Key Takeaways:

- Truist has initiated coverage on DexCom (DXCM, Financial) with a favorable "buy" rating, highlighting an attractive valuation.

- Analysts predict a significant potential upside of 24% with a price target of $102.

- Average brokerage recommendations label DexCom as "Outperform," indicating broad market confidence.

Truist has begun coverage on DexCom (DXCM) with a "buy" rating, underscoring its favorable valuation in comparison to peers. Despite some previous execution issues, analysts are optimistic about a 24% potential upside, setting a price target of $102. This indicates confidence in DexCom's market position and its future growth trajectory.

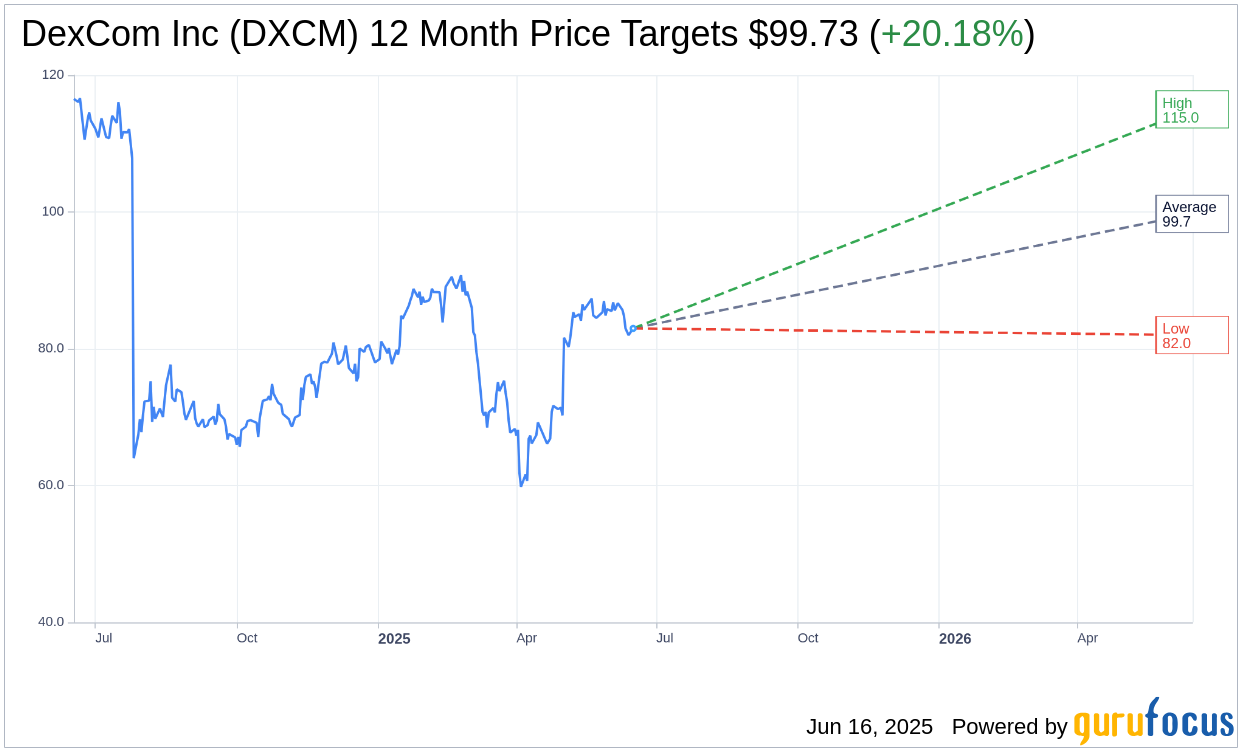

Wall Street Analysts Forecast

According to the one-year price targets from 25 analysts, the average target price for DexCom Inc (DXCM, Financial) stands at $99.73. Price estimates range from a high of $115.00 to a low of $82.00. This average target suggests an upside of 20.18% from the current price of $82.98. For additional details, visit the DexCom Inc (DXCM) Forecast page.

Analyst Consensus and Guidance

The consensus recommendation from 27 brokerage firms positions DexCom Inc's (DXCM, Financial) average brokerage recommendation at 1.7, meaning "Outperform." This rating is part of a scale from 1 to 5, where 1 signifies Strong Buy, and 5 indicates Sell.

Understanding GF Value Estimation

Based on GuruFocus metrics, the estimated GF Value for DexCom Inc (DXCM, Financial) in the next year is $166.85. This figure suggests an impressive upside of 101.07% from the current price of $82.98. The GF Value is calculated using the historical multiples the stock has traded at, past business growth, and future business performance estimates. For more comprehensive data, explore the DexCom Inc (DXCM) Summary page.