Key Takeaways:

- Texas Capital Securities rates Gambling.com Group Ltd (GAMB, Financial) as a Buy due to its robust market presence.

- Analysts forecast significant EBITDA growth from strategic acquisitions and global expansion.

- Current stock performance shows a 12.8% decrease year-to-date, with a $17 price target.

Texas Capital Securities Initiates Buy Rating

Texas Capital Securities has taken a bullish stance on Gambling.com Group Ltd. (NASDAQ: GAMB), initiating coverage with a Buy rating. The firm highlights the company's solid footing in the online wagering market, expecting its EBITDA growth to outperform industry standards. This optimistic outlook is supported by Gambling.com's strategic acquisitions and its ongoing international expansion efforts. Despite the positive projection, GAMB's stock has declined by 12.8% so far this year, but analysts have set a price target of $17.

Wall Street Analysts' Forecast

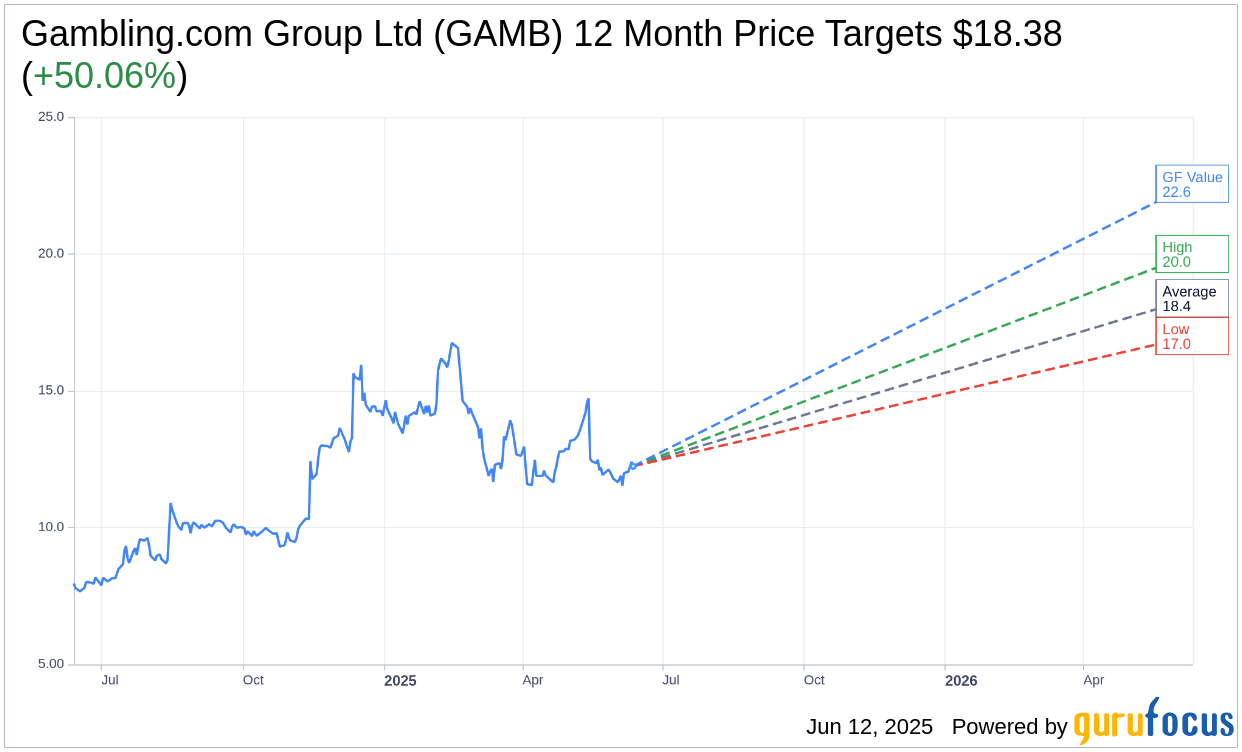

Wall Street anticipates promising growth for Gambling.com Group Ltd (GAMB, Financial). With input from 8 analysts, the consensus average price target for GAMB in the next year is $18.38, ranging from a low of $17.00 to a high of $20.00. This average target suggests a potential upside of 50.06% from the current stock price of $12.25. For more detailed projections, visit the Gambling.com Group Ltd (GAMB) Forecast page.

Market sentiment supports this forecast, with an average brokerage recommendation of 1.6 out of 8 firms, which classifies the stock as "Outperform." This rating is based on a scale where 1 is a Strong Buy and 5 is a Sell.

GuruFocus GF Value Estimation

The GF Value model of GuruFocus, which determines a stock's fair trading value, estimates that Gambling.com Group Ltd (GAMB, Financial) could reach $22.57 within a year. This projection indicates a substantial potential upside of 84.32% from its current price of $12.25. The GF Value is derived from historical trading multiples, past business growth, and future performance forecasts. For a comprehensive overview, explore the Gambling.com Group Ltd (GAMB) Summary page.