Following a detailed evaluation of the potential impacts of Generative AI on the commercial real estate sector, Morgan Stanley has adjusted its outlook on CBRE Group (CBRE, Financial). The analysis indicates that AI could significantly enhance labor efficiency in the industry, affecting numerous roles in public REIT and commercial real estate services.

As a result, the firm has raised its price target for CBRE Group, recognizing the company's potential for increased productivity and efficiency. This optimistic forecast reflects a broader industry trend towards integrating advanced technologies to improve operational outcomes.

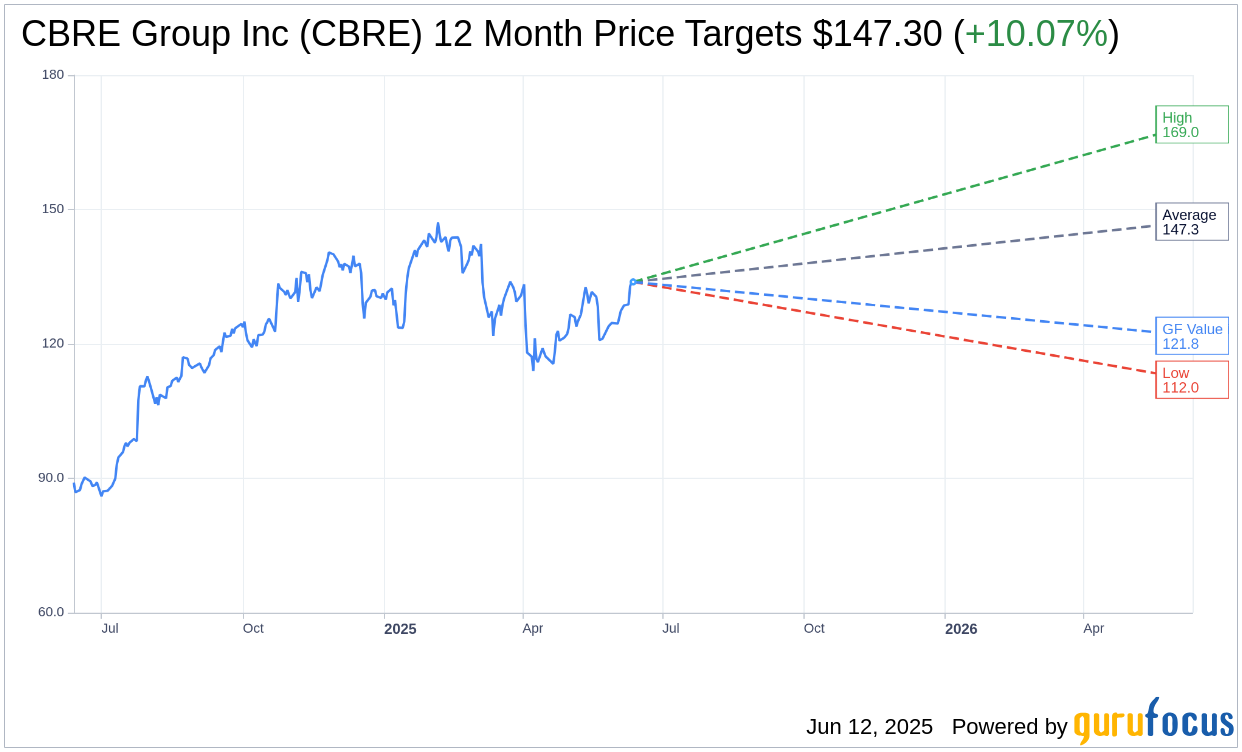

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for CBRE Group Inc (CBRE, Financial) is $147.30 with a high estimate of $169.00 and a low estimate of $112.00. The average target implies an upside of 10.07% from the current price of $133.83. More detailed estimate data can be found on the CBRE Group Inc (CBRE) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, CBRE Group Inc's (CBRE, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CBRE Group Inc (CBRE, Financial) in one year is $121.83, suggesting a downside of 8.97% from the current price of $133.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CBRE Group Inc (CBRE) Summary page.