CIBC analyst Krista Friesen has lifted the price target for AtkinsRealis (SNCAF, Financial) from C$92 to C$106, while maintaining an Outperform rating on the company's shares. This adjustment reflects the analyst's positive outlook on the stock's potential performance and growth prospects.

Wall Street Analysts Forecast

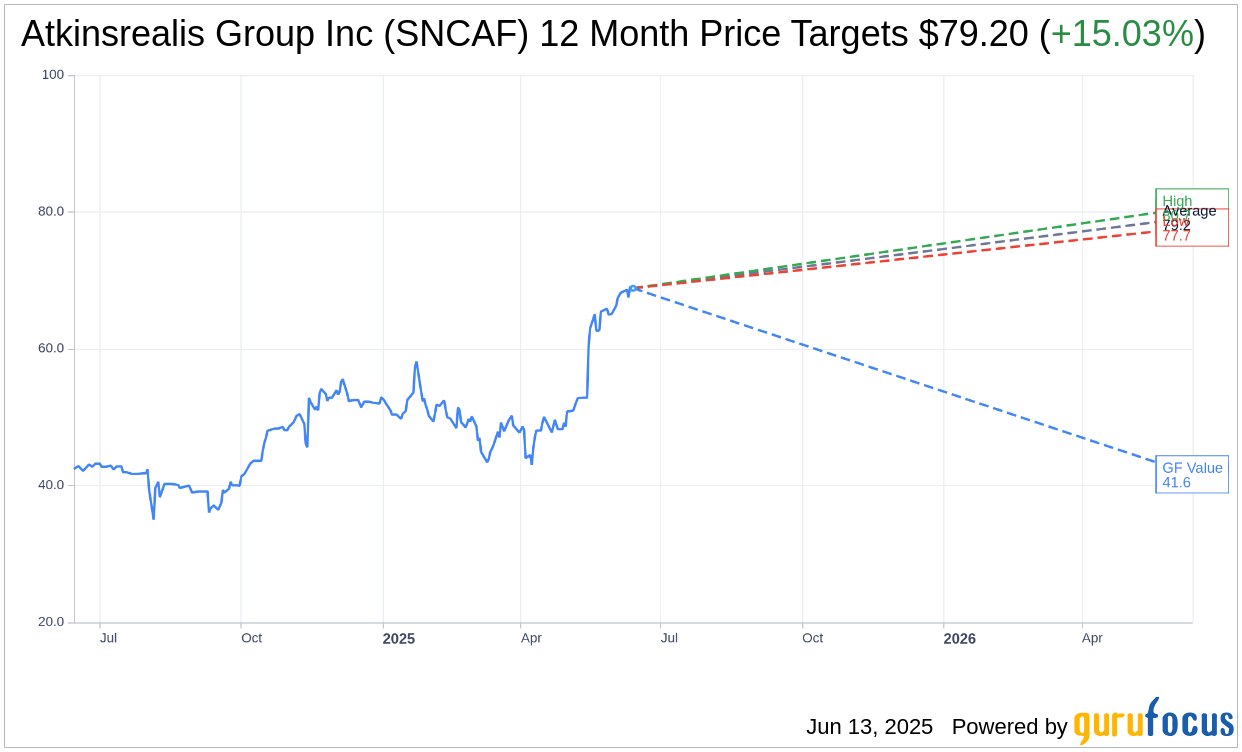

Based on the one-year price targets offered by 2 analysts, the average target price for Atkinsrealis Group Inc (SNCAF, Financial) is $79.20 with a high estimate of $80.66 and a low estimate of $77.73. The average target implies an upside of 15.03% from the current price of $68.85. More detailed estimate data can be found on the Atkinsrealis Group Inc (SNCAF) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Atkinsrealis Group Inc's (SNCAF, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Atkinsrealis Group Inc (SNCAF, Financial) in one year is $41.64, suggesting a downside of 39.52% from the current price of $68.85. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Atkinsrealis Group Inc (SNCAF) Summary page.

SNCAF Key Business Developments

Release Date: May 15, 2025

- Total Revenue: Increased 10% organically to $2.5 billion.

- Engineering Services Regions Revenue: Declined 4% organically to $1.7 billion.

- Nuclear Revenue: Grew 77% organically to $538 million.

- Adjusted EBIT for AtkinsRéal Services: Increased 20% to $224 million.

- Operating Cash Flow: Positive $39 million for the quarter.

- Net Leverage Ratio: 1.1 times, at the low end of the long-term target range.

- Backlog: Increased 32% year over year, reaching $12.7 billion.

- Segment Adjusted EBITDA Margin: Approximately 15% for the first quarter.

- IFRS Net Income: Increased 50% to $69 million.

- Adjusted EPS: Increased to $0.57 per diluted share from $0.42.

- Free Cash Flow: Negative $14 million for the quarter.

- Nuclear Backlog: $5.2 billion, 185% higher than March 31, 2024.

- Nuclear Revenue Outlook for 2025: Increased to $1.9 billion to $2 billion.

- Credit Rating: Updated to investment grade, BBB low with a positive outlook.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Atkinsrealis Group Inc (SNCAF, Financial) reported significant organic revenue growth, with total revenue increasing by 10% to $2.5 billion.

- The nuclear segment experienced a remarkable 77% organic revenue growth, reaching a quarterly record high of $538 million.

- The company achieved a strong increase in EPS and adjusted EBITDA, with the services segment's adjusted EBIT rising by 20% to $224 million.

- Backlog growth was robust, with a 32% increase over the prior year, driven by growth in nuclear and engineering services regions.

- The company maintained a strong balance sheet with a net leverage ratio of 1.1 times, at the low end of its long-term target range.

Negative Points

- Engineering Services Regions revenue declined by 4% organically to $1.7 billion, impacted by project completions and delays.

- Revenue in Canada declined 14% organically due to the completion of a large project with high flow-through costs.

- The EMEA region saw a 9% organic revenue decline, with a 12% decrease in backlog due to the completion of a major project phase.

- Free cash flow was negative $14 million for the quarter, despite positive operating cash flow.

- The company adjusted its nuclear adjusted EBIT to gross revenue ratio outlook for 2025 to a lower range of 11% to 13% due to business mix changes.