Key Takeaways:

- IMAX Corporation boosts its share repurchase program by $100 million, raising total authorization to $500 million.

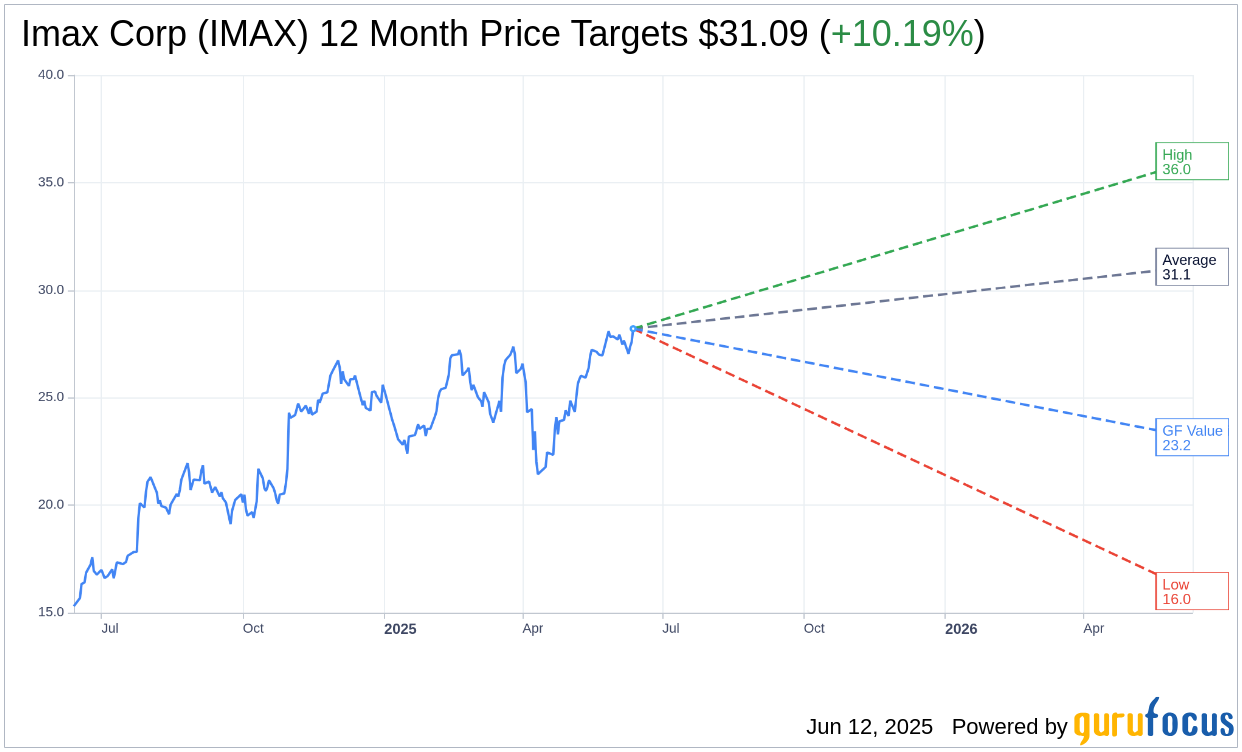

- Analysts set a one-year average price target of $31.09, forecasting a potential upside of over 10%.

- GuruFocus estimates a GF Value of $23.16, indicating a possible downside of nearly 18%.

IMAX Corporation's Strategic Financial Moves

In an ambitious move to enhance shareholder value, IMAX Corporation (NYSE: IMAX) has announced an impressive $100 million increase to its existing share repurchase program. This strategic enhancement now extends the program until June 30, 2027, and increases the total authorization to $500 million. Following this announcement, IMAX shares observed a modest 1% rise in premarket trading on Thursday, reflecting positive investor sentiment.

Analyst Projections and Market Outlook

Wall Street analysts are weighing in with optimistic projections for IMAX. The latest forecasts from 11 analysts reveal an average price target of $31.09 for the stock, with projections ranging from a low of $16.00 to a high of $36.00. This average target signifies a potential upside of 10.19% from the current trading price of $28.22. For additional details, investors can explore further on the Imax Corp (IMAX, Financial) Forecast page.

Brokerage Recommendations

IMAX Corporation is currently basking in favorable brokerage sentiment as well. With a consensus recommendation of 2.1 from 12 brokerage firms, the stock is rated as "Outperform." This scale, ranging from 1 (Strong Buy) to 5 (Sell), places IMAX in a promising position, encouraging investors to consider its potential for solid returns.

GuruFocus Evaluation: GF Value Insight

Despite the bullish sentiments from analysts, GuruFocus presents a more cautious perspective. The estimated GF Value for IMAX Corporation is pegged at $23.16 for the coming year, suggesting a potential downside of 17.92% from the current price of $28.215. The GF Value is a critical metric, representing the fair trading value calculated from historical stock multiples, along with past and future business performance estimations. Investors seeking a broader analysis can find more in-depth data on the Imax Corp (IMAX, Financial) Summary page.