Raymond James analyst J.R. Weston has begun coverage on Constellation Energy (CEG, Financial), assigning it an Outperform rating and setting a price target of $326. Constellation Energy stands out as a leader in clean energy production, operating the largest nuclear fleet and possessing the most substantial commercial-industrial retail portfolio, reinforcing its dominant market position.

The analyst highlights the strategic advantage gained from the acquisition and integration of the private merchant generator, Calpine. This move enhances Constellation Energy's story of low capital expenditure, providing the company with notable financial flexibility, especially through its potential for share buybacks.

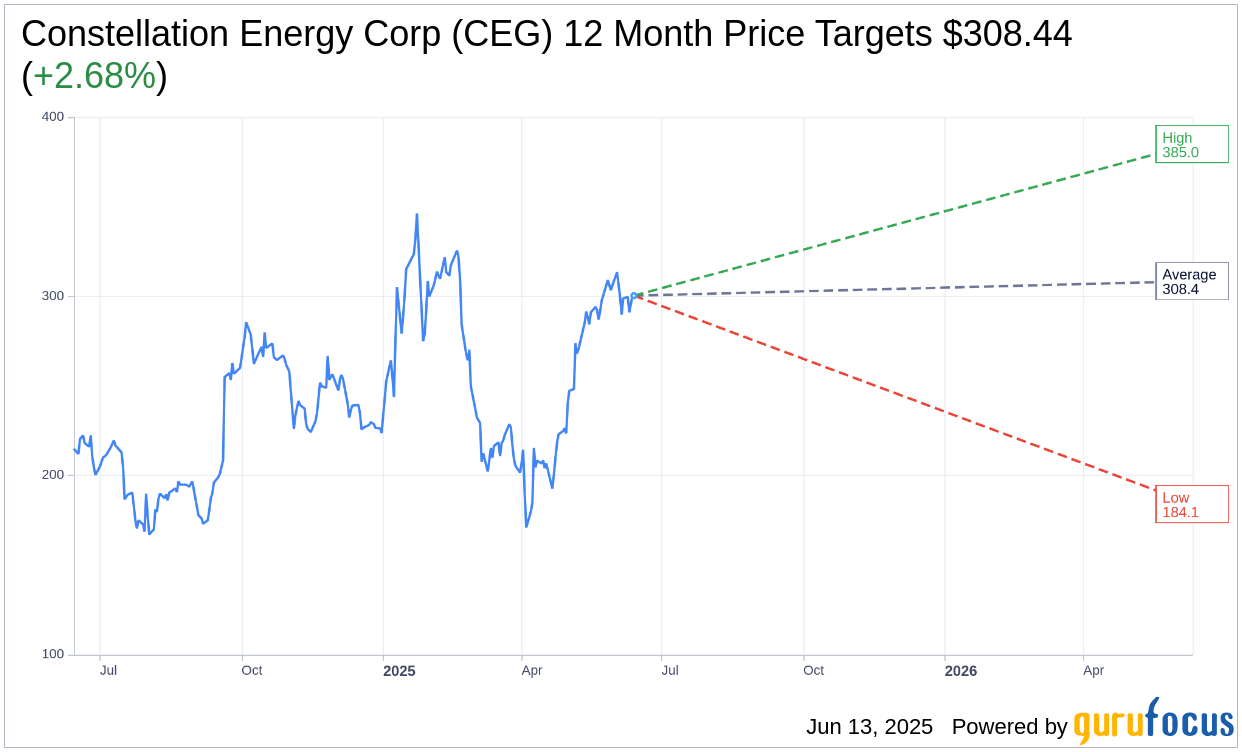

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Constellation Energy Corp (CEG, Financial) is $308.44 with a high estimate of $385.00 and a low estimate of $184.05. The average target implies an upside of 2.68% from the current price of $300.38. More detailed estimate data can be found on the Constellation Energy Corp (CEG) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Constellation Energy Corp's (CEG, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Constellation Energy Corp (CEG, Financial) in one year is $106.76, suggesting a downside of 64.46% from the current price of $300.38. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Constellation Energy Corp (CEG) Summary page.

CEG Key Business Developments

Release Date: May 06, 2025

- GAAP Earnings: $0.38 per share.

- Adjusted Operating Earnings: $2.14 per share, $0.32 higher than last year.

- Full-Year Operating EPS Guidance: Reaffirmed at $8.90 to $9.60 per share.

- Nuclear Generation: Over 41 million megawatt hours with a capacity factor of 94.1%.

- Refueling Outage Performance: Average of 24 days compared to industry average of nearly 40 days.

- Renewable Energy Capture: 96.2%.

- Power Dispatch Match: 99.2%.

- Calpine Acquisition Impact: Expected to add at least $2 in EPS and $2 billion of free cash flow before growth starting next year.

- Inflation Adjustment Impact: Estimated to add an incremental $500 million in revenues to base earnings for 2028.

- Buyback Authorization: Approximately $1 billion remaining.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Constellation Energy Corp (CEG, Financial) reported strong financial performance with GAAP earnings of $0.38 per share and adjusted operating earnings of $2.14 per share, exceeding last year's figures.

- The company is making significant progress in its data economy strategy, with favorable market conditions and strong demand for clean and reliable energy solutions.

- Constellation Energy Corp (CEG) is well-positioned to capitalize on the growing demand for data centers, leveraging its clean and reliable nuclear energy assets.

- The acquisition of Calpine is seen as a strategic advantage, providing new capabilities and enhancing the company's competitive position in the market.

- The company has a strong investment-grade credit rating, providing confidence to customers and supporting long-term contracts.

Negative Points

- There is equity volatility affecting Constellation Energy Corp (CEG)'s stock price, driven by macroeconomic factors beyond the company's control.

- The regulatory process for behind-the-meter configurations is currently tied up at FERC, creating uncertainty and potential delays in project execution.

- The company faces challenges in managing the cost of new entry for power generation, as costs for combined cycle machines and solar with storage have increased substantially.

- There is skepticism about the overstated demand forecasts for data centers, which could impact future planning and investments.

- The reconciliation process for the IRA and nuclear tax credits may be bumpy, with potential impacts on the company's financial strategy.