Key Takeaways:

- Amazon's massive AUD 20 billion investment targets data center growth in Australia by 2029.

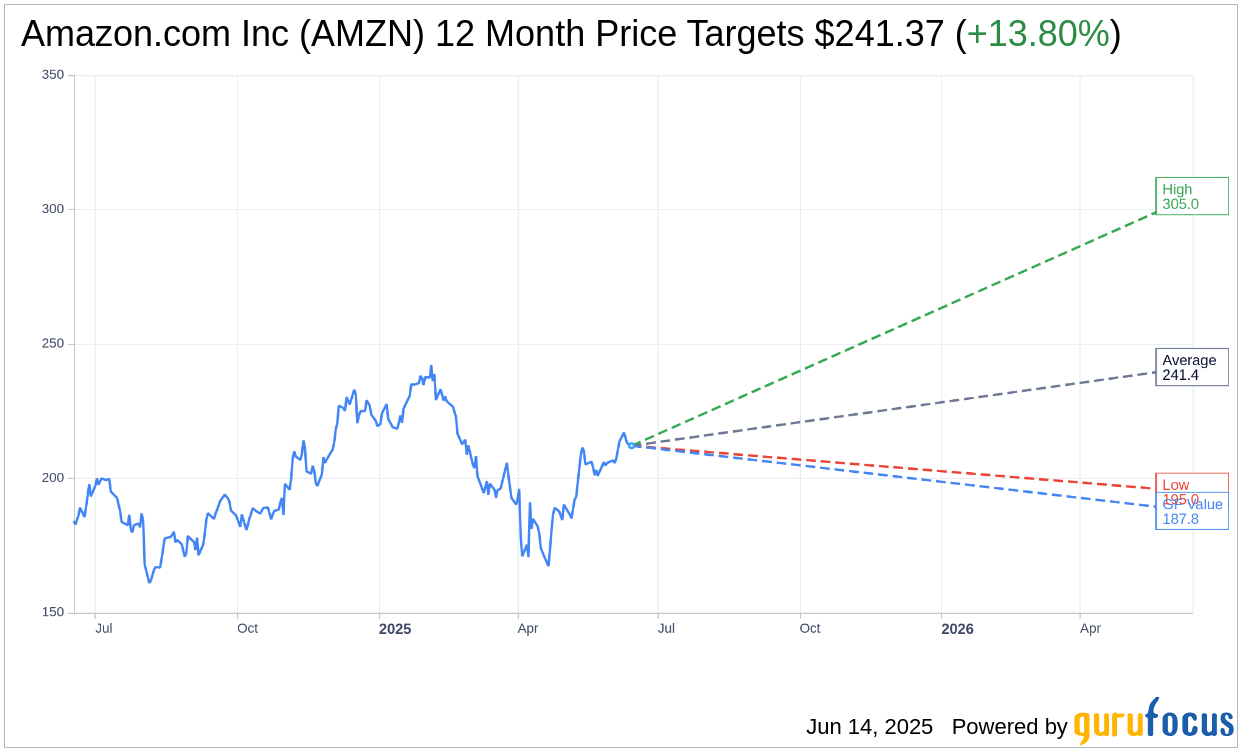

- Wall Street analysts predict a potential 13.80% upside for Amazon's stock price.

- Despite positive analyst forecasts, GuruFocus estimates a potential downside based on the GF Value metric.

Amazon.com Inc (NASDAQ: AMZN) is making headlines with a bold move to expand its data center infrastructure in Australia. The e-commerce giant has announced a hefty AUD 20 billion ($12.97 billion) investment, set for completion by 2029. This ambitious plan also includes the development of three new solar farms in Victoria and Queensland, collectively aiming for a capacity exceeding 170 MW. Such strategic growth initiatives underscore Amazon's commitment to enhancing its global operations and sustainability efforts.

Wall Street Analysts Forecast

Amazon's stock performance continues to captivate analysts and investors. According to projections from 67 analysts, the average price target over the next year is $241.37, with forecasts ranging from a high of $305.00 to a low of $195.00. This average target suggests a significant upside potential of 13.80% from the current trading price of $212.10. For a deeper dive into these projections, visit the Amazon.com Inc (AMZN, Financial) Forecast page.

Meanwhile, brokerage firms remain optimistic, as reflected in the average recommendation of 1.8 out of 5, indicating an "Outperform" status. The rating scale ranges from 1, indicating a Strong Buy, to 5, suggesting a Sell. Such bullish sentiments signify strong market confidence in Amazon's future prospects.

For a contrasting viewpoint, GuruFocus presents its GF Value estimate, valuing Amazon at $187.85 in a year. This estimate implies a potential downside of 11.43% from the present price of $212.10. The GF Value metric is meticulously calculated using historical trading multiples, past business growth, and projected future performance. Investors can explore more on this analysis by visiting the Amazon.com Inc (AMZN, Financial) Summary page.