1: Marathon Petroleum in the First Quarter of 2025: Performance and Challenges.

Overview of Operations and Market Position

Marathon Petroleum Corporation (NYSE: MPC), based in Findlay, Ohio, operates a complex and integrated downstream business primarily focused on refining, marketing, and transporting petroleum products. It is the largest independent petroleum refining company in the United States based on crude oil processing capacity.

Key Assets and Partnerships

The company's largest refinery, the Galveston Bay Refinery in Texas, has a processing capacity of approximately 593K barrels per calendar day (bpcd). Marathon Petroleum owns a majority interest in MPLX LP, a midstream master limited partnership that manages logistics and infrastructure assets.

Industry Landscape and Strategic Shift

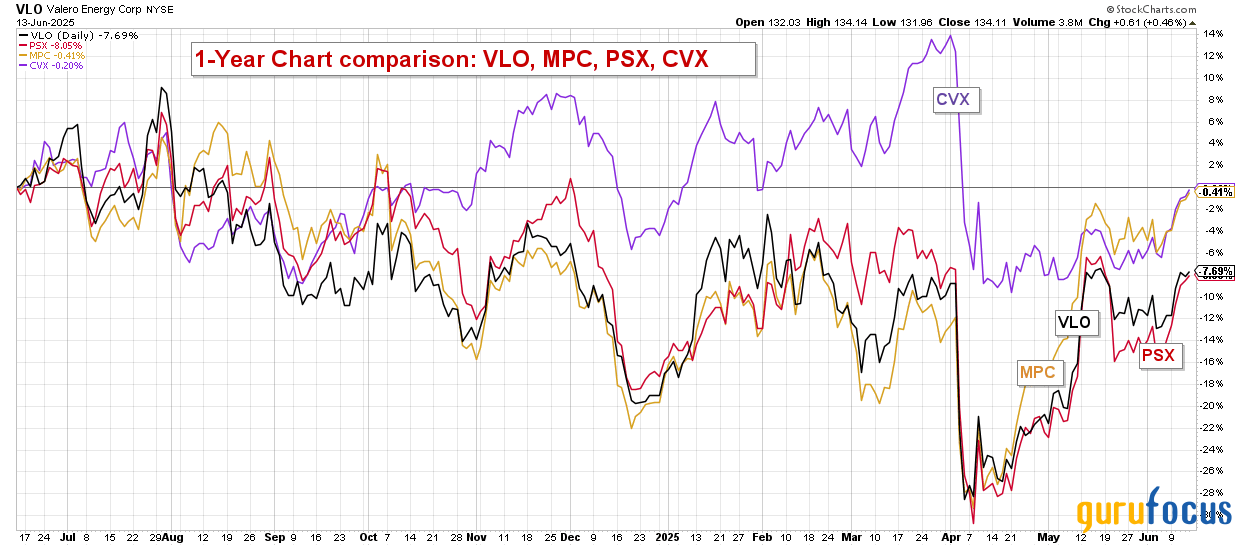

Chevron (CVX, Financial), Marathon Petroleum, Valero Energy (VLO, Financial), and Phillips 66 (PSX, Financial) are four of the largest and most influential refiners in the United States. Each of them plays a significant role in the downstream oil and gas sector, particularly in refining crude oil into usable fuels and chemicals.

Following the sale of Speedway in 2021 for gross cash proceeds of $21 billion, Marathon Petroleum has reorganized to focus more on its core refining and midstream operations. Importantly, the company has maintained a strong presence in fuel distribution and marketing, a testament to its market position and strategic focus.

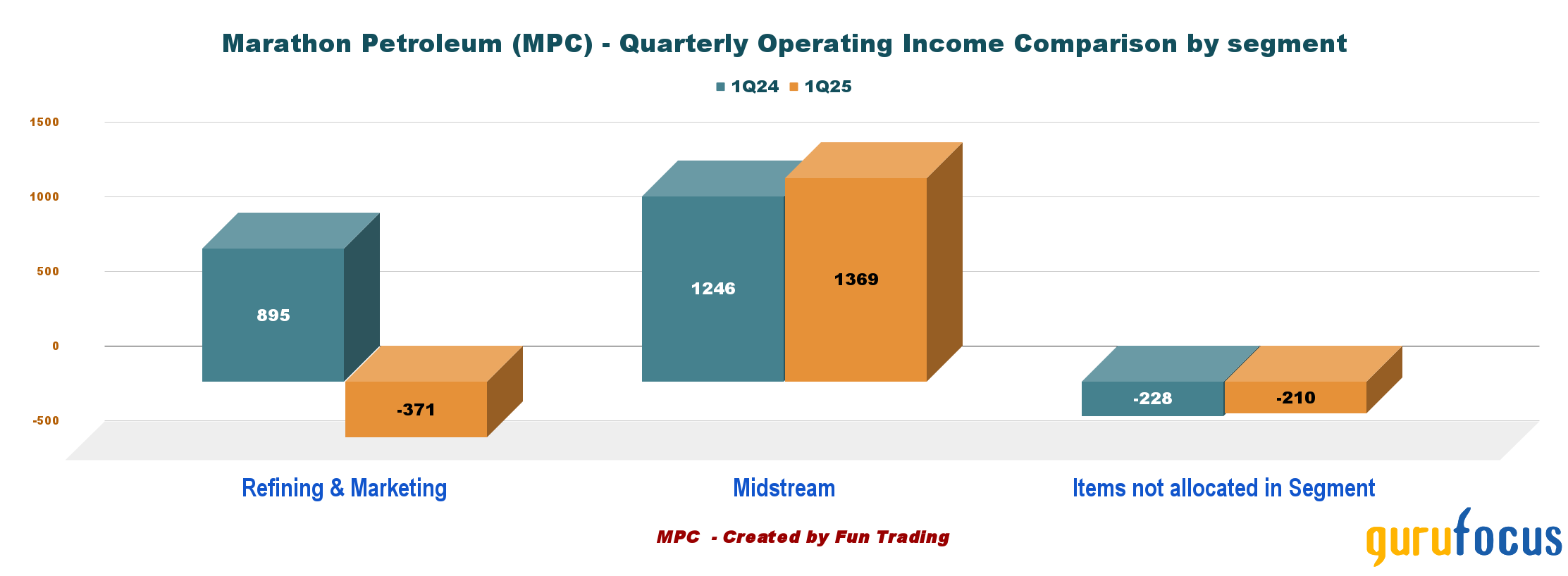

Below, you will find the quarterly operating income for Marathon Petroleum, which operates in three segments: refining and marketing, midstream, and items not allocated, including renewable diesel.

Struggles in Renewable Diesel and Regulatory Uncertainty

MPC's renewable diesel segment, which is classified under unallocated items, reported a negative adjusted EBITDA of $42 million, down from a positive $28 million in 4Q24. This segment, which includes certain business activities not directly related to the company's core operations, negatively impacted the first-quarter results due to operational disruptions and regulatory uncertainties associated with the Trump administration.

The chart provides a clear comparison of the income per segment between 1Q24 and 1Q25, giving a comprehensive view of Marathon Petroleum's historical performance.

Regional Refining Performance and Margin Pressures But Recovery In Sight.

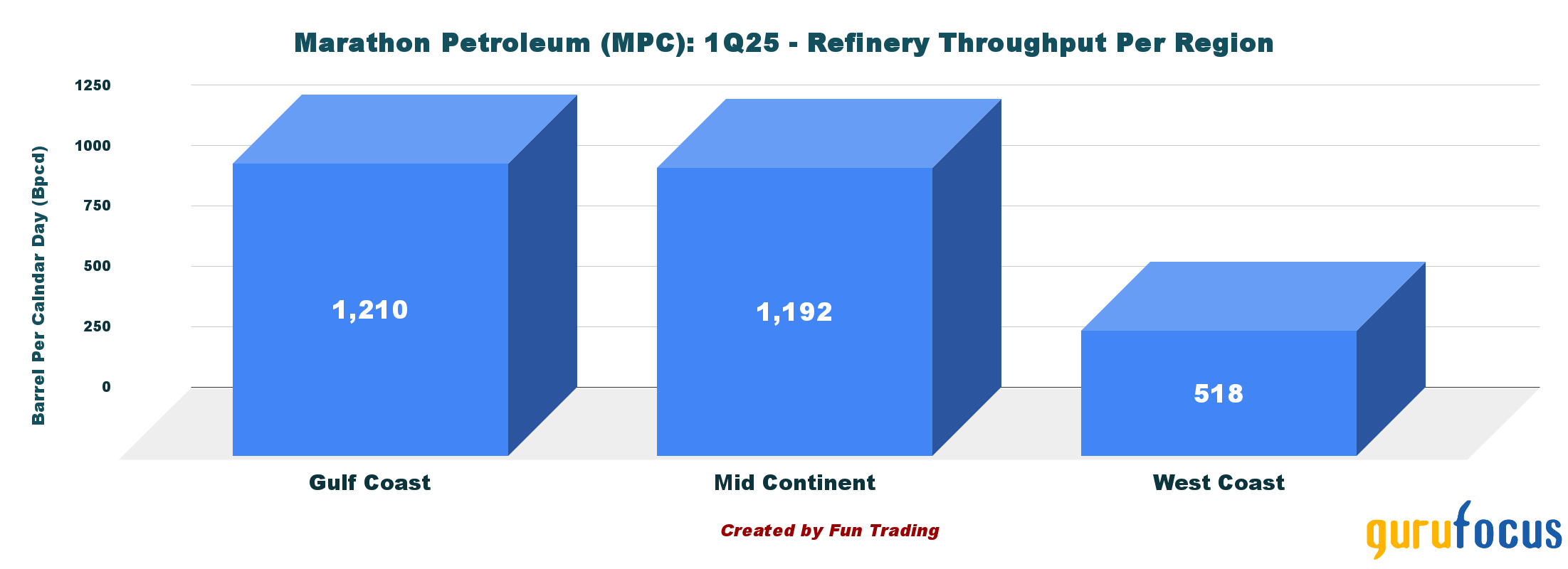

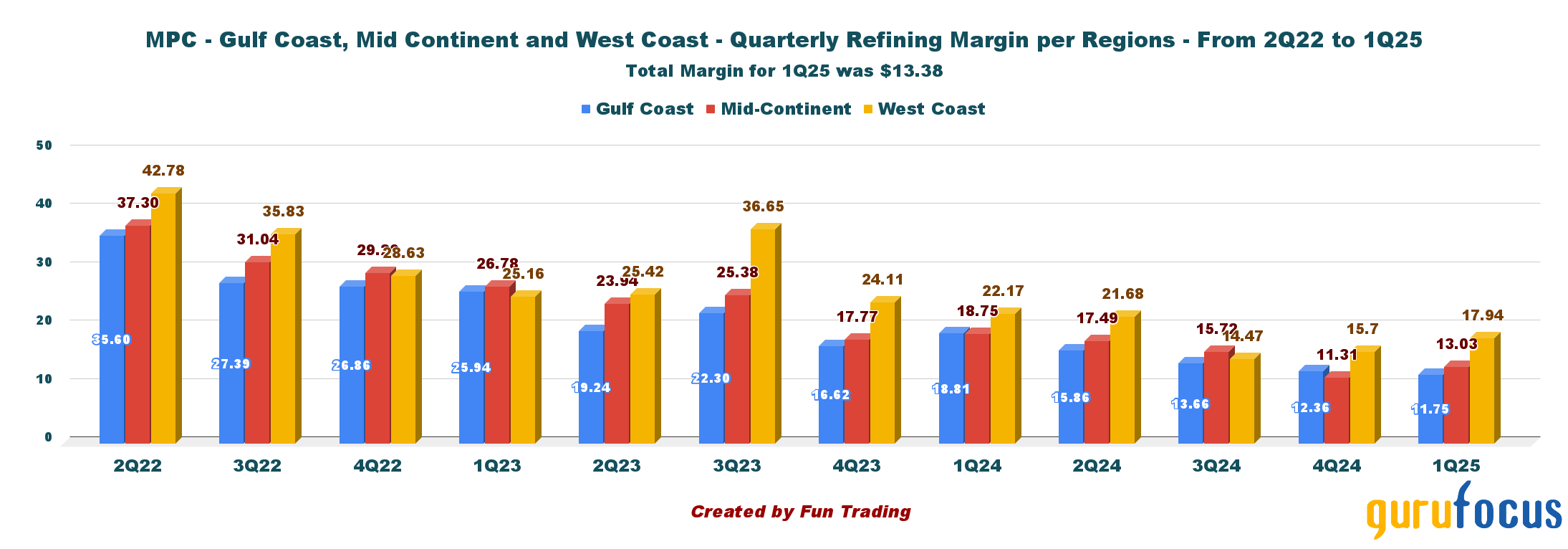

The refining business is comprised of three regions: the Gulf Coast, the Mid-Continent, and the West Coast. Marathon operates 13 refineries across the US, with a total throughput volume of 2,920 thousand barrels per calendar day (Bpcd). As illustrated in the chart below, the U.S. Gulf Coast is the most productive region, showing a 4% year-over-year increase, followed closely by the Mid-Continent.

Operational Disruptions and Impact on Margins

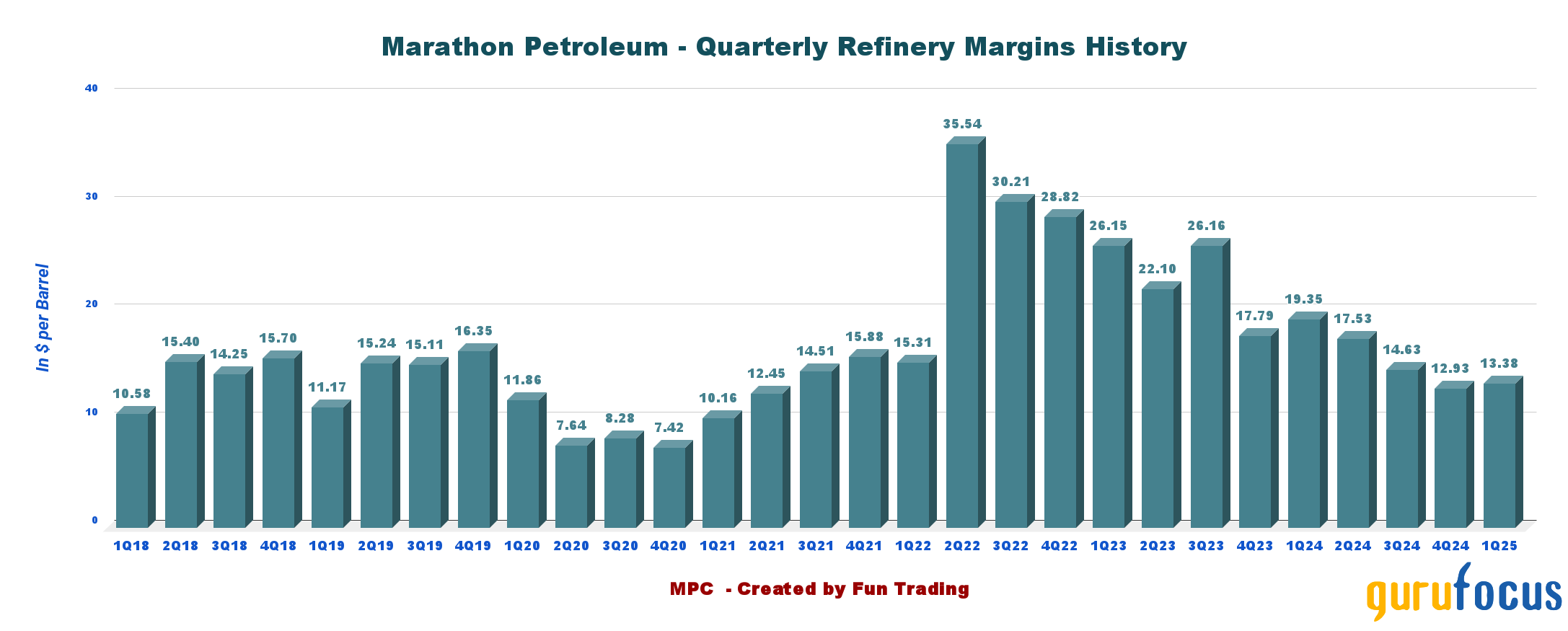

During the first quarter of 2025, Marathon faced some serious challenges. One of the main issues was a sharp decline in profit margins, which fell from $19.35 per barrel in the previous year to $13.38 per barrel.

Despite these serious hurdles, the company's midstream operations, which are managed through MPLX, performed quite well.

Below is a graph showing the historical quarterly refining margins by region since 2Q22.

This significant decrease was due to weaker crack spreads and maintenance downtime, which limited production. Additionally, Marathon Petroleum experienced its second-largest planned maintenance in company history in 1Q25. Furthermore, the renewable diesel business encountered unplanned downtime, resulting in a utilization rate of only 70%, and faced uncertainties regarding regulatory credits.

Sour vs. Sweet Crude dynamics In Light Of The Recent Bombing of Iran by the USA

Disruptions in the Persian Gulf present a significant risk to Marathon Petroleum due to its dependence on sour crude feedstocks. This risk has increased following the recent US bombing of Iran.

Marathon's complex refineries are specifically designed to process discounted sour crude grades, in contrast to refiners that are optimized for sweeter Permian barrels. This dependence on sour grades makes Marathon's earnings more vulnerable to supply disruptions. Approximately 20% of global oil production passes through the Strait of Hormuz, and if Iran were to close this route, oil prices could rise significantly.

If the price difference between sour and sweet crude widens, it could result in tighter profit margins and lower utilization rates for the refineries.

2: Performance Overview: First quarter 2025 Results

First Quarter loss Breakdown

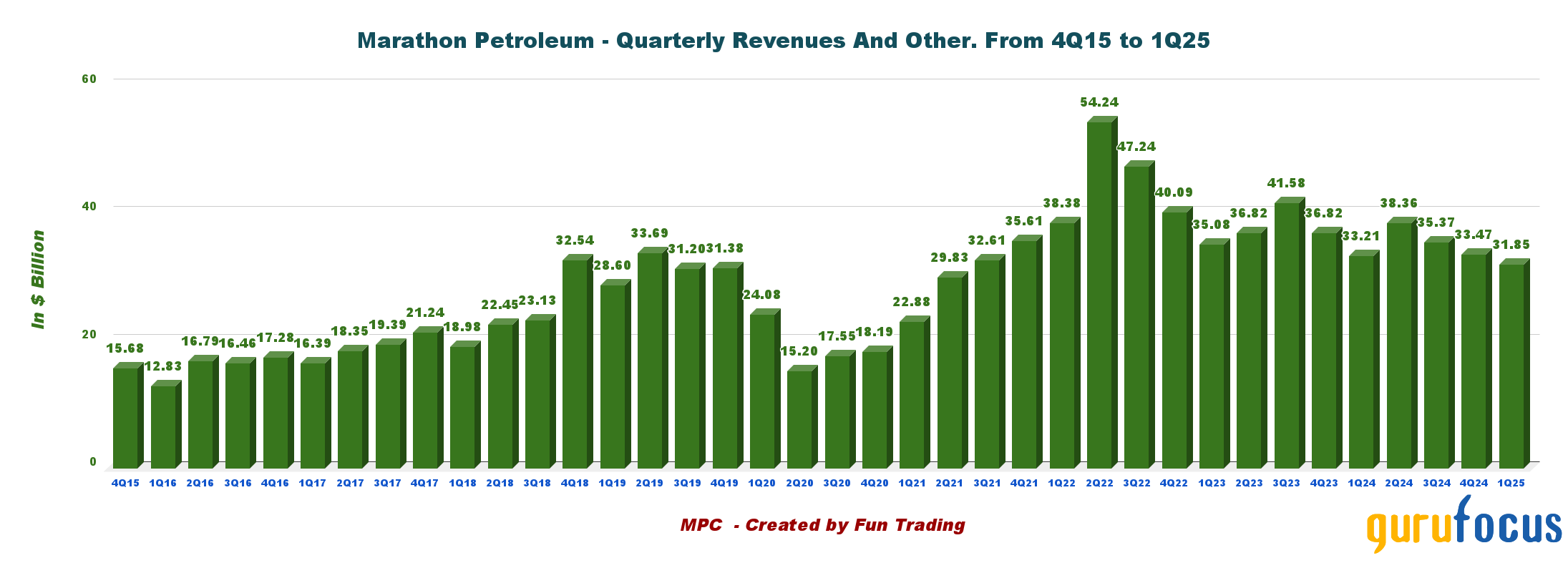

Marathon Petroleum's financial performance in the first quarter of 2025 was mixed, resulting in a net loss of $74 million, with total revenue of $31.85 billion and an EBITDA of $1.51 billion. The net loss was primarily due to significant planned maintenance activities and lower refining margins during the quarter, as previously explained.

However, after excluding these temporary operational factors, the company reported an adjusted net income of $282 million, equivalent to $0.89 per share. This performance was above expectations. These results not only highlight the challenges faced but also underscore the resilience of Marathon's core business and its ability to navigate substantial external and internal challenges effectively.

For comparison purposes, Valero Energy, another major U.S. refiner that I covered on GuruFocus, also faced pressure from weaker refining margins and seasonal maintenance in 1Q25 but managed to post a smaller decline in profitability.

Valero's geographically diversified refining operations and lower operating costs helped cushion the impact of the weak margin environment. This contrast emphasizes the varying sensitivities within the refining sector. While Marathon remains fundamentally strong, its earnings are more susceptible to operational downtime and fluctuations in regional margins.

Shareholders' Return

In the first quarter of 2025, Marathon Petroleum announced a quarterly dividend of $0.91 per share and completed $1.1 billion in share repurchases. These actions demonstrate strong cash flow and a dedication to returning value to shareholders, totaling $1.3 billion returned.

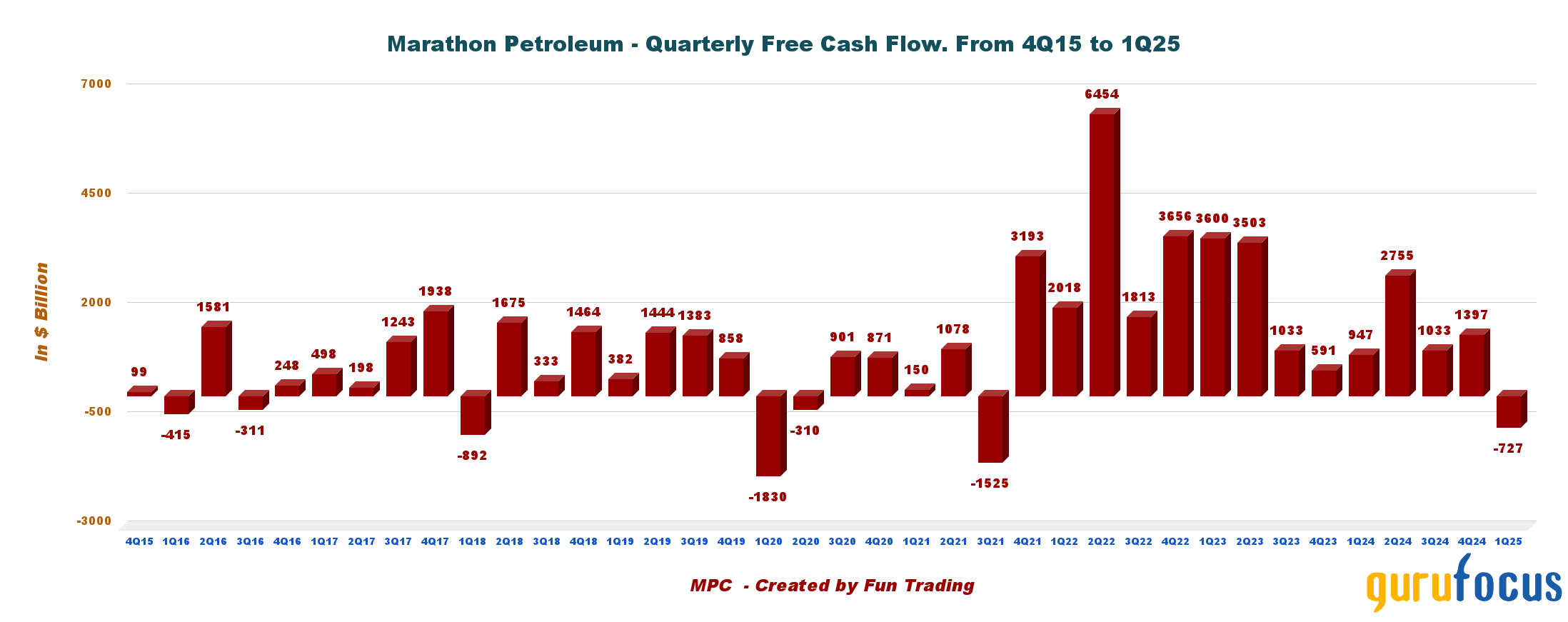

The high MPC's DCF valuation in contradiction with the free cash flow turning negative this quarter.

Marathon Petroleum's free cash flow exhibited a significant decline, recording a loss of $727 million in 1Q25, compared to a positive $946 million in the same quarter a year earlier. It is the first negative free cash flow since 3Q21.

This raises concerns about optimistic valuations based on DCF analysis (10-year valuation, Buffett's assumptions of 5% growth and 8% discount, or AlphaSpread's base-case DCF). The DCF values vary from $189 to $377 and imply a 20% discount to actual value.

The DCF valuation is often used to determine if a stock is whether undervalued or overvalued based on its ability to generate future cash flows, rather than relying solely on current market prices.

Marathon Petroleum's discounted cash flow (DCF) valuation appears overly optimistic because it relies on peak refining margins and assumes that high levels of free cash flow will be sustained. The projected cash flows seem unrealistic, given the cyclical nature of these margins and their tendency to revert. As a result, the valuation likely exaggerates the company's actual long-term earnings potential. Therefore, I would advise against relying on such a valuation.

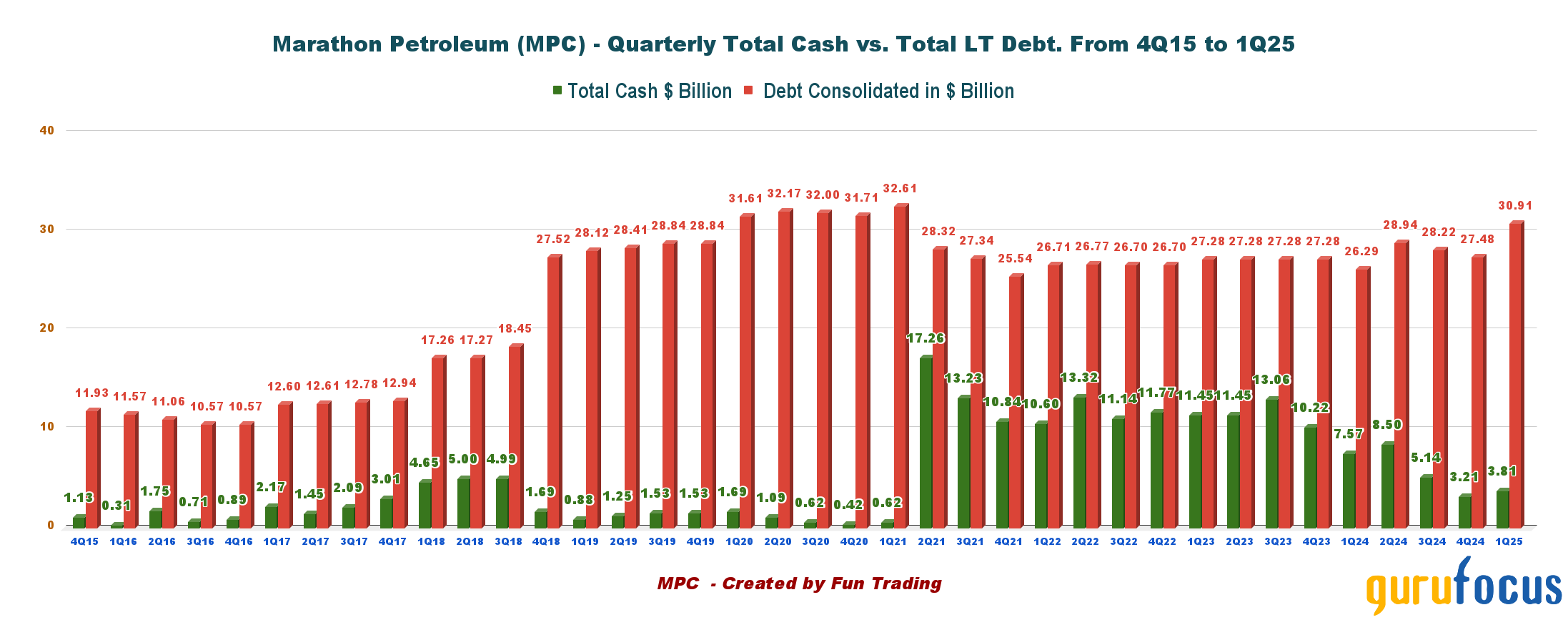

Debt Levels and Liquidity Considerations

Marathon Petroleum's debt position in 1Q25 remains manageable but requires close monitoring. Although the company has a total debt of $30.91 billion, which is substantial, especially given the 57% net debt-to-capital ratio, this situation is supported by strong and stable cash flows from MPLX, along with solid interest coverage.

However, total cash has decreased to $3.81 billion, which is nearly half of what it was a year ago, and with the debt approaching record levels, it is not encouraging. The recent $2 billion bond issuance seems to be a strategic move rather than a sign of distress. As long as refining margins remain robust and MPLX performs well, their balance sheet risk appears to be manageable. Nevertheless, rising interest rates or weaker demand could quickly alter this situation.

Note: MPC holds $8.5 billion in standalone debt, while MPLX carries $22.4 billion. Total consolidated debt is $30.91 billion. MPLX bears most liabilities, isolating financial risk from Marathon Petroleum's parent balance sheet.

3: Conclusion and near-term expectations

Outlook for 2Q25 and Sector Dynamics

At first glance, U.S. refiners are well-positioned to benefit in 2Q25. The recent surge in oil prices, driven by geopolitical tensions between Israel and Iran, has increased fuel prices and sustained strong refining margins. With resilient demand and limited global refining capacity, it creates a favorable environment for refiners to thrive.

Risks Watch

However, potential gains could be limited or even reversed if OPEC+ decides to increase oil supply or if the U.S. economy experiences further weakening due to uncertainties surrounding tariffs. In 1Q25, the U.S. GDP saw a slight contraction, and it could potentially contract again in 2Q25 under certain circumstances related to the Trump administration's tariff policy or geopolitical risks (Israel/Iran war).

It may indicate the possibility of an economic recession, which could be exacerbated by a potential crisis in long-term U.S. bond rates reaching 5% recently.

Final Assessment

In my opinion, the outlook for refiners like Marathon Petroleum, Valero Energy, and Phillips 66 for the second quarter is cautiously optimistic. However, these stocks are relatively expensive, and any uncertainty could greatly impact their performance. For this reason, I don't see much potential for significant upside, apart from a few temporary gains, unless the economy can demonstrate a clear, long-lasting upward trend, which is uncertain at the moment.

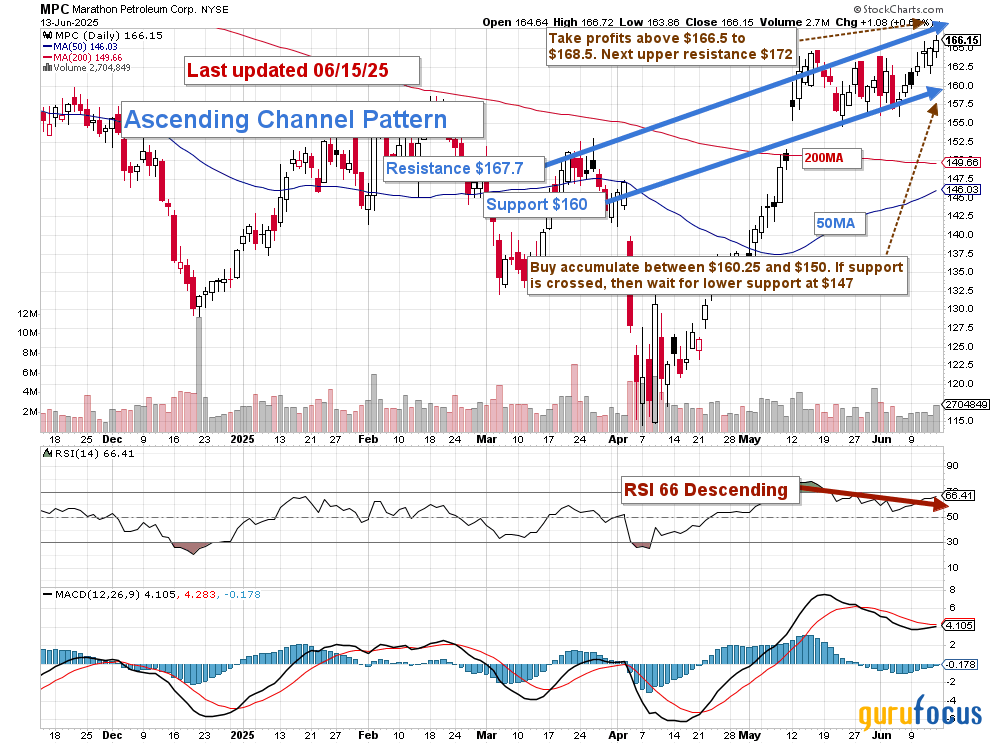

4: Technical Analysis: An Ascending Channel Pattern Reaching Resistance.

Note: The chart has been adjusted to account for the dividend.

Marathon Petroleum is currently trading within an ascending channel pattern, with resistance at $167.70 and support at $160. The relative strength index (RSI) is at 66 and is trending downwards, indicating that MPC may continue to decline until it reaches its 50-day moving average (MA) at $146.

An ascending channel is generally considered a bullish continuation pattern, which can persist until a breakdown or breakout occurs, typically following the initial trend established at the start of the channel (which, in this case, is upward). For more details, please refer to the chart above.

I recommend adopting a Last-In, First-Out (LIFO) strategy for approximately half of your position, especially with a dividend yield at currently 2.27%.

Set your target sell price between $166.5 and $168.5. Given the current level of market uncertainty, it is advisable to utilize a LIFO strategy for most of your investments. Conversely, it may be wise to accumulate more shares between $160 and $146, but do so cautiously.

Note: It is essential to frequently update the TA chart to remain relevant, as we operate in an extremely volatile environment.