Summary:

- AMD CEO Lisa Su unveiled the MI350 GPU series, emphasizing a surge in AI model-driven inference growth.

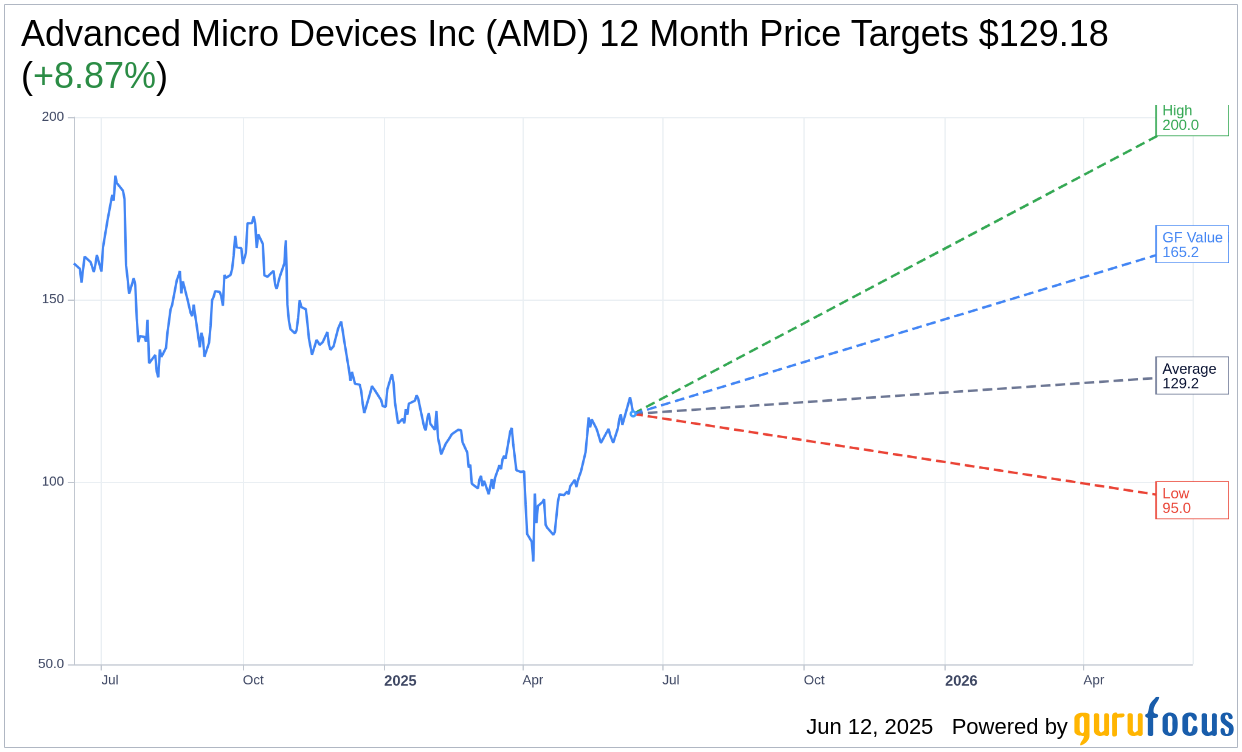

- Analysts predict a 8.87% upside potential for AMD, with an average price target of $129.18.

- GuruFocus estimates suggest a 39.23% upside with a GF Value of $165.21 for AMD.

AMD's Strategic Move in AI Technology

Advanced Micro Devices Inc (NASDAQ: AMD) is making significant strides in the artificial intelligence (AI) arena. At a recent conference, CEO Lisa Su spotlighted the rapidly evolving AI landscape, emphasizing a pivotal shift with inference demand now surpassing training due to a proliferation of AI models. This insight was coupled with the introduction of the MI350 GPU series, expected to drive substantial growth in AI model inference across various industries.

Wall Street Analysts' Expectations for AMD

According to insights from 41 analysts, the average one-year price target for AMD is set at $129.18. This reflects a potential upside of 8.87% from its current trading price of $118.66. Experts anticipate a price spectrum ranging from a low of $95.00 to a high of $200.00. For a more detailed outlook, you can explore further on the Advanced Micro Devices Inc (AMD, Financial) Forecast page.

Consensus among 52 brokerage firms places AMD's average recommendation at 2.1, suggesting an "Outperform" rating. This scale ranges between 1, indicating a "Strong Buy," to 5, which signals "Sell."

GuruFocus's Valuation Insight

Through the lens of GuruFocus's proprietary metrics, the estimated GF Value for AMD over the next year is $165.21. This valuation forecasts an impressive potential upside of 39.23% from its current price point of $118.66. The GF Value is a calculated estimate, considering historical trading multiples, past business growth, and projected future performance. For an in-depth analysis, visit the Advanced Micro Devices Inc (AMD, Financial) Summary page.