Teleflex (TFX, Financial) has unveiled results from a comprehensive international study examining the Arrow Chlorhexidine-Impregnated Central Venous Catheters' (CVCs) effectiveness. Conducted across 12 intensive care units in eight hospitals located in India, Malaysia, Papua New Guinea, Colombia, Egypt, and Turkey, the study encompassed over 6,670 patients. Key findings of the study highlight a 70.5% decrease in central line-associated bloodstream infections (CLABSIs) among patients using Arrowg+ard Blue and Arrowg+ard Blue Plus catheters compared to those with plain catheters.

The Chlorhexidine-impregnated CVCs demonstrated a substantial reduction in infection-causing pathogens, covering both gram-positive and gram-negative bacteria, as well as fungi. Importantly, despite similar insertion training and adherence to barrier precautions between groups, the impregnated catheters marked a statistically significant reduction in CLABSIs. Even among patients experiencing longer ICU stays and higher catheter usage, infection rates were notably lower, illustrating the antimicrobial device's efficacy. Though variations among hospitals and patient characteristics existed without adjustment metrics, the study provides compelling evidence about the antimicrobial CVCs' benefits.

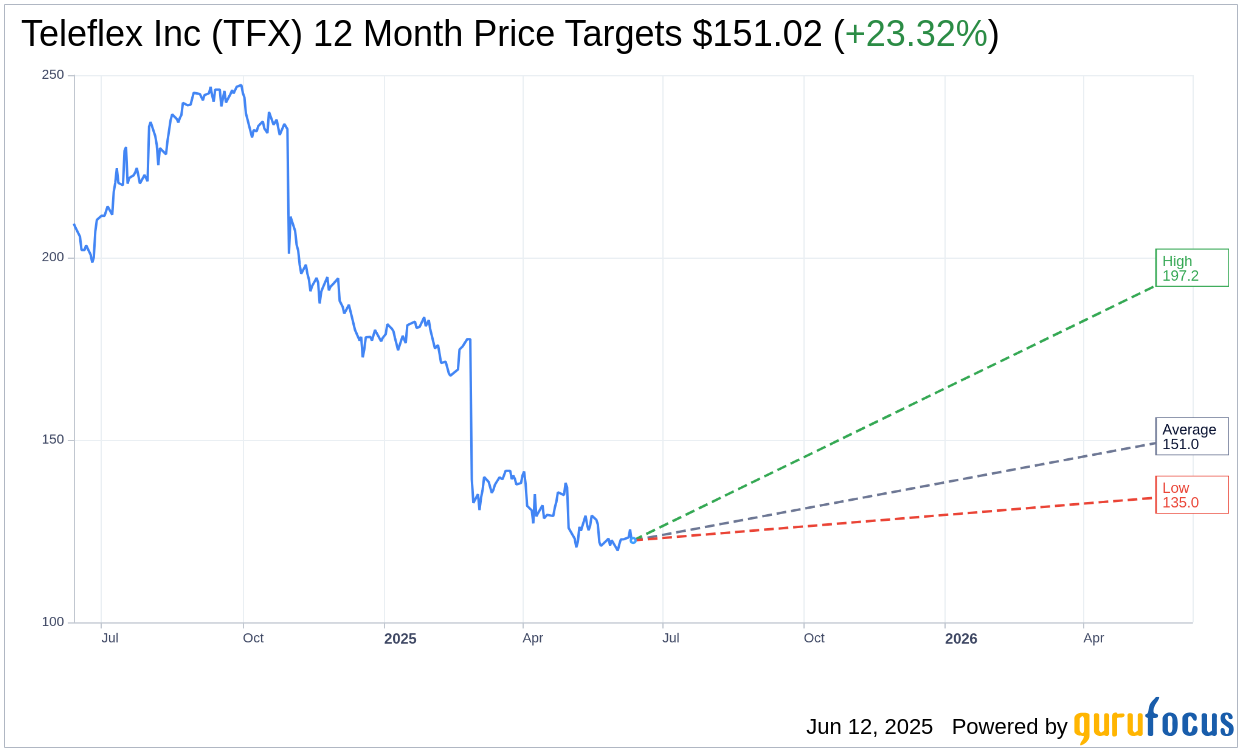

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Teleflex Inc (TFX, Financial) is $151.02 with a high estimate of $197.22 and a low estimate of $135.00. The average target implies an upside of 23.32% from the current price of $122.47. More detailed estimate data can be found on the Teleflex Inc (TFX) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Teleflex Inc's (TFX, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teleflex Inc (TFX, Financial) in one year is $257.00, suggesting a upside of 109.85% from the current price of $122.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teleflex Inc (TFX) Summary page.

TFX Key Business Developments

Release Date: May 01, 2025

- Revenue: $700.7 million, down 5% year-over-year on a GAAP basis; 3.8% decline on adjusted constant currency basis.

- Adjusted Earnings Per Share (EPS): $2.91, a 9.3% decrease year-over-year.

- Americas Revenue: $475.7 million, a 3.2% decrease year-over-year.

- EMEA Revenue: $151.2 million, a 2.8% decrease year-over-year.

- Asia Revenue: $73.8 million, a 9.7% decrease year-over-year.

- Vascular Access Revenue: $182.4 million, a 1.9% increase year-over-year.

- Interventional Revenue: $137.5 million, a 3.2% increase year-over-year.

- Anesthesia Revenue: $86.6 million, an 8.6% decrease year-over-year.

- Surgical Revenue: $105.8 million, a 2% increase year-over-year.

- Interventional Urology Revenue: $71 million, a 10.7% decrease year-over-year.

- OEM Revenue: $63.9 million, a 26.8% decrease year-over-year.

- Other Revenue: $53.5 million, a 4.5% increase year-over-year.

- Adjusted Gross Margin: 60.4%, a 70 basis point decrease year-over-year.

- Adjusted Operating Margin: 24.7%, a 190 basis point decrease year-over-year.

- Net Interest Expense: $16.6 million, down from $21 million in the prior year period.

- Adjusted Tax Rate: 14.5%, up from 13.2% in the prior year period.

- Cash Flow from Operations: $73.3 million, down from $112.8 million in the prior year period.

- Cash and Cash Equivalents: $317.5 million at the end of the first quarter.

- Net Leverage: Approximately 1.8x at quarter end.

- Accelerated Share Repurchase Program: Completed with over 2.2 million shares repurchased at an average price of $135.23.

- 2025 Revenue Guidance: Adjusted constant currency growth of 1% to 2%; reported revenue growth of 1.3% to 2.3%.

- 2025 Adjusted EPS Guidance: $13.20 to $13.60.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Teleflex Inc (TFX, Financial) reported first quarter revenues of $700.7 million, which was within the guidance range provided during the previous earnings call.

- The Vascular Access segment saw a revenue increase of 1.9% year-over-year, driven by double-digit growth in PICCs and solid performance in EZ-IO.

- The Interventional segment experienced a 3.2% year-over-year revenue increase, with strong demand for intra-aortic balloon pumps in the Americas.

- The AC3 Range Intra-Aortic Balloon Pump received 510(k) clearance from the FDA, with full market release in the United States expected in the second quarter of 2025.

- Teleflex Inc (TFX) announced the intention to separate into two independent publicly traded companies, aiming to enhance shareholder value and strategic focus.

Negative Points

- First quarter revenues declined by 5% year-over-year on a GAAP basis, with adjusted earnings per share decreasing by 9.3% year-over-year.

- The OEM segment experienced a significant revenue decrease of 26.8% year-over-year, impacted by customer contract losses and inventory management.

- The Interventional Urology segment saw a 10.7% year-over-year revenue decline, with continued pressure on the UroLift business.

- Adjusted gross margin decreased by 70 basis points year-over-year, primarily due to macroeconomic factors affecting labor and raw materials costs.

- The company faces a $55 million impact from tariffs enacted since the previous guidance, with ongoing efforts to mitigate this exposure.