Key Highlights:

- AppLovin (APP, Financial) faces scrutiny following claims by Culper Research.

- Wall Street analysts show optimism with a notable price target upside.

- Contrasting perspectives highlight potential investment risks and rewards.

AppLovin Faces Allegations and Market Impact

AppLovin (APP) recently experienced a 5% drop in its stock price. This decline followed Culper Research's announcement of a short position, where the firm accused AppLovin of misleading investors regarding its ties with Chinese shareholders. These allegations, according to Culper Research, could pose risks to both shareholders and national security. In response, AppLovin has firmly denied all such allegations, maintaining their stance of transparency and compliance.

Wall Street Analysts' Insights

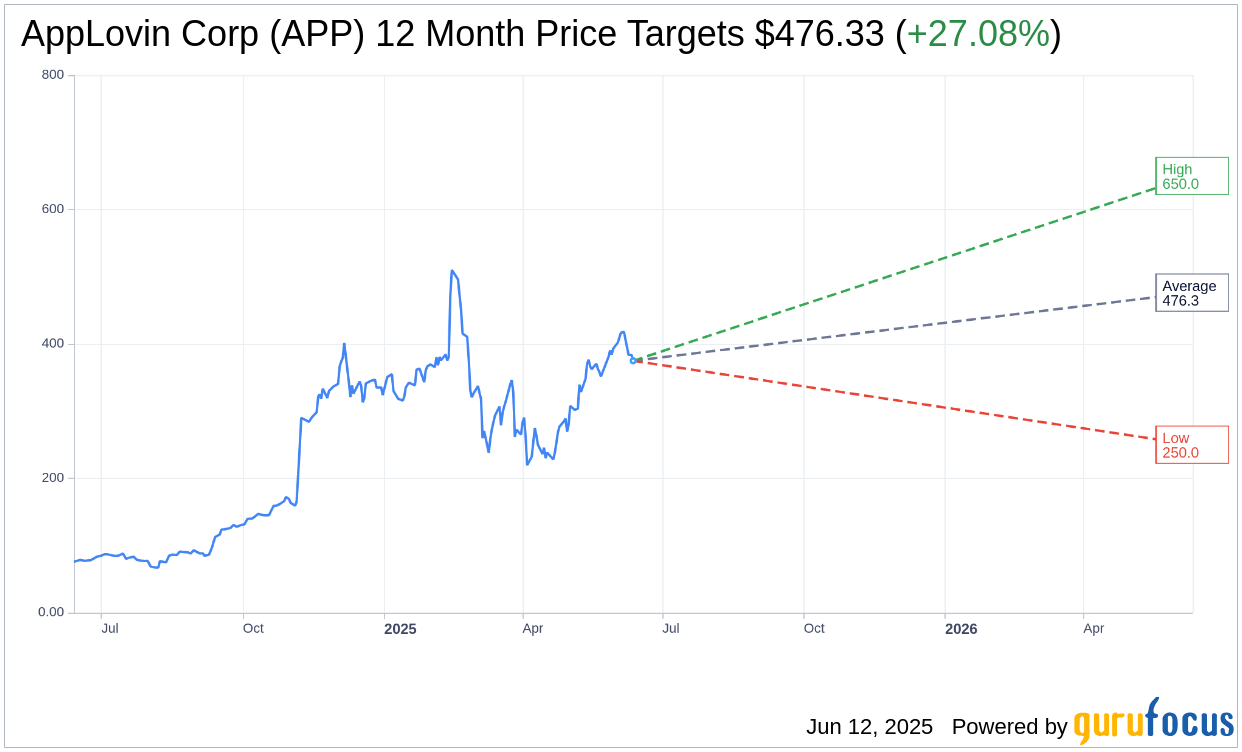

The outlook from Wall Street regarding AppLovin Corp (APP, Financial) paints an encouraging picture. According to 22 analysts, the average one-year price target is set at $476.33. Should this target be met, it represents a potential upside of 27.08% from the current trading price of $374.84. Analysts have projected a high estimate of $650.00 and a low estimate of $250.00. Investors seeking a deeper dive into these estimates can visit the AppLovin Corp (APP) Forecast page.

Additionally, the consensus recommendation from 26 brokerage firms categorizes AppLovin Corp's (APP, Financial) standing as "Outperform" with an average recommendation rating of 1.9. This rating operates on a scale from 1 to 5, where 1 suggests a Strong Buy and 5 indicates a Sell.

GuruFocus Assessment: GF Value

Contrasting the optimistic analyst perspectives, GuruFocus presents a more cautious estimate. The platform's GF Value for AppLovin Corp (APP, Financial) in one year is calculated at $93.57, implying a potential downside of 75.04% from the current price of $374.839. This GF Value represents GuruFocus's assessment of the stock's fair trading value, derived from historical trading multiples, past business growth, and projections of future performance. Investors interested in exploring additional data can refer to the AppLovin Corp (APP) Summary page.