On June 13, 2025, RBC Capital initiated coverage on Air Products (APD, Financial) with an "Outperform" rating. This marks a significant development for the company, adding another layer of interest for investors and market analysts.

RBC Capital's analyst Arun Viswanathan has announced a price target of USD 355.00 for Air Products (APD, Financial). This target provides a qualitative measure of the stock's potential value in the market.

As there were no prior ratings or price targets issued by RBC Capital for Air Products (APD, Financial), this initiation offers a fresh and insightful perspective on the stock's positioning in the market.

Investors in Air Products (APD, Financial) will be keeping a close watch on market movements and any subsequent updates provided by RBC Capital or other analysts in the coming months.

Wall Street Analysts Forecast

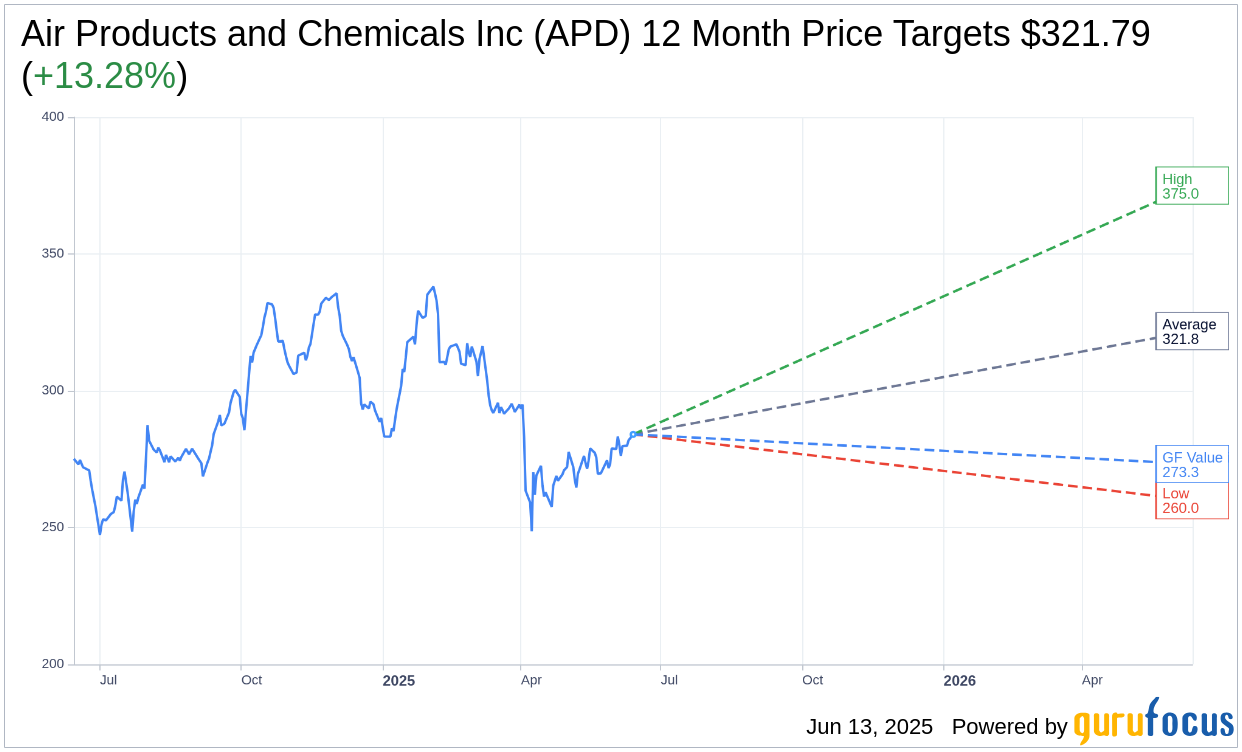

Based on the one-year price targets offered by 22 analysts, the average target price for Air Products and Chemicals Inc (APD, Financial) is $321.79 with a high estimate of $375.00 and a low estimate of $260.00. The average target implies an upside of 13.28% from the current price of $284.07. More detailed estimate data can be found on the Air Products and Chemicals Inc (APD) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Air Products and Chemicals Inc's (APD, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Air Products and Chemicals Inc (APD, Financial) in one year is $273.25, suggesting a downside of 3.81% from the current price of $284.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Air Products and Chemicals Inc (APD) Summary page.