KeyBanc has revised its price target for Rockwell Automation (ROK, Financial), elevating it from $345 to $360. The firm maintains an Overweight rating on ROK shares, reflecting optimism following a robust Q1 earnings season and insights gathered during a recent conference in Boston focused on Industrials and Basic Materials. Despite ongoing global trade challenges and macroeconomic uncertainty, KeyBanc notes that recent industry data has been more promising than anticipated, suggesting a positive outlook for the stock.

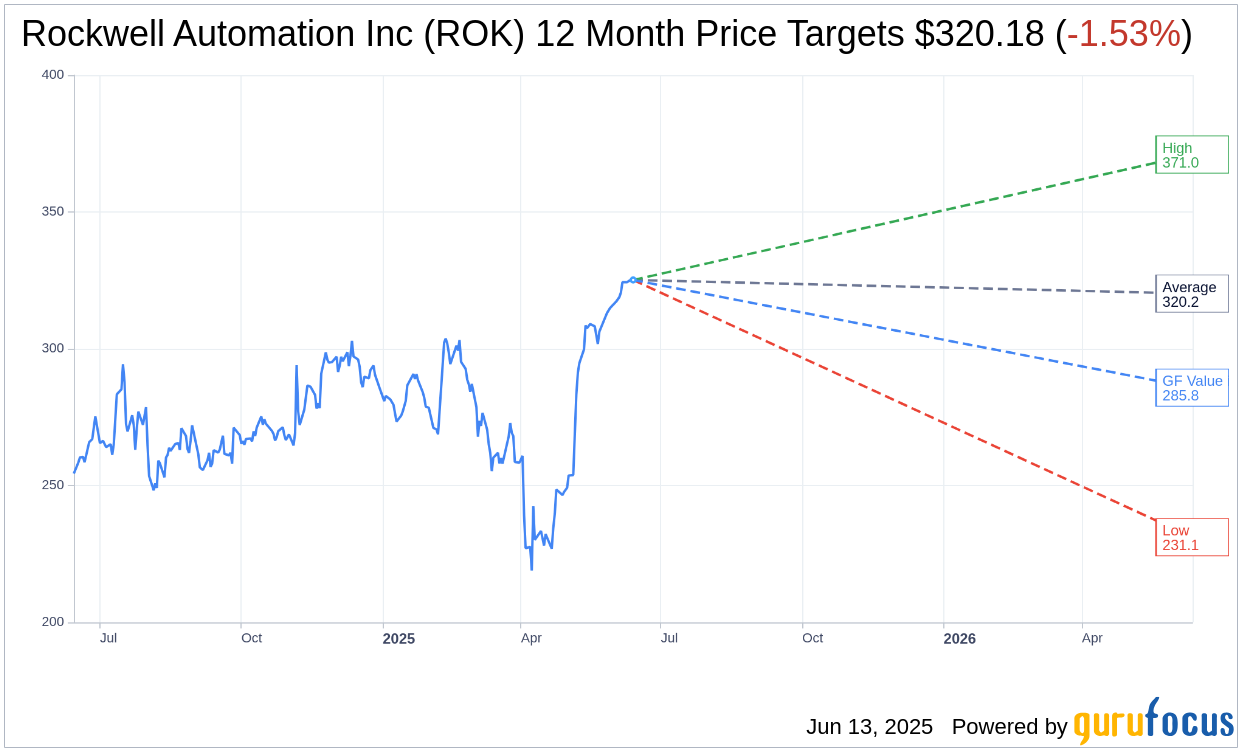

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for Rockwell Automation Inc (ROK, Financial) is $320.18 with a high estimate of $371.00 and a low estimate of $231.12. The average target implies an downside of 1.53% from the current price of $325.14. More detailed estimate data can be found on the Rockwell Automation Inc (ROK) Forecast page.

Based on the consensus recommendation from 29 brokerage firms, Rockwell Automation Inc's (ROK, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rockwell Automation Inc (ROK, Financial) in one year is $285.79, suggesting a downside of 12.1% from the current price of $325.14. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rockwell Automation Inc (ROK) Summary page.

ROK Key Business Developments

Release Date: May 07, 2025

- Reported Sales: Down 6% year-over-year.

- Organic Sales: Declined 4% year-over-year.

- Segment Operating Margin: 20.4%, up from 19% a year ago.

- Adjusted EPS: $2.45, above expectations.

- Free Cash Flow: $171 million, $102 million higher than the prior year.

- Free Cash Flow Conversion: 61% in the second quarter.

- Intelligent Devices Organic Sales: Declined 6% year-over-year.

- Software & Control Organic Sales: Up 2% year-over-year.

- Lifecycle Services Organic Sales: Decreased 6% year-over-year.

- Annual Recurring Revenue (ARR): Grew 8% in the quarter.

- Full Year Segment Margin Target: Increased to 20%.

- Full Year Adjusted EPS Guidance: $9.20 to $10.20, midpoint at $9.70.

- Free Cash Flow Conversion Target: 100% for fiscal year 2025.

- Currency Impact: Negative 2 points on sales in the quarter.

- Book-to-Bill Ratio: In line with historical norm of about 1.0.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Rockwell Automation Inc (ROK, Financial) reported a solid sequential improvement in customer demand across many parts of its business, with a healthy intake of orders and a book-to-bill ratio in line with historical norms.

- The company's Intelligent Devices segment saw double-digit sequential growth across all key product lines, driven by strong performance in the Power Control business.

- Software & Control organic sales were up 2% year-over-year, with increased adoption of the FactoryTalk Design Studio, featuring a GenAI Copilot.

- Rockwell Automation Inc (ROK) achieved a segment margin of 20.4% and adjusted EPS of $2.45, both above expectations, driven by cost reduction and margin expansion actions.

- The company is increasing its full-year segment margin target to 20% and expects adjusted EPS to be about $9.70 at the midpoint, reflecting strong execution and demand.

Negative Points

- Reported sales were down 6% year-over-year, with organic sales down 4% due to difficult year-over-year comparisons.

- Lifecycle Services organic sales decreased 6% year-over-year, impacted by trade and policy uncertainty affecting large CapEx projects.

- The company's energy business underperformed expectations due to customers exercising capital discipline and project delays.

- Unfavorable currency reduced sales by about 2 percentage points, impacting overall financial performance.

- Despite strong execution, there remains uncertainty in the second half regarding pricing to offset new tariffs and the timing of CapEx investments by customers.