Shares of Meta Platforms (META, Financial) experienced a decline of $1.04, settling around $693.10. Option trading activity remained about average, with approximately 189,000 contracts exchanged. Calls were more prevalent than puts, leading to a put/call ratio of 0.61, which is higher than the typical ratio of around 0.55.

Implied volatility for META, represented by IV30, increased slightly by 0.1 points to 27.48, placing it in the lower quarter of its range from the past year. This suggests an anticipated daily price movement of $12.00. The steepening of the put-call skew indicates a rising demand for options that provide downside protection.

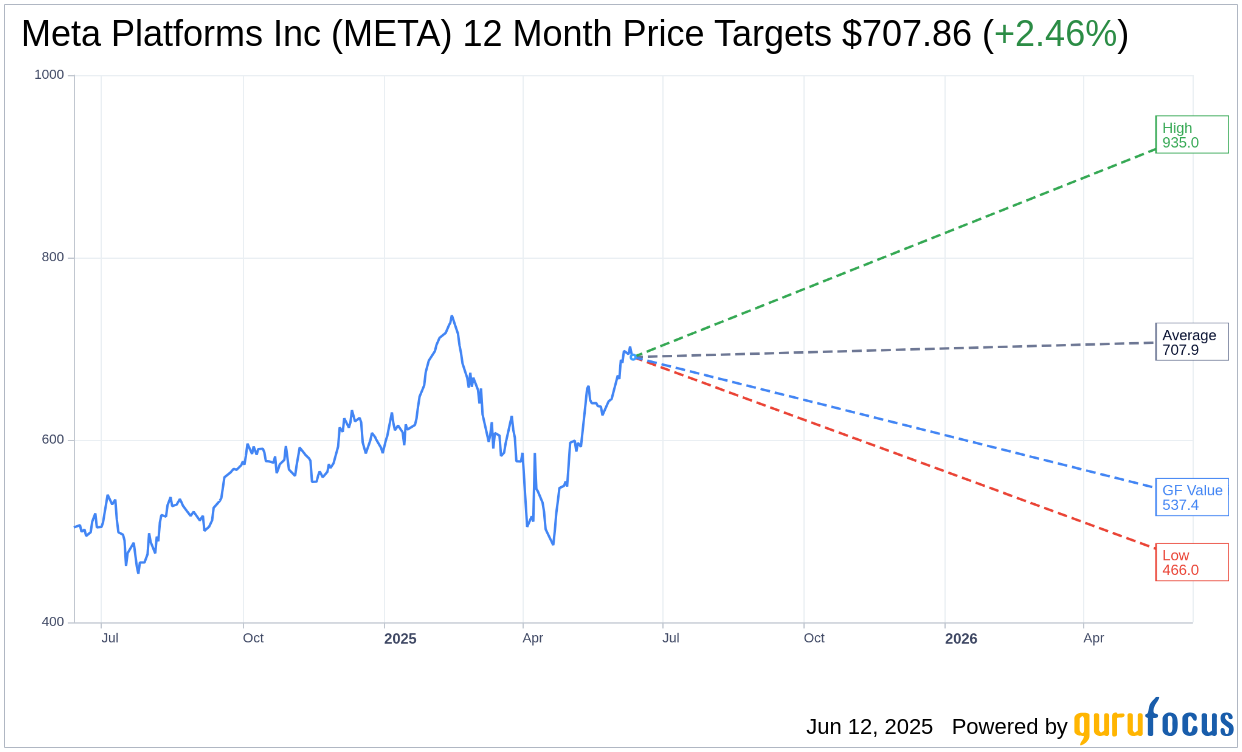

Wall Street Analysts Forecast

Based on the one-year price targets offered by 61 analysts, the average target price for Meta Platforms Inc (META, Financial) is $707.86 with a high estimate of $935.00 and a low estimate of $466.00. The average target implies an upside of 2.46% from the current price of $690.88. More detailed estimate data can be found on the Meta Platforms Inc (META) Forecast page.

Based on the consensus recommendation from 72 brokerage firms, Meta Platforms Inc's (META, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Meta Platforms Inc (META, Financial) in one year is $537.38, suggesting a downside of 22.22% from the current price of $690.8805. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Meta Platforms Inc (META) Summary page.

META Key Business Developments

Release Date: April 30, 2025

- Total Revenue: $42.3 billion, up 16% year-over-year.

- Total Expenses: $24.8 billion, up 9% year-over-year.

- Operating Income: $17.6 billion, representing a 41% operating margin.

- Free Cash Flow: $10.3 billion.

- Cash and Marketable Securities: $70.2 billion.

- Debt: $28.8 billion.

- Family of Apps Revenue: $41.9 billion, up 16% year-over-year.

- Family of Apps Ad Revenue: $41.4 billion, up 16% year-over-year.

- Reality Labs Revenue: $412 million, down 6% year-over-year.

- Reality Labs Operating Loss: $4.2 billion.

- Capital Expenditures: $13.7 billion, driven by investments in servers, data centers, and network infrastructure.

- Employee Headcount: Over 76,800 employees, up 4% quarter-over-quarter.

- Q2 2025 Revenue Guidance: $42.5 billion to $45.5 billion.

- Full Year 2025 Expense Guidance: $113 billion to $118 billion.

- Full Year 2025 CapEx Guidance: $64 billion to $72 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Meta Platforms Inc (META, Financial) reported a strong start to the year with a 16% increase in total revenue, reaching $42.3 billion.

- The company has seen significant growth in user engagement, with improvements to recommendation systems leading to increased time spent on Facebook, Instagram, and Threads.

- Meta AI has nearly 1 billion monthly active users, with strong engagement particularly on WhatsApp and Facebook.

- The company is making strides in AI-driven advertising, with new models increasing conversion rates and more advertisers using AI creative tools.

- Meta Platforms Inc (META) is expanding its AI and hardware capabilities, with Ray-Ban Meta AI glasses tripling in sales and new launches planned with Essilor Luxottica.

Negative Points

- Reality Labs continues to operate at a loss, with a $4.2 billion operating loss reported for the quarter.

- The company faces regulatory challenges in the EU, which could impact its business model and revenue in the region.

- Increased infrastructure and hardware costs have led to a higher capital expenditure outlook for 2025, impacting financial flexibility.

- There is uncertainty in the macroeconomic environment, including potential impacts from changes in e-commerce regulations affecting advertiser spend.

- Meta Platforms Inc (META) is experiencing capacity constraints in AI infrastructure, which could delay some product developments and testing.