- Hudson Pacific Properties launches a major public offering to raise funds for debt repayment and corporate activities.

- Analysts set a one-year average price target of $3.17, indicating potential upside despite a recent dip in stock prices.

- GuruFocus projects a substantial 100.4% upside with a GF Value estimate of $4.97 per share.

Hudson Pacific Properties (HPP, Financial) has taken a bold step with a large-scale public offering, aiming to bolster its financial standing. The company plans to offer approximately 197.2 million shares at $2.23 each, alongside warrants for around 71.8 million shares priced at $2.22 per warrant. This strategic move targets raising a substantial $575.6 million, potentially escalating to $662 million if the underwriters exercise their option. The funds are earmarked for debt repayment and general corporate purposes. Notably, this announcement led to a 9.3% decline in pre-market trading for Hudson Pacific Properties' stock.

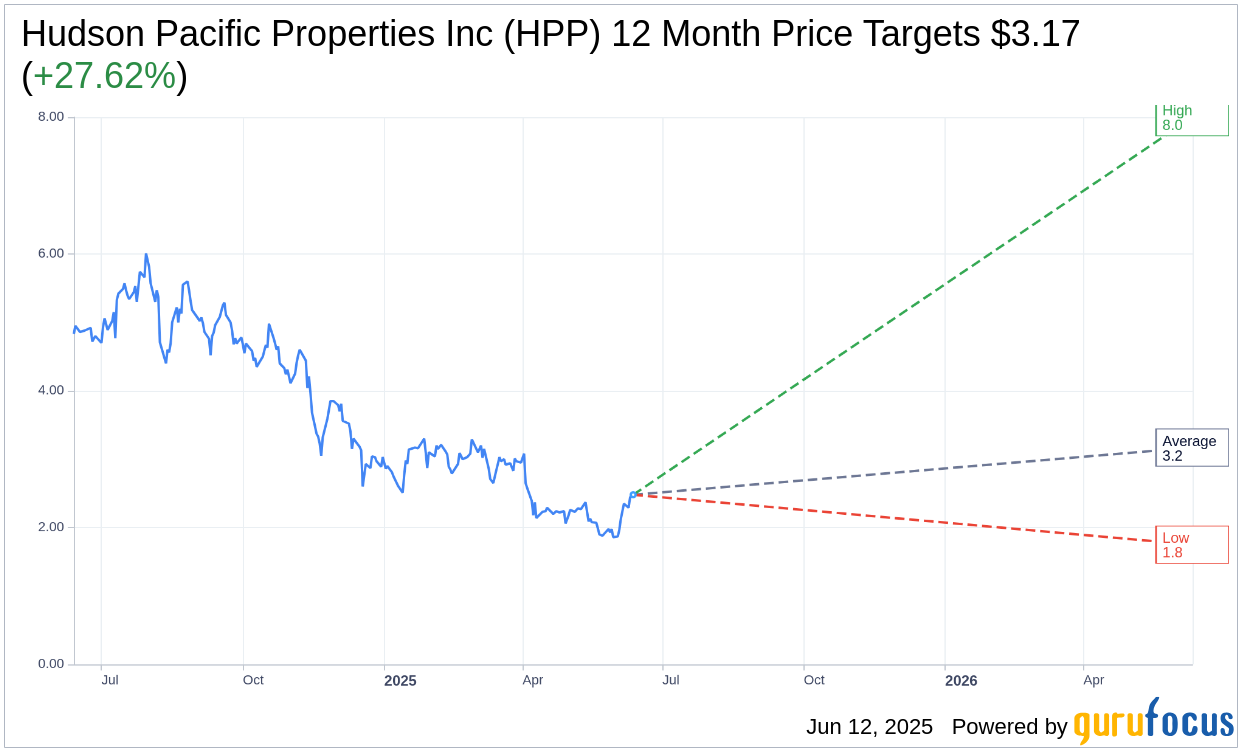

Wall Street Analysts Forecast

Analyzing the one-year price targets provided by 10 analysts, the consensus sets the average target price for Hudson Pacific Properties Inc (HPP, Financial) at $3.17. The projections display a wide range, with a high estimate of $8.00 and a low of $1.75. The average target suggests an impressive upside of 27.62% from the current price of $2.48. For additional insights, please visit the Hudson Pacific Properties Inc (HPP) Forecast page.

The advisory sentiment among 11 brokerage firms positions Hudson Pacific Properties Inc (HPP, Financial) at an average recommendation of 2.7, aligning with a "Hold" status. This rating scale ranges from 1 (Strong Buy) to 5 (Sell), reflecting a cautious but stable outlook.

According to GuruFocus estimates, the anticipated GF Value for Hudson Pacific Properties Inc (HPP, Financial) over the next year is $4.97. This estimate indicates a potential upside of 100.4% from the current share price of $2.48. The GF Value is GuruFocus' calculated fair value based on historical trading multiples, business growth, and future performance forecasts. For a comprehensive analysis, visit the Hudson Pacific Properties Inc (HPP) Summary page.