On June 16, 2025, Freeport-McMoRan (FCX, Financial) garnered attention in the stock market as Scotiabank upgraded its rating on the company. Analyst Orest Wowkodaw shifted his rating from "Sector Perform" to "Sector Outperform."

The upgrade was accompanied by a notable increase in the stock's price target. The revised price target set by Scotiabank stands at $48.00, up from the previous target of $43.00. This adjustment represents an 11.63% increase.

Freeport-McMoRan (FCX, Financial), a major player in the mining industry, is expected to benefit from this positive outlook, reflecting a more favorable forecast for the company in the eyes of Scotiabank. Investors and market watchers may find the updated ratings and price target as a sign of potential growth prospects for FCX.

Wall Street Analysts Forecast

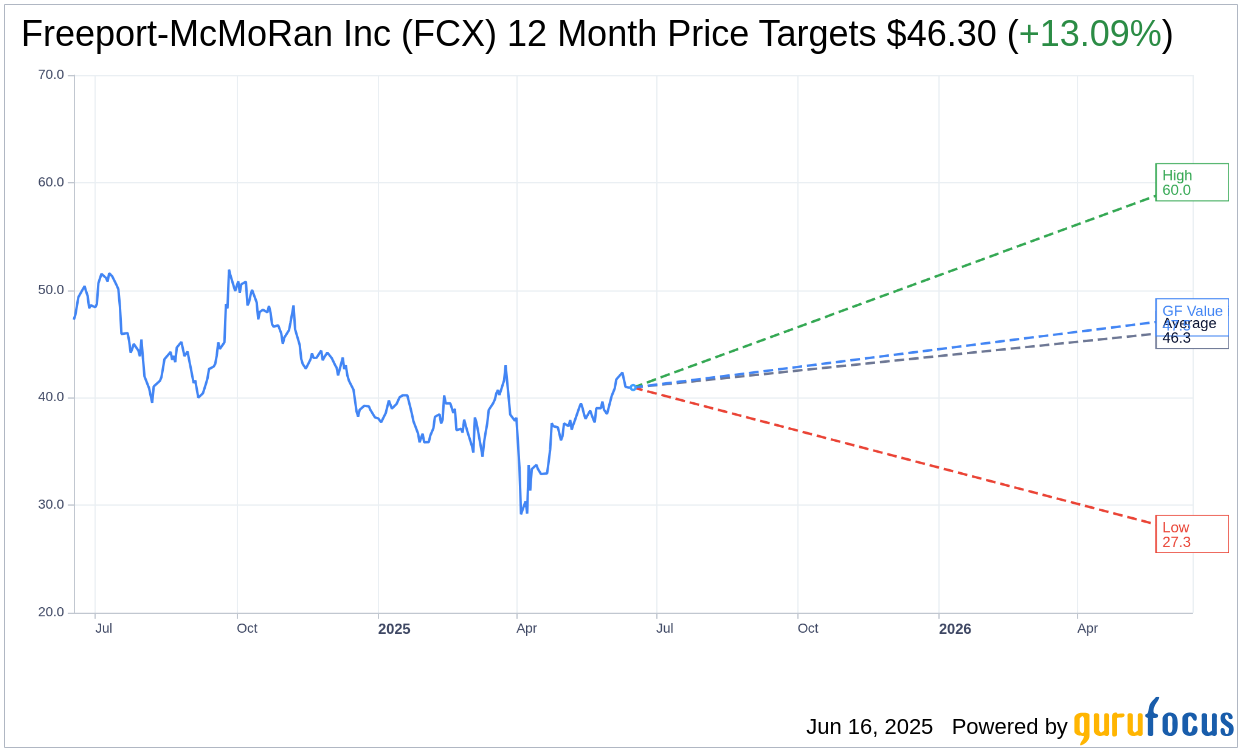

Based on the one-year price targets offered by 18 analysts, the average target price for Freeport-McMoRan Inc (FCX, Financial) is $46.30 with a high estimate of $60.04 and a low estimate of $27.32. The average target implies an upside of 13.09% from the current price of $40.94. More detailed estimate data can be found on the Freeport-McMoRan Inc (FCX) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Freeport-McMoRan Inc's (FCX, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Freeport-McMoRan Inc (FCX, Financial) in one year is $47.47, suggesting a upside of 15.95% from the current price of $40.94. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Freeport-McMoRan Inc (FCX) Summary page.