- Teck Resources and Sumitomo Metal Mining are currently facing a copper supply pricing dispute, spotlighting challenges in traditional pricing amidst a global shortage.

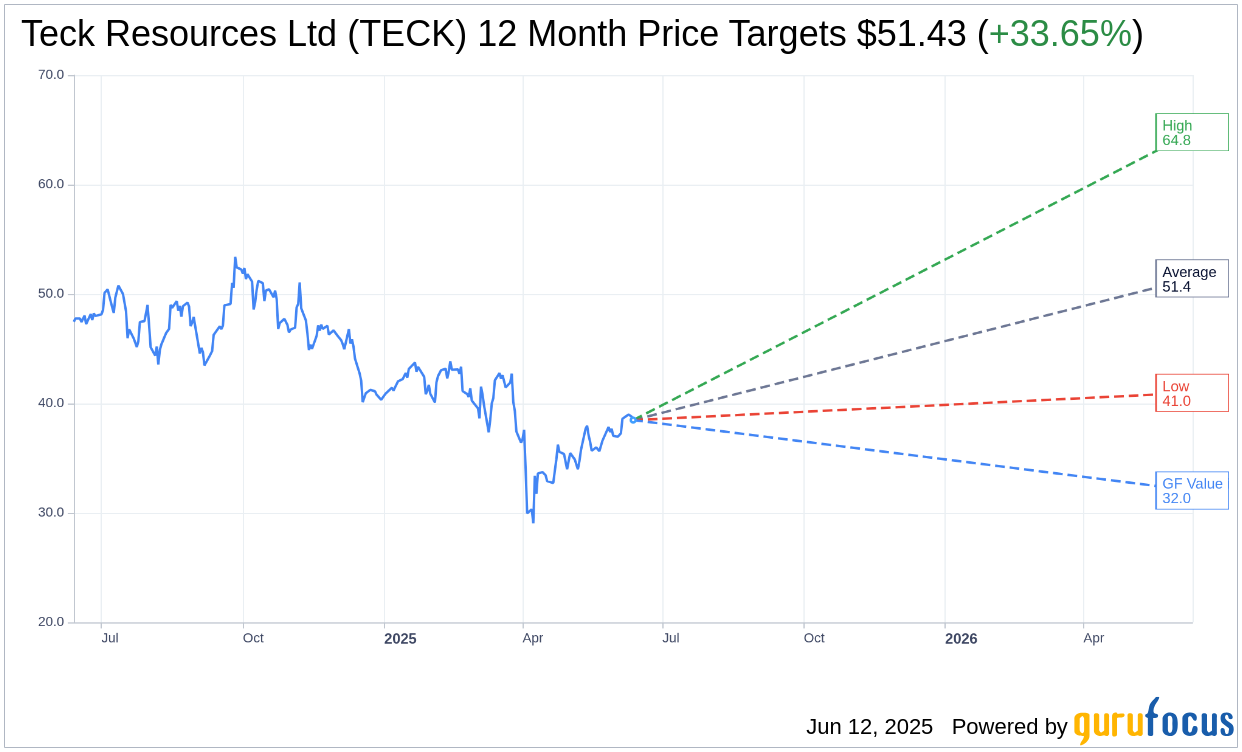

- Wall Street analysts predict significant upside potential for Teck Resources, with price targets suggesting a notable increase.

- GuruFocus estimates, however, indicate a possible downside when evaluating the GF Value of the stock.

Teck Resources Ltd (TECK) finds itself at the center of a contractual conflict with Sumitomo Metal Mining over the pricing of copper supply. This dispute underscores weaknesses in traditional pricing models, especially during a period characterized by a worldwide copper supply crunch. As treatment and refining charges decline, negotiations become increasingly heated, painting a picture of a challenging commercial landscape.

Wall Street Analysts Forecast for Teck Resources

According to predictions from 14 analysts, Teck Resources Ltd (TECK, Financial) is poised for a promising future with an average one-year price target of $51.43. Analysts' targets range from a high of $64.79 to a low of $40.98, indicating a potential upside of 33.65% from its current trading price of $38.48. For a deeper dive into these estimates, visit the Teck Resources Ltd (TECK) Forecast page.

The consensus among 15 brokerage firms places Teck Resources Ltd in an "Outperform" position, with an average brokerage recommendation standing at 1.8. This rating suggests positive sentiment from the analysis community, where the scale ranges from 1 (Strong Buy) to 5 (Sell).

Evaluating Teck Resources with GuruFocus Metrics

Turning to GuruFocus's proprietary metrics, the GF Value for Teck Resources Ltd (TECK, Financial) in the upcoming year is estimated at $32.05. This suggests a potential downside of 16.71% relative to its present price of $38.48. The GF Value provides an estimate of the fair trading value, calculated using historical trading multiples, past business growth, and projected future performance. For more comprehensive data, be sure to visit the Teck Resources Ltd (TECK) Summary page.