Citi has revised its price target for Comstock Resources (CRK, Financial), increasing it from $22 to $27 while maintaining a Neutral rating on the stock. The adjustment comes after the firm made slight updates to the company's model, aiming to determine a tangible value for the Western Haynesville development.

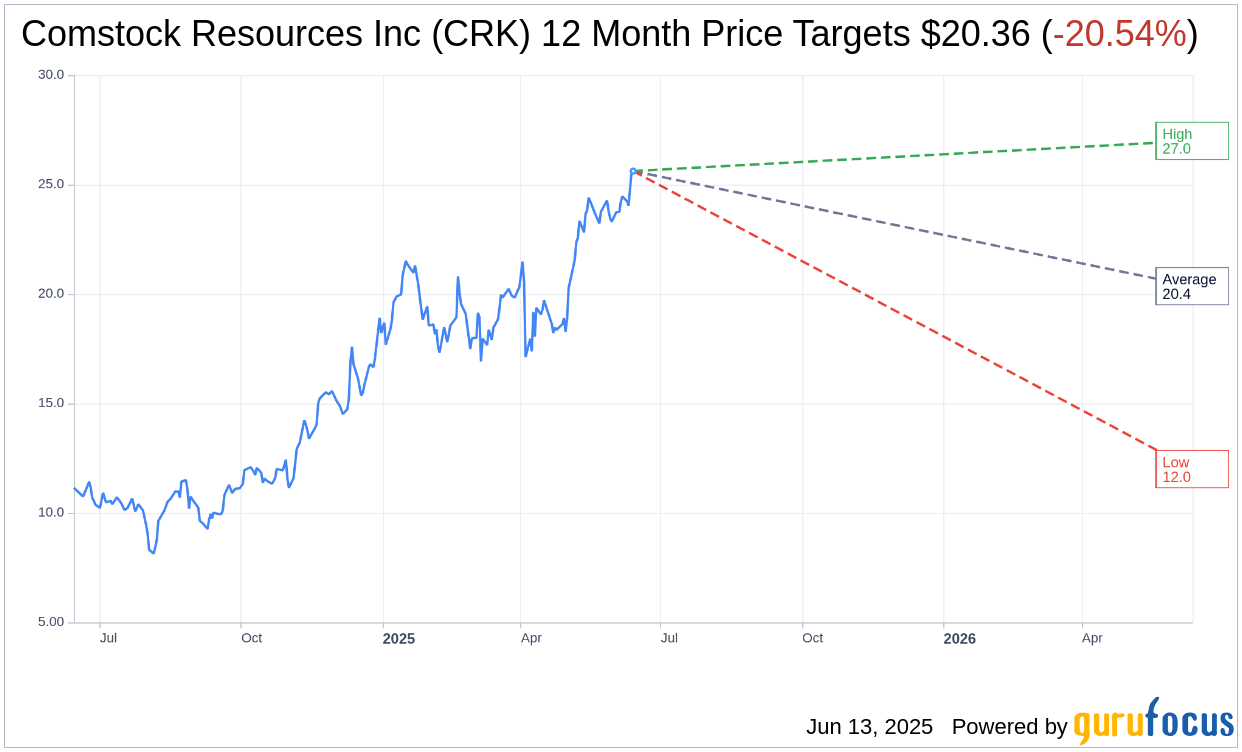

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Comstock Resources Inc (CRK, Financial) is $20.36 with a high estimate of $27.00 and a low estimate of $12.00. The average target implies an downside of 20.54% from the current price of $25.62. More detailed estimate data can be found on the Comstock Resources Inc (CRK) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Comstock Resources Inc's (CRK, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Comstock Resources Inc (CRK, Financial) in one year is $11.06, suggesting a downside of 56.83% from the current price of $25.62. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Comstock Resources Inc (CRK) Summary page.

CRK Key Business Developments

Release Date: May 01, 2025

- Natural Gas and Oil Sales: $405 million.

- Operating Cash Flow: $239 million or $0.81 per diluted share.

- Adjusted EBITDA: $293 million.

- Adjusted Net Income: $53.8 million or $0.18 per diluted share.

- Production: 1.28 BCFE per day, 17% lower than Q1 2024.

- Realized Gas Price: $3.58 per MCF.

- Operating Cost per MCFE: $0.83.

- EBITDAX Margin: 76%.

- Development Spending: $250 million.

- Total Debt: $3.1 billion.

- Liquidity: Approximately $1 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Comstock Resources Inc (CRK, Financial) reported a significant increase in natural gas and oil sales, reaching $405 million in Q1 2025, driven by higher natural gas prices.

- The company achieved a major milestone with the successful drilling of the Elijah one well in the Western Haynesville, which confirmed the potential of their geologic work and added thousands of future drilling locations.

- Comstock Resources Inc (CRK) has materially reduced the cost of wells and continues to optimize drilling and completion designs to maximize performance and returns.

- The company has strong financial liquidity, totaling almost $1 billion, and expects to fund its drilling program out of operating cash flow.

- Comstock Resources Inc (CRK) has made significant progress in reducing greenhouse gas and methane emissions, achieving a 28% improvement in greenhouse gas intensity over the past two years.

Negative Points

- Production in Q1 2025 averaged 1.28 BCFE per day, which is 17% lower than the first quarter of 2024 due to the decision to drop two rigs early and defer completion activity.

- The company experienced a $16 million loss on third-party gas marketing due to high volatility in gas prices and obligations to fill transport commitments.

- Operating costs per MCFE increased by $0.11 compared to the fourth quarter, driven by higher production and ad valorem taxes.

- Comstock Resources Inc (CRK) has a substantial amount of debt, with $3.1 billion in total debt, including outstanding senior notes.

- The company faces challenges in expanding its midstream infrastructure to keep up with growing production, which could delay the drilling of new wells in certain areas.