Key Highlights:

- Schrödinger (SDGR, Financial) experiences a stock drop post Phase 1 trial data release for the drug SGR-1505.

- Phase 1 trial shows a 22% overall response rate with no dose-limiting toxicities.

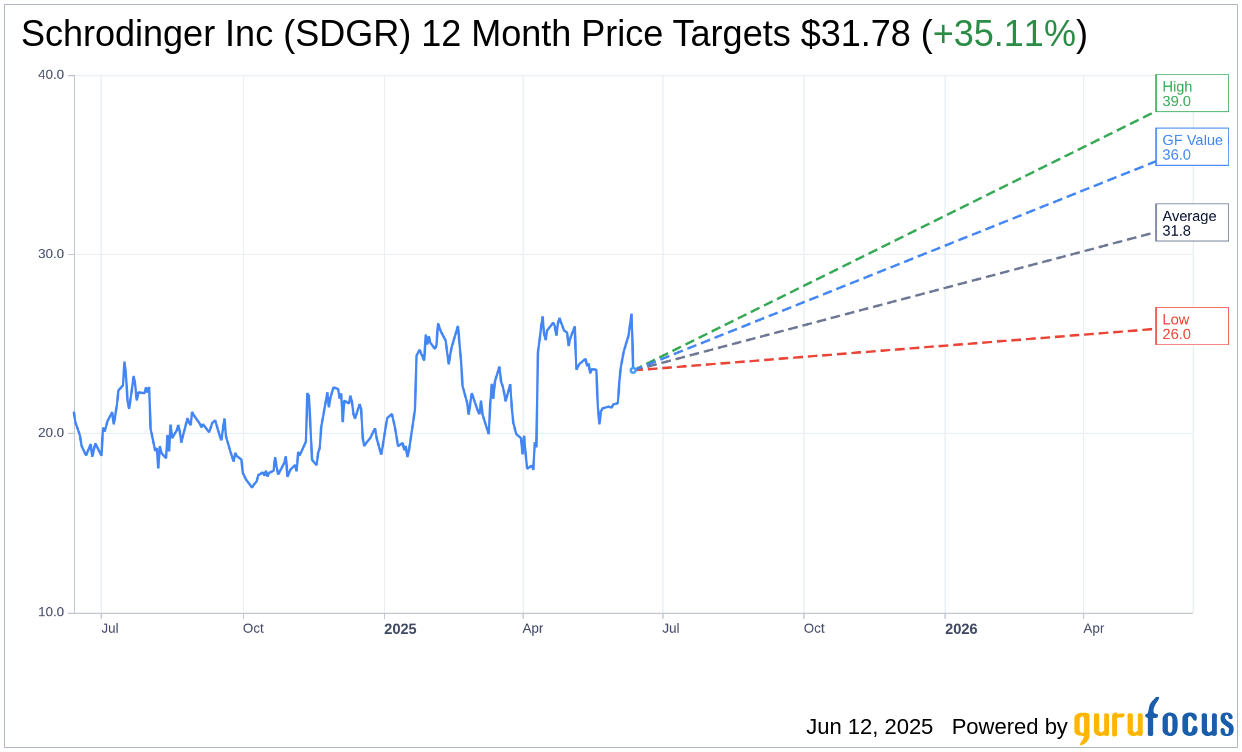

- Analysts predict a potential 35.11% upside for SDGR stock with a price target of $31.78.

Clinical Trial Insights

Schrödinger (NASDAQ: SDGR) recently faced a decline in its stock price following the announcement of initial data from a Phase 1 trial for its innovative drug, SGR-1505, designed to target specific B-cell malignancies. Of the 49 participants in the study, 43% encountered treatment-related adverse events. However, it is significant to note that no dose-limiting toxicities were reported. The drug demonstrated a promising 22% overall response rate, shedding light on its potential therapeutic benefits.

Wall Street Analysts' Forecasts

According to price targets set by 9 esteemed analysts, Schrödinger Inc (SDGR, Financial) is poised for significant growth. The average price target is pegged at $31.78, with a potential high of $39.00 and a low of $26.00. This suggests an impressive 35.11% upside from the stock's current trading price of $23.52. Investors can explore more in-depth estimates on the Schrödinger Inc (SDGR) Forecast page.

Brokerage Recommendations

Analyzing the consensus from 9 brokerage firms, Schrödinger Inc (SDGR, Financial) currently holds an average brokerage recommendation of 1.9, indicating an "Outperform" status. This rating, operating on a scale from 1 to 5, underscores the stock's potential, where 1 equates to a Strong Buy and 5 denotes a Sell.

GuruFocus Valuation Perspective

From the perspective of GuruFocus, the estimated GF Value for Schrödinger Inc (SDGR, Financial) in the coming year is projected at $36.01. This points to a substantial 53.1% potential upside from the current trading price of $23.52. The GF Value is a sophisticated metric by GuruFocus, reflecting the fair valuation of the stock based on historical trading multiples, previous business growth rates, and anticipated future performance. For more comprehensive data, investors can visit the Schrödinger Inc (SDGR) Summary page.