Key Takeaways:

- The U.S. Army has ended its light tank project contract with General Dynamics, affecting future production plans.

- Analysts see potential upside for General Dynamics stock with target prices above current levels.

- GuruFocus estimates suggest a fair value increase for General Dynamics, indicating a positive outlook.

The recent decision by the U.S. Army to terminate the M10 Booker light tank project has significant implications for General Dynamics (GD, Financial). Originally poised to enter full production, the contract's cancellation comes after over $1 billion spent on development. This move reflects a shift in strategic military priorities and halts plans to acquire up to 504 units of the tank.

Analyst Price Target Insights

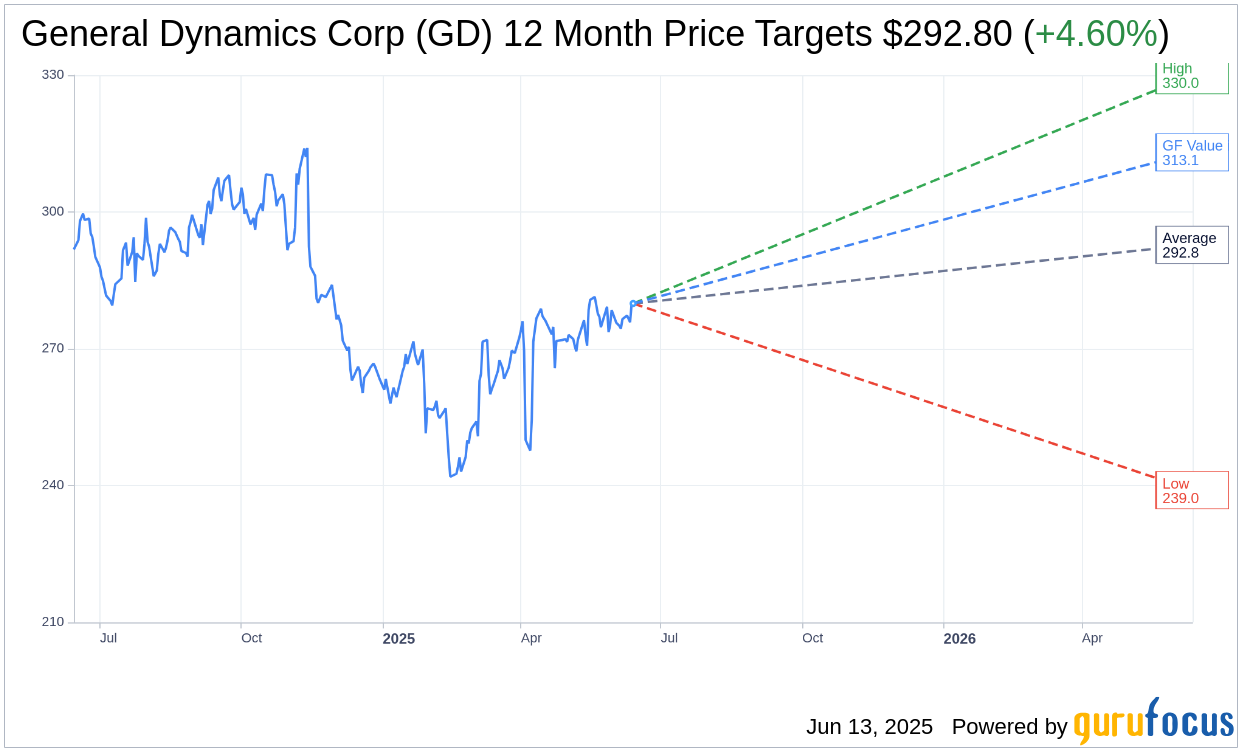

Wall Street analysts have projected the average price target for General Dynamics Corp (GD, Financial) at $292.80 over the next year. The range spans from a high estimate of $330.00 to a low estimate of $239.00. These projections suggest a potential upside of 4.60% from its current trading price of $279.93. To explore more detailed estimates, visit the General Dynamics Corp (GD) Forecast page on GuruFocus.

Brokerage Recommendations

General Dynamics Corp (GD, Financial) holds an "Outperform" rating with an average brokerage recommendation of 2.5 on a scale where 1 signifies a Strong Buy and 5 denotes Sell. This consensus reflects the positive sentiment from 25 brokerage firms regarding GD's market prospects.

GF Value and Investment Outlook

According to GuruFocus, the estimated GF Value for General Dynamics Corp (GD, Financial) is projected at $313.07 within one year. This suggests an attractive upside potential of 11.84% from the current price of $279.93. The GF Value is an estimate of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. Investors can access more details on the General Dynamics Corp (GD) Summary page on GuruFocus.