Financial statements for the first quarter revealed that MNY reported revenues of $14.314 million, a notable decline from the $22.175 million recorded in the same period last year. Despite the reduction in revenue, the company showcased significant financial advances. The net loss was effectively reduced to $2.4 million from the previous year's $13.1 million during the same quarter.

MNY also posted an improvement in its Adjusted EBITDA loss, which now stands at $3.3 million. Additionally, the company successfully decreased its cost of revenue to 44% of total revenue, marking a 20-point reduction. These positive developments demonstrate a strategic enhancement in revenue quality, operating efficiency, and margin expansion, setting a promising tone for 2025.

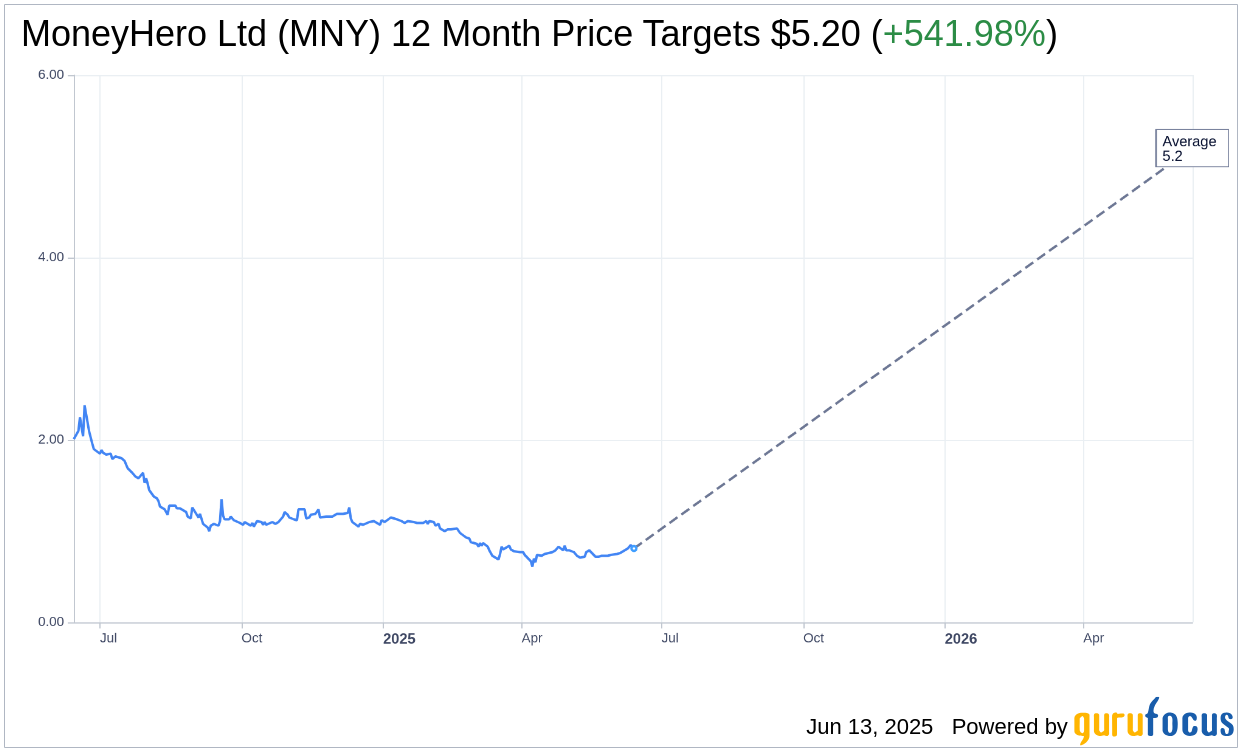

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for MoneyHero Ltd (MNY, Financial) is $5.20 with a high estimate of $5.20 and a low estimate of $5.20. The average target implies an upside of 541.98% from the current price of $0.81. More detailed estimate data can be found on the MoneyHero Ltd (MNY) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, MoneyHero Ltd's (MNY, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

MNY Key Business Developments

Release Date: April 29, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MoneyHero Ltd (MNY, Financial) reported a significant improvement in adjusted EBITDA loss, reducing it to $2.9 million, marking their best quarterly performance since going public.

- The company's gross margin expanded by 25 percentage points year over year, indicating improved profitability.

- Registered members increased by 42% year over year to 7.5 million, showcasing strong user engagement.

- Insurance revenue grew by 40% to $8.2 million in 2024, now accounting for a double-digit share of total revenue.

- Wealth revenues surged by 138% to $8.5 million in 2024, driven by strong demand for investment products and banking accounts.

Negative Points

- Total revenue during the quarter fell by 40% year over year to $15.7 million, primarily due to a strategic pivot towards high-margin products.

- Net loss, although narrowed, was still substantial at $18.8 million compared to $94.3 million the previous year.

- The company incurred a $67 million one-time share-based payment expense related to its Nasdaq listing, impacting financials.

- Advertising and marketing expenses were up significantly from last year in terms of absolute dollars and as a percentage of revenue.

- The company faces challenges in maintaining its Nasdaq listing due to its current share price being below the dollar threshold.