Key Highlights:

- Nvidia CEO Jensen Huang leads the charge in "sovereign AI," aiming for digital autonomy globally.

- Analysts provide optimistic price targets for Nvidia, signifying potential growth in the market.

- GuruFocus estimates a significant upside for Nvidia's stock, indicating its potential as a lucrative investment.

Nvidia's Global AI Endeavors

As Jensen Huang, CEO of Nvidia (NVDA, Financial), takes the helm in advocating for "sovereign AI," European countries are ambitiously pursuing digital sovereignty. This movement is set to detach them from dependence on U.S. tech giants. A significant step in this direction includes Nvidia's initiative to establish an industrial AI cloud in Germany. Furthermore, the company's collaborations with various firms in the UK and France are poised to bolster AI infrastructure considerably.

Wall Street's Optimistic Outlook

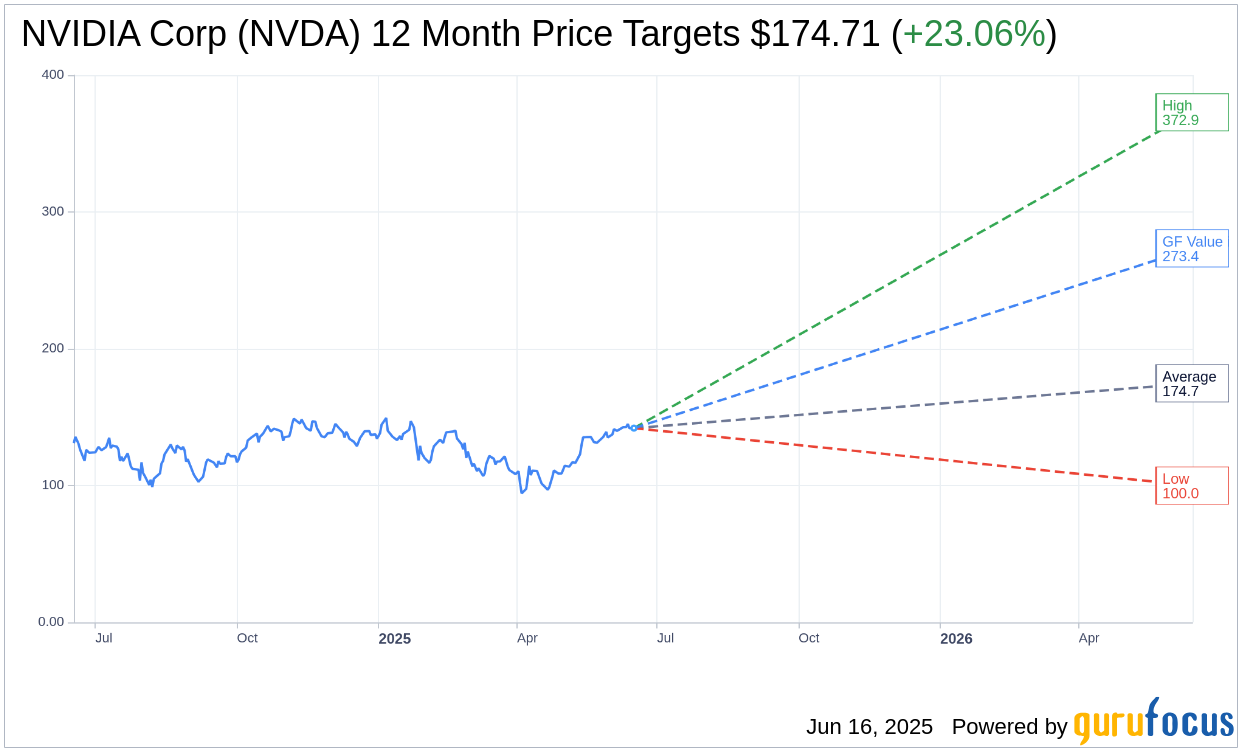

According to the latest insights from 52 analysts, the target price for NVIDIA Corp (NVDA, Financial) over the next year averages at $174.71. This projection spans a high forecast of $372.87 and a low of $100.00. These estimates suggest a potential upside of 23.06% from the current share price of $141.97. For a deeper dive into the numbers, visit the NVIDIA Corp (NVDA) Forecast page.

Moreover, the collective view from 65 brokerage firms positions NVIDIA Corp (NVDA, Financial) at an average recommendation of 1.8, translating to an "Outperform" status. On this scale, 1 indicates a Strong Buy and 5 signals a Sell.

GuruFocus' Valuation Insights

Leveraging GuruFocus estimates, the anticipated GF Value for NVIDIA Corp (NVDA, Financial) stands at $273.40 for the next year. This presents a remarkable 92.58% upside from the existing price of $141.97. The GF Value reflects an assessment of what the stock's fair trading value should be, considering historical trading multiples, business growth trajectories, and future performance forecasts. For further exploration, visit the NVIDIA Corp (NVDA) Summary page.