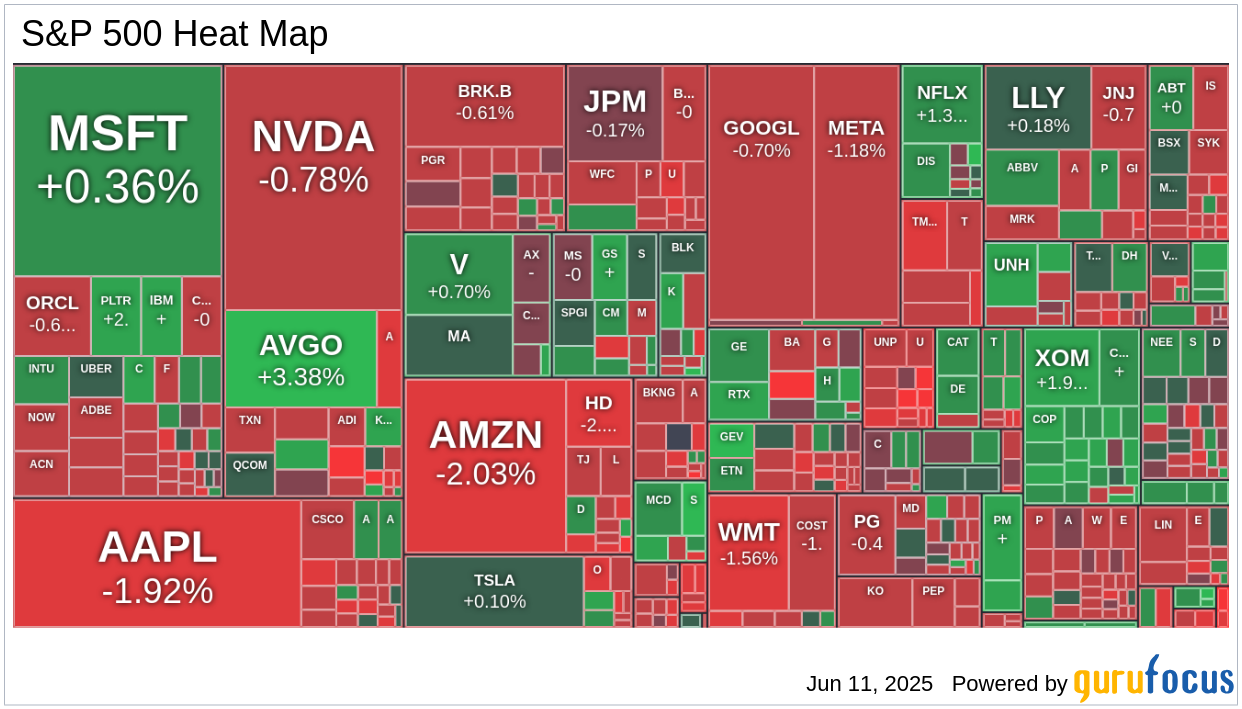

Sector Performance

- Consumer discretionary and materials sectors faced the steepest declines, each down by 1.0%.

- Nucor (NUE) and Steel Dynamics (STLD) suffered due to possible reductions in Mexican steel tariffs.

- The energy sector gained 1.5%, bolstered by rising tensions in the Middle East and a strong crude oil price increase of 5.0% to $68.21 per barrel.

- Technology stocks initially performed well but later declined, with Apple (AAPL) down 1.9% and NVIDIA (NVDA) slipping by 0.8% despite early gains.

- Quantum computing stocks, such as Rigetti Computing (RGTI) and Quantum Computing (QUBT), saw large gains but faced late profit taking.

Economic Indicators

- Treasuries saw gains as the 10-yr yield fell six basis points to 4.41%, aided by the cooler-than-expected CPI.

- The Treasury Budget deficit for May was $316.0 billion, an improvement over the previous year's deficit.

- The year-to-date deficit has grown by 13.6% year-over-year, but this is a slower pace compared to previous months.

NUE, STLD, AAPL, NVDA, RGTI, QUBT

Stock News

● Tesla (TSLA, Financial) is preparing to launch its robotaxi service in Austin, Texas, on June 22, with a limited fleet of self-driving Model Y SUVs. CEO Elon Musk emphasized safety as a priority, suggesting the date could change if necessary. The service is expected to expand to other U.S. cities later this year, potentially boosting Tesla's market presence in autonomous vehicles.

● General Motors (GM, Financial) announced a $4 billion investment in its U.S. manufacturing plants over the next two years. This move aims to increase production capacity for both gas-powered and electric vehicles, with a focus on popular models. The investment is expected to enhance GM's ability to produce over two million vehicles annually in the U.S.

● Papa John's (PZZA, Financial) shares surged 11.5% following reports of takeover interest from Apollo Global and a Qatari investment fund. The potential deal could value the pizza chain at around $2 billion, sparking investor interest and outperforming rival Domino's Pizza (DPZ) in share price return this year.

● Walgreens Boots Alliance (WBA, Financial) is reportedly considering bids for Rite Aid's (RADCQ, Financial) assets amid the latter's bankruptcy proceedings. Walgreens, along with other brand management firms, is eyeing Rite Aid's intellectual property and loyalty program, potentially expanding its market share in the pharmacy sector.

● GitLab (GTLB, Financial) outlined a revenue target of $936M-$942M for FY26, driven by accelerated AI adoption. The company reported a 27% year-over-year revenue increase in Q1, highlighting significant customer wins and strategic partnerships, including an expansion with AWS.

● Stitch Fix (SFIX, Financial) raised its FY'25 revenue outlook to up to $1.259B, citing sustained growth in average order value and strategic flexibility. The company reported a 10% increase in AOV and emphasized enhanced client engagement and inventory management as key growth drivers.

● Talen Energy (TLN, Financial) expanded its nuclear power relationship with Amazon (AMZN, Financial), agreeing to supply carbon-free energy to AWS data centers in Pennsylvania. The agreement includes plans to explore new small modular reactors, potentially increasing Talen's energy output and market presence.

● Vaxart (VXRT, Financial) shares soared 37% following positive data from a new norovirus vaccine trial. The second-generation oral pill vaccine showed significant improvements in blocking antibodies and was well-tolerated, paving the way for a phase 2b trial later this year.

● Ouster (OUST, Financial) saw a 21% premarket jump after its OS1 digital lidar received approval from the Department of Defense for use in unmanned aerial systems. This approval marks a significant milestone for Ouster, potentially expanding its market in defense applications.

● Karat Packaging (KRT, Financial) stock slid 7.43% after announcing a secondary offering of 1.5 million shares at $27 each. The offering, expected to close on June 12, will not provide proceeds to the company, impacting investor sentiment.

● Chewy (CHWY, Financial) reported solid Q1 earnings but saw shares fall 7.2% due to cautious full-year guidance. Despite an 8.3% revenue increase and a rise in active customers, the guidance fell slightly below consensus expectations, affecting investor confidence.

● Lockheed Martin (LMT, Financial) faces a potential setback as the U.S. Air Force slashed its F-35 jet request by half for fiscal 2026. The reduction reflects a shift in defense priorities and could impact Lockheed's long-term revenue from its flagship program.

● Dow (DOW, Financial) announced a Canadian court ruling requiring Nova Chemicals to pay an additional $1.2B in damages. This follows a previous payment related to a jointly owned ethylene asset, potentially boosting Dow's financial position.

● VinFast Auto (VFS, Financial) highlighted significant growth in electric vehicle deliveries, reporting a 296% year-over-year increase in Q1. Despite a net loss, the company sees improved operating leverage and plans to enhance product quality and affordability.

● Academy Sports (ASO, Financial) outlined a sales range of $5.97B-$6.26B for 2025, amid tariff volatility and new brand launches. The company reported increased foot traffic from higher-income customers and continued store expansion as key growth drivers.

● The J. M. Smucker Company (SJM, Financial) provided a 2-4% net sales growth outlook for fiscal 2026, amid a strategy reset for its Hostess segment. The company emphasized strong brand performance and ongoing pricing actions to manage commodity headwinds.

● GameStop (GME, Financial) reported a sequential decline in Q1 sales across hardware, software, and collectibles. Despite a cash reserve of over $6B, the company faces challenges in maintaining growth amid shifting consumer preferences.

● Dave & Buster's (PLAY, Financial) posted mixed Q1 results, with shares initially falling but later recovering. The company reported a decline in comparable sales but expressed confidence in its strategy to improve revenue and shareholder value.

● Bristol Myers Squibb (BMY, Financial) announced positive phase 3 trial results for Sotyktu in treating psoriatic arthritis. The TYK2 inhibitor met its primary endpoint, potentially expanding its market approval beyond plaque psoriasis.

● Oncolytics Biotech (ONCY, Financial) appointed Jared Kelly as CEO, aiming to leverage his experience in clinical program development and industry partnerships. The company seeks to enhance its potential for delivering transformative outcomes for patients and investors.

GuruFocus Stock Analysis

- Nvidia (NVDA) to Build First Industrial AI Cloud in Germany by Faizan Farooque

- Altman-Backed Coco Robotics Raises $80 Million for Delivery Bots by Faizan Farooque

- Trump's Tariffs Haven't Hit Yet--But the Fed's Already on Fire by Khac Phu Nguyen

- Nvidia Builds Europe's First Industrial AI Cloud by Moz Farooque

- Palantir-Backed Voyager Rockets Above $31 IPO Price by Moz Farooque