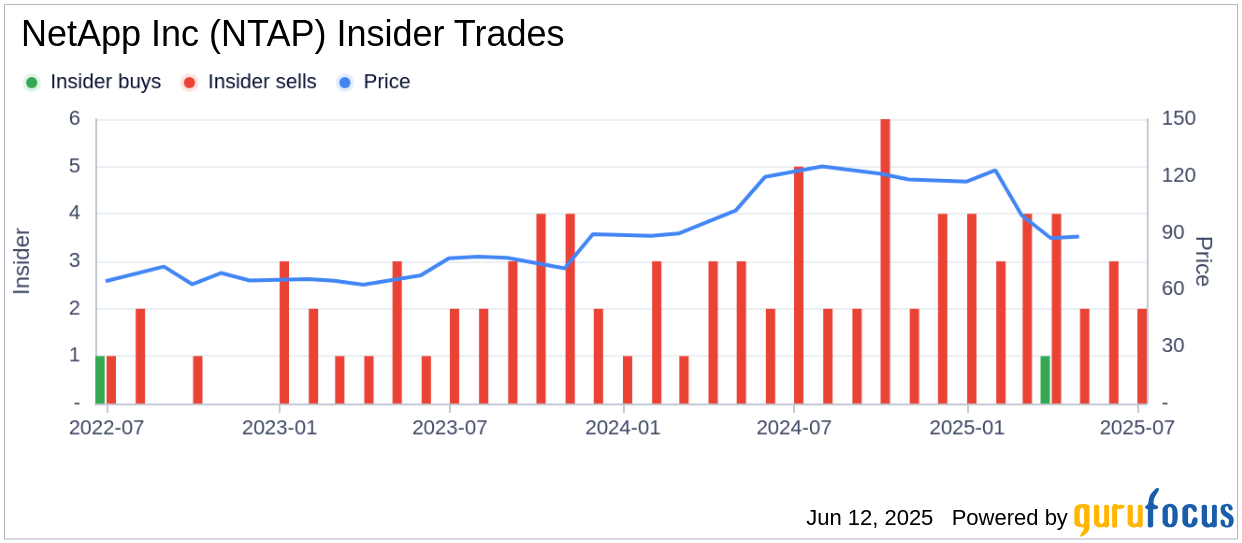

On June 10, 2025, Elizabeth O'callahan, Executive Vice President and Chief Administrative Officer at NetApp Inc's branch, executed a sale of 528 shares of NetApp Inc (NTAP, Financial). Following this transaction, the insider now holds 25,251 shares of the company. The details of this transaction can be found in the SEC Filing. NetApp Inc is a global cloud-led, data-centric software company that empowers organizations to lead with data in the age of accelerated digital transformation. The company provides a full range of hybrid cloud data services that simplify management of applications and data across cloud and on-premises environments to accelerate digital transformation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.