In a significant move for RadNet (RDNT, Financial), B. Riley Securities has initiated coverage of the stock with a "Buy" rating. This announcement, made by analyst Yuan Zhi on June 13, 2025, sets a positive tone for the company’s future prospects.

Alongside the "Buy" rating, B. Riley Securities has announced a price target of $69.00 USD for RadNet (RDNT, Financial). This represents the initial target set by the firm, as there was no prior adjusted price target available for comparison.

The initiation of coverage by B. Riley Securities could potentially influence investor sentiment and trading activity for RadNet (RDNT, Financial), given the firm's reputable standing in the financial analysis community. Investors typically view new analyst coverage as a sign of the company’s growth potential and market relevance.

As of the date of the announcement, RadNet (RDNT, Financial) is focused on maintaining its position in the market with this positive analyst outlook. The stock’s performance and any changes in its market perceptions remain to be observed following this coverage initiation.

Wall Street Analysts Forecast

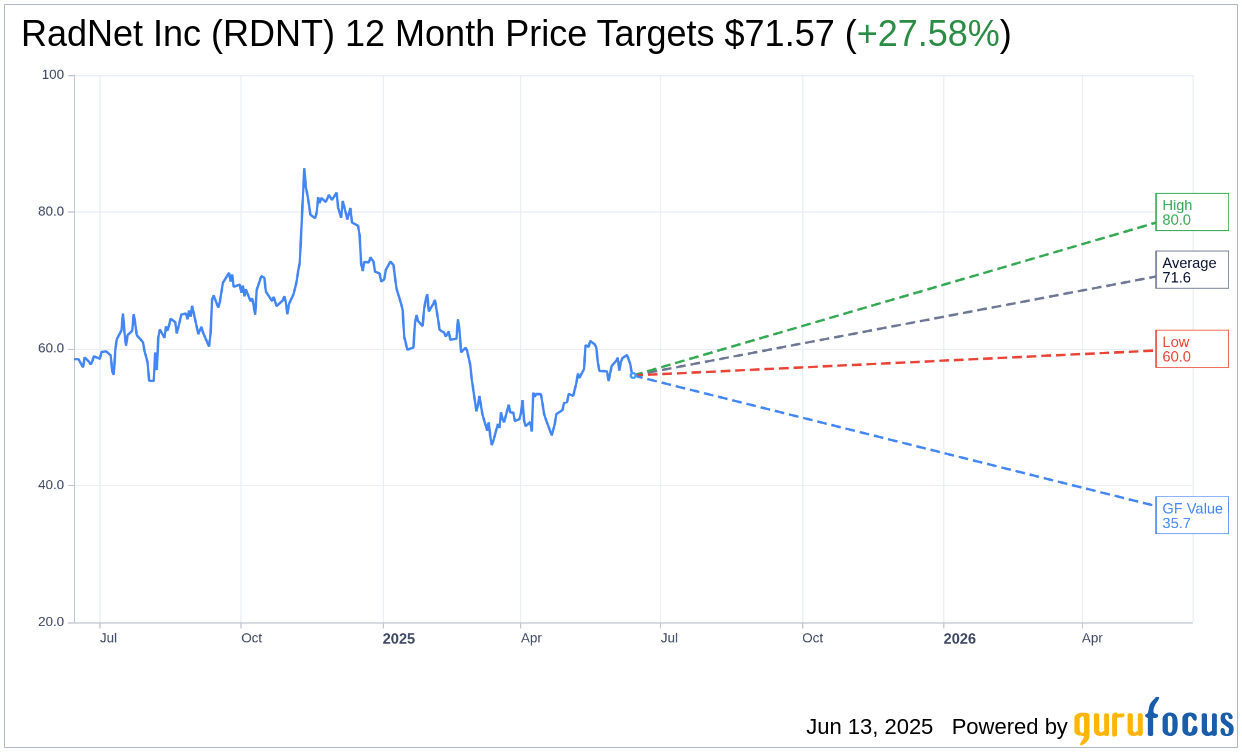

Based on the one-year price targets offered by 7 analysts, the average target price for RadNet Inc (RDNT, Financial) is $71.57 with a high estimate of $80.00 and a low estimate of $60.00. The average target implies an upside of 27.58% from the current price of $56.10. More detailed estimate data can be found on the RadNet Inc (RDNT) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, RadNet Inc's (RDNT, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for RadNet Inc (RDNT, Financial) in one year is $35.67, suggesting a downside of 36.42% from the current price of $56.1. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the RadNet Inc (RDNT) Summary page.