Johnson Controls (JCI, Financial) has expanded its share repurchase plan with the board approving an additional $9 billion in buybacks. This decision builds upon the $1.1 billion still available from a previous repurchase authorization set in motion in 2021.

The company has the flexibility to buy back shares through various means, including open market purchases and programs like Rule 10b5-1 plans, tender offers, or accelerated share repurchase methods. Despite the new authorization, Johnson Controls is under no obligation to repurchase a specific number of shares or adhere to a strict timeline. Such actions will depend on factors like the company’s share price and broader market conditions.

Furthermore, the buyback initiative has no expiration date, granting Johnson Controls the ability to amend or cease the program at any point. The company aims to conduct these repurchases as redemptions in line with Article 3(d) of its Articles of Association, providing it with significant flexibility in execution.

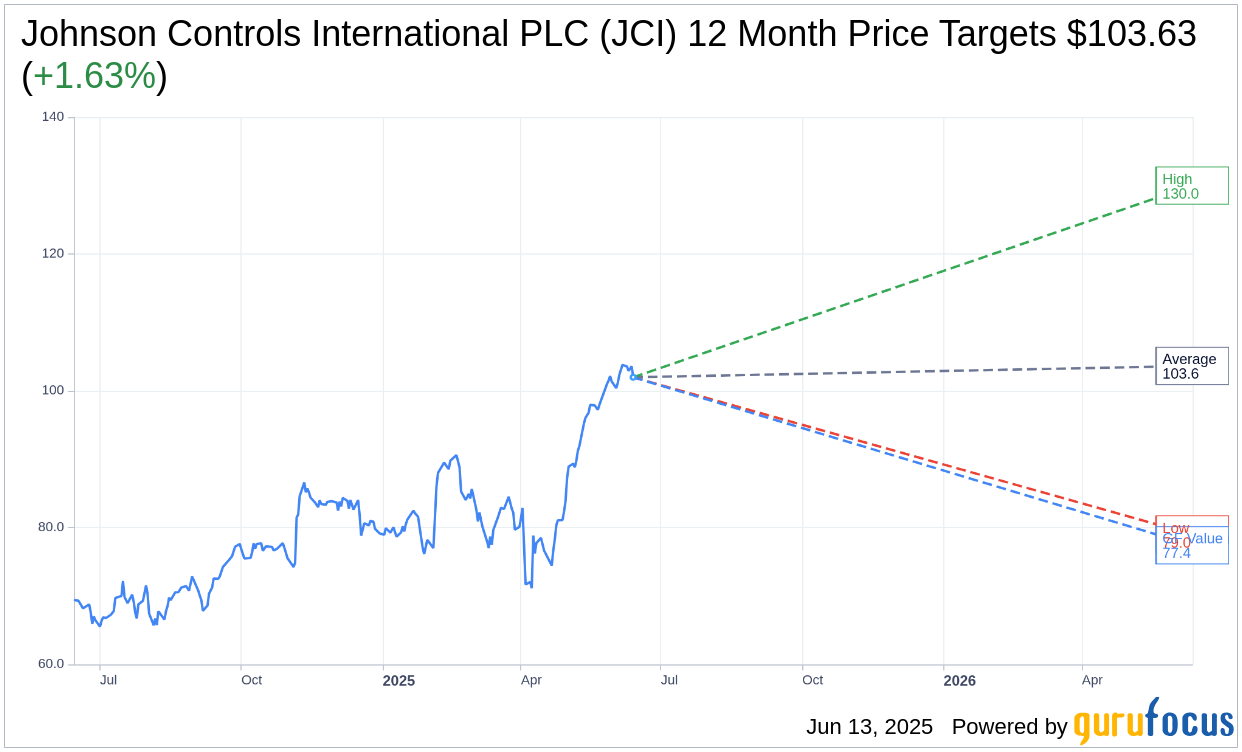

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Johnson Controls International PLC (JCI, Financial) is $103.63 with a high estimate of $130.00 and a low estimate of $79.00. The average target implies an upside of 1.63% from the current price of $101.97. More detailed estimate data can be found on the Johnson Controls International PLC (JCI) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Johnson Controls International PLC's (JCI, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Johnson Controls International PLC (JCI, Financial) in one year is $77.41, suggesting a downside of 24.09% from the current price of $101.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Johnson Controls International PLC (JCI) Summary page.

JCI Key Business Developments

Release Date: May 07, 2025

- Organic Sales Growth: 7% increase.

- Segment Margins: Expanded 180 basis points to 16.7%.

- Adjusted EPS: Increased 19% to $0.82.

- Orders Growth: Up 5%.

- Backlog: Grew 12% to $14 billion.

- Available Cash: Approximately $800 million.

- Net Debt: Decreased to 2.4 times.

- Adjusted Free Cash Flow: Increased approximately $1.1 billion year-to-date.

- Building Solutions Orders: North America up 4%, EMEA/LA up 10%, Asia Pacific flat.

- Building Solutions Organic Sales: North America up 7%, EMEA/LA up 5%, Asia Pacific up 13%.

- Building Solutions Margin: EMEA/LA expanded 410 basis points to 12.5%, APAC expanded 360 basis points to 14.6%, North America declined 20 basis points to 13.4%.

- Global Products Organic Sales Growth: 8%.

- Applied HVAC Growth: More than 20%.

- Adjusted Segment EBITA Margin: Expanded 600 basis points to 30.3%.

- Full Year Guidance: Adjusted EPS to approximate $3.60, representing roughly 12% growth.

- Free Cash Flow Conversion: Anticipated to be approximately 100% for the full year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Johnson Controls International PLC (JCI, Financial) reported strong second-quarter results with organic sales growth of 7% and a 19% increase in adjusted EPS.

- Segment margins expanded by 180 basis points to 16.7%, indicating improved operational efficiencies.

- The company raised its full-year guidance, reflecting confidence in continued growth and operational improvements.

- JCI's backlog grew by 12% to $14 billion, showcasing sustained demand for its solutions.

- The company is implementing a new organizational model to enhance customer focus and operational performance, which is expected to drive future growth.

Negative Points

- The company faces complexities in its current product offerings, including a high number of SKUs, which may slow operational and innovation execution.

- Tariffs and geopolitical uncertainties pose potential risks, with an estimated exposure of 2% of sales or 3% of cost of goods sold.

- Despite improvements, the North America segment saw a slight decline in adjusted margin by 20 basis points due to system growth outpacing service growth.

- The company's operational and innovation execution is hindered by complexities in its footprint and operating methods.

- There is a need for further strategic evaluation of the portfolio to optimize growth and shareholder value, indicating potential areas of underperformance.