A significant event is set to unfold as DA Davidson hosts a meeting in Minneapolis on June 17, with FSS actively participating in the proceedings. This gathering offers an opportunity for investors to gain in-depth insights into FSS's strategies and market positioning.

Investors looking to make informed decisions can benefit from advanced tools like TipRanks' new KPI Data, which allows users to delve into a company's performance metrics effectively. Additionally, TipRanks offers a Smart Value Newsletter that delivers information about undervalued and resilient stocks directly to subscribers' inboxes, further aiding investment strategies.

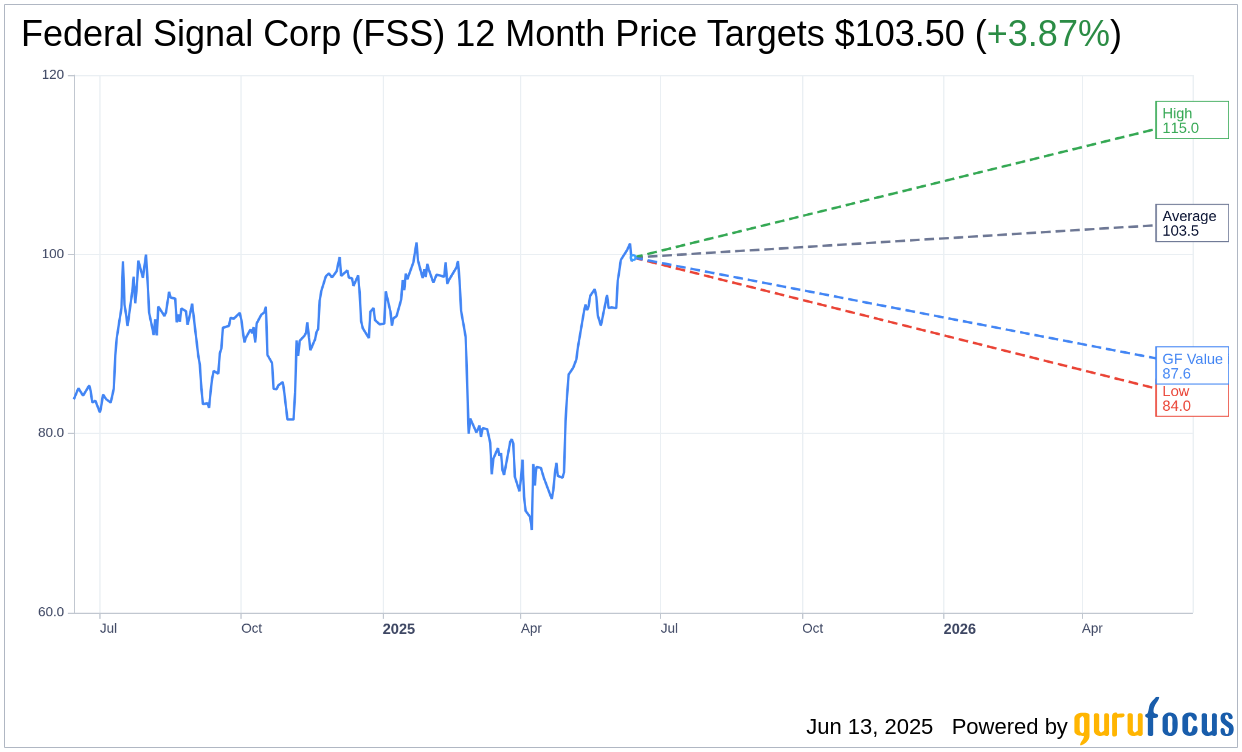

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Federal Signal Corp (FSS, Financial) is $103.50 with a high estimate of $115.00 and a low estimate of $84.00. The average target implies an upside of 3.87% from the current price of $99.64. More detailed estimate data can be found on the Federal Signal Corp (FSS) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Federal Signal Corp's (FSS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Federal Signal Corp (FSS, Financial) in one year is $87.60, suggesting a downside of 12.08% from the current price of $99.64. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Federal Signal Corp (FSS) Summary page.

FSS Key Business Developments

Release Date: April 30, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Federal Signal Corp (FSS, Financial) reported a 9% year-over-year increase in net sales, reaching $464 million for the quarter.

- The company achieved a 21% increase in consolidated operating income, amounting to $65.7 million.

- Record order intake was set at $568 million, a 13% increase compared to the previous year.

- Backlog reached an all-time high of $1.1 billion, providing strong visibility for future sales.

- The Environmental Solutions Group (ESG) reported a 17% increase in adjusted EBITDA, with margins expanding by 120 basis points to 20%.

Negative Points

- GAAP diluted EPS decreased to $0.75 per share from $0.84 per share in the same quarter last year.

- Tax expense increased significantly to $15.7 million, compared to a benefit of $700,000 in the prior year.

- The company faces potential challenges from global tariffs, although it has strategies in place to mitigate impacts.

- Despite strong performance, the macroeconomic environment remains uncertain, which could affect future growth.

- There is a need for continued investment in capacity and strategic initiatives to maintain growth momentum.