On June 16, 2025, Leerink Partners analyst Mike Kratky initiated coverage on Medtronic (MDT, Financial), issuing an "Outperform" rating. This marks an optimistic outlook for the company with a strong recommendation from the analyst.

Alongside the initiation of coverage, a price target of $110.00 USD was announced for Medtronic (MDT, Financial). This target reflects potential growth for the stock, as the company continues to navigate its market position in the healthcare sector.

Medtronic (MDT, Financial), a leading player in the medical technology industry, has been identified by Leerink Partners as having favorable prospects moving forward. Investors might find interest in this recent coverage as it could suggest potential increased value in Medtronic (MDT) shares.

Wall Street Analysts Forecast

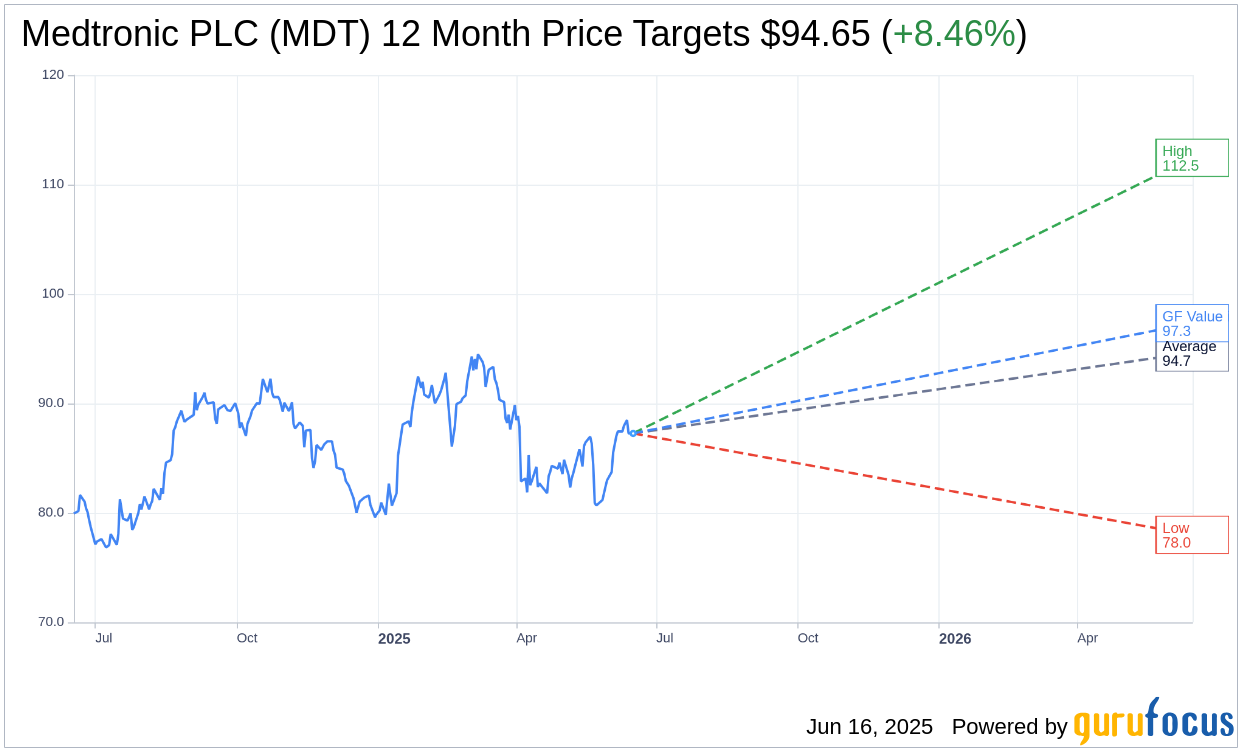

Based on the one-year price targets offered by 27 analysts, the average target price for Medtronic PLC (MDT, Financial) is $94.65 with a high estimate of $112.45 and a low estimate of $78.00. The average target implies an upside of 8.46% from the current price of $87.27. More detailed estimate data can be found on the Medtronic PLC (MDT) Forecast page.

Based on the consensus recommendation from 34 brokerage firms, Medtronic PLC's (MDT, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Medtronic PLC (MDT, Financial) in one year is $97.34, suggesting a upside of 11.54% from the current price of $87.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Medtronic PLC (MDT) Summary page.