Citi analyst Patrick Cunningham has revised the price target for Axalta Coating Systems (AXTA, Financial), lowering it to $34 from the previous $35 while maintaining a Neutral rating on the stock. The outlook for fiscal 2025 indicates ongoing challenges for coating companies, particularly due to uncertainties related to tariffs. Despite the adjustments for AXTA, the firm has shown a preference for investing in companies like RPM and PPG, citing clearer opportunities for gaining market share and growth.

Wall Street Analysts Forecast

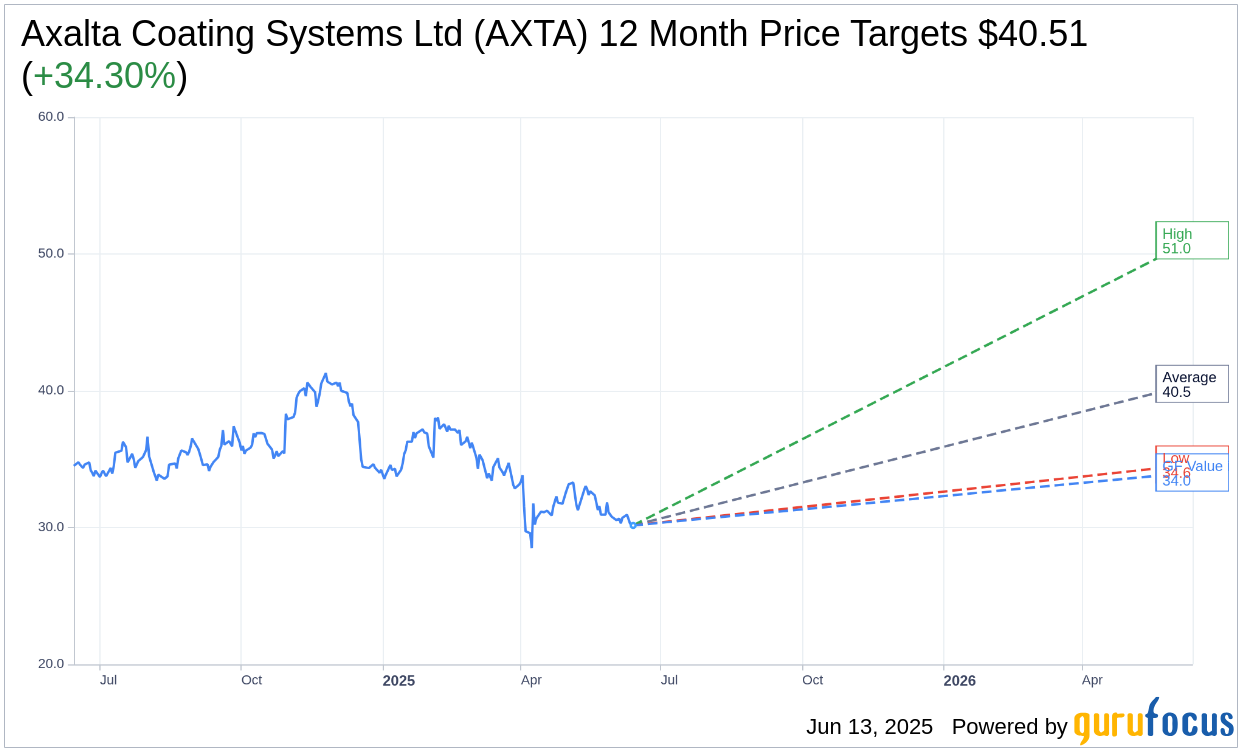

Based on the one-year price targets offered by 19 analysts, the average target price for Axalta Coating Systems Ltd (AXTA, Financial) is $40.51 with a high estimate of $51.00 and a low estimate of $34.61. The average target implies an upside of 34.30% from the current price of $30.16. More detailed estimate data can be found on the Axalta Coating Systems Ltd (AXTA) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Axalta Coating Systems Ltd's (AXTA, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Axalta Coating Systems Ltd (AXTA, Financial) in one year is $34.03, suggesting a upside of 12.83% from the current price of $30.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Axalta Coating Systems Ltd (AXTA) Summary page.

AXTA Key Business Developments

Release Date: May 07, 2025

- Adjusted EBITDA: $270 million, a 4% increase year-over-year.

- Adjusted EBITDA Margin: Increased by 140 basis points year-over-year.

- Adjusted Diluted EPS: Grew by 16% year-over-year to $0.59.

- Net Sales: Decreased by approximately 3% year-over-year to $1.26 billion.

- Gross Margin: 34%, an increase of 110 basis points over last year.

- Operating Expenses: Decreased by 4% from last year.

- Performance Coatings Net Sales: Declined 3% year-over-year to $822 million.

- Refinish Net Sales: Decreased 2% to $511 million.

- Industrial Net Sales: Declined 6% year-over-year to $311 million.

- Mobility Coatings Net Sales: $440 million, a decrease of 1% from the prior year.

- Light Vehicle Net Sales: Down 1% in the first quarter.

- Commercial Vehicle Net Sales: Declined 3%.

- Free Cash Flow: Expected to be in the range of $475 million to $500 million for the full year.

- Net Leverage: Remained steady at 2.5 times.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Axalta Coating Systems Ltd (AXTA, Financial) reported a record adjusted EBITDA of $270 million for Q1 2025, marking a 4% increase year-over-year.

- Adjusted EBITDA margin grew by 140 basis points year-over-year, marking the tenth consecutive quarter of adjusted EBITDA margin growth.

- Adjusted diluted EPS grew by 16% year-over-year to $0.59, marking the seventh consecutive quarter of adjusted diluted EPS growth.

- Axalta Coating Systems Ltd (AXTA) received two Edison awards and a BIG Innovation award, highlighting their strength in innovation and product development.

- The company achieved double-digit volume growth year-over-year in both China and Latin America, surpassing auto production rates in those regions.

Negative Points

- Net sales decreased by approximately 3% year-over-year to $1.26 billion, primarily due to unfavorable foreign currency impacts and lower volumes.

- Three of the four end markets showed macro declines, with industrial organic net sales decreasing by 4% year-over-year.

- Refinish organic net sales decreased by 1%, with the industry down mid-single digits due to external demand pressures.

- The USMCA Class 8 market production forecast was revised down to 255,000 units, a decline of over 20% compared to 2024.

- The company is facing potential tariff impacts, estimating costs of approximately $50 million annually, with $25 million expected to impact in 2025.