As I explored the electric utilities industry, I was surprised to find that it comprises nearly 3,000 organizations serving more than 140 million consumers. However, my attention kept going back to one name time and time again and that is Eversource Energy (ES:Financial). The company is pretty stable in an industry that is usually torn between policy changes, infrastructure needs, and investor requirements. It has demonstrated the capacity to evolve successfully and has reported steady performance without losing track of its regulated operations. It appears to be refining its long-term strategy instead of losing its way even as it deals with the regulatory risks and issues associated with its offshore wind exit. It remains focused on stability, operational discipline and shareholder value. These traits seem all too unfamiliar in the current marketplace. Meanwhile, its Q1 earnings reinstated this stability, and the current price and valuation action indicate a meaningful upside over time, although gurus continue to be split in their opinions.

While no utility is risk-free, the combination of strength and transparency makes Eversource a cornerstone for stability in the industry.

Company overview

Eversource Energy is a large utility company in America and has a market capitalization of approximately $24 billion. It was established in 1927 and is a major provider of essential services in the Northeast.

Moreover, Eversource has its operations running in a number of segments such as electric distribution, gas distribution, electric transmission and water services. It has approximately 4.4 million customers today and the majority of them (approximately 3.3 million) are users of electric utilities.

The advantage of Eversource with the business model of a regulated utility is the stability of demand and guaranteed returns. After all, it provides services that individuals simply cannot do without in modern life.

Q1 2025: Eversource is off to a strong start

Eversource has had an excellent Q1 2025, as its revenue increased, earnings remained steady, and its business performed well in the majority of areas despite increased expenditure. So, let us have a closer look and analyze what is behind the numbers.

Higher revenue and steady margins: In Q1 2025, the operating revenues of the company increased 24% to $4.12 billion compared to $3.33 billion a year ago. This stellar expansion was pushed by controlled rate increases, ongoing infrastructure investments as well as seasonal demand that is characteristic of colder conditions. Notably, all the major units of the company's business added more in this quarter, which helped in an overall increase in revenue.

This revenue growth was however accompanied by an increase in expenses. The total operating costs rose 27.4% to $3.19 billion compared to $2.49 billion, indicating the capital-intensive business nature of Eversource. Among these costs, power and fuel were the biggest purchases, accounting for more than $1.34 billion, Meanwhile, depreciation and amortization charges exceeded $835 million or above 20% YOY. Such raises are due to the continuing investments of Eversource in the restructuring of power grids and infrastructure which obviously increases the asset base yet also burdens short-term margins.

Nevertheless, operating income increased to $926 million against $846 million, and net income available to common shareholders clocked in at $550.8 million, more than Q1 2024's $521.8 million. The diluted EPS was reported at $1.50 on a per-share basis, which is a little higher than last year's $1.49. This was however capped by an increase in the number of shares as a result of equity issued under ATM programs and DRIPs of the company.

Q1 performance by segment: On a closer examination of each of the segments, the highest earnings growth was seen in the natural gas distribution business. It gave out $218.4 million net income compared to $190.6 million last year, which is an increase of nearly 15%. This was equivalent to an EPS of $0.60 against $0.54 in the previous year. Favorable weather, an increase in rate base and probable improvement in efficiency contributed to the performance, particularly in Massachusetts and Connecticut where regulatory structures permit allowed recovery in a short time.

Electric Transmission also exhibited good improvement as the earnings increased by $22.7 million to $199.4 million. That is an EPS contribution of $0.54, compared to $0.50. This segment is still enjoying huge investments in infrastructure and comparatively high allowed returns. The transmission line expansion that Eversource has done to meet its clean energy objectives in its service territories is paying off big time.

The Electric Distribution contributed to net income by $188.4 million, which is an increase of $20.3 million compared to Q1 2024. The EPS in this segment increased to $0.51 against $0.48. The gains were helped by the approved rate increases in a number of regions, controlled growth in dollar usage by customers, and tight cost control.

Not every segment did very well, though. The water distribution business comprising Aquarion is currently in the process of being sold and recorded a $1.8 million decline in earnings, reducing its quarterly total to $3.6 million. The EPS effect was negligible at a value of $0.01. Still, the decrease means less attention by the management as the divestiture progresses.

More importantly, the ‘parent and other segment' also incurred a deeper loss of $59 million, as opposed to $19 million last year. This pulled down EPS by $0.16 as compared to $0.04 in Q1 2024. The elevated loss is probably associated with more expenses at the holding company level such as financing expenses or other overheads. With Eversource investing a lot of money and relying on its balance sheet, controlling these expenses will also be a good way to save margins.

Regulatory support and investment strategy strengthen long-term outlook: Eversource is regulated in a favorable environment, where it has already received a number of rate cases, and new ones are being processed. To illustrate, in Massachusetts, electric and gas subsidiaries will obtain a combined amount of rate increases up to November 2025, and it will be equal to $139 million. In Connecticut, an impending adjustment, including a 6% reduction on residential electric bills effective May 2025, makes the balancing of investor returns and customer relief a tightrope act on the part of Eversource.

In the future, Eversource restated its long-term goal of 5%-7% annual EPS growth, with the help of increasing investments and regulatory certainty. The company anticipates an increase in its regulated rate base to $41.9 billion in 2029, up by $26.4 billion in 2023, with transmission and electric distribution expenditures leading the pack. Although near-term earnings per share increases could be small, this base growth offers a good foundation for future growth.

In sum, Eversource is doing well despite the fact that it has to address an increase in amortization and holding company losses.

Dividend cushion & capex

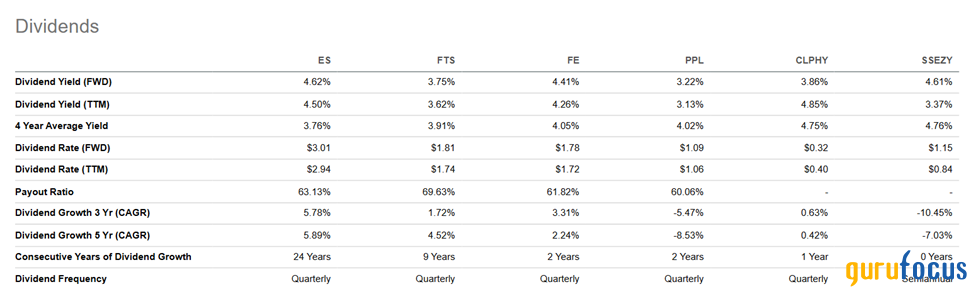

Eversource is a solid dividend payer without any doubt. It provides a forward dividend yield of 4.6% that is not only comfortably above its own four-year average of 3.75% but also comes out as a notable figure when compared with the majority of its peers. The nearest competitor is Fortis (FTS:Financial) with a yield of 3.79%. Regardless, Eversource still has the upper hand when it comes to yield and growth consistency.

Source: Dividends - ES vs. peers (Seeking Alpha)

In addition to the yield, Eversource's dividend growth is also on a good momentum. It has produced a 3-year and 5-year CAGR of 5.78% and 5.89% respectively. Such numbers indicate a stable and reliable income trend. Once again, the next closest competitor is Fortis, with respective growth rates of 1.72% and 4.52%. The most significant thing about the company is the fact that it has witnessed 24 years of consecutive dividend growth. Comparatively, the longest dividend growth history in the group is only 9 years with Fortis and most other peers are less than 5 years. Moreover, Eversource has a dividend payout ratio of 63.13%, which is rather sustainable in the industry of utilities, given the stability of its growth and well-balanced yield.

Investment-wise, the company is continuing with a capital plan of $24.2 billion up to 2029. Meanwhile, transmission projects are expected to cost almost half of this amount. Massachusetts remains a major figure in this development. In order to finance these projects and maintain a favorable credit rating, Eversource issued $990 million in equity in 2024 and intends to issue $1.2 billion by 2029. Its funds-from-operations to debt ratio is also well above downgrade levels and this is why it has good investment-grade credit ratings by both Moody's and S&P.

Therefore, although Fortis provides a certain competition, Eversource is obviously ahead in terms of yielding power, relatively stable growth, and long-term reliability, which is a rare combination of factors.

Valuation gap & re-rating case

Eversource Energy appears to be relatively cheap at present and it is not a superficial assumption. Looking at market multiples or going long-term with cash flows and dividends, the figures indicate that the stock is highly undervalued.

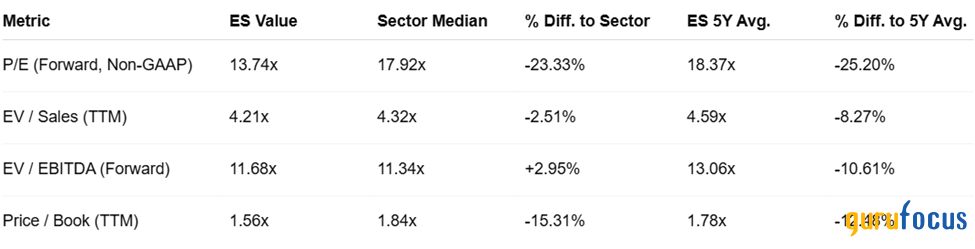

Source: ES Valuation Metrics (Author created based on data)

So, we can begin with the basics. The forward P/E ratio of ES is only 13.8x. That is already a very respectable 22% discount on the sector median of 17.7x. It becomes even more interesting when viewed against the company's five-year average of 18.4x. It means that ES is currently being priced in the market below its historical values, in spite of the fact that the business fundamentals have not changed. Actually, they have become better as the company continues to invest in clean energy and grid modernization.

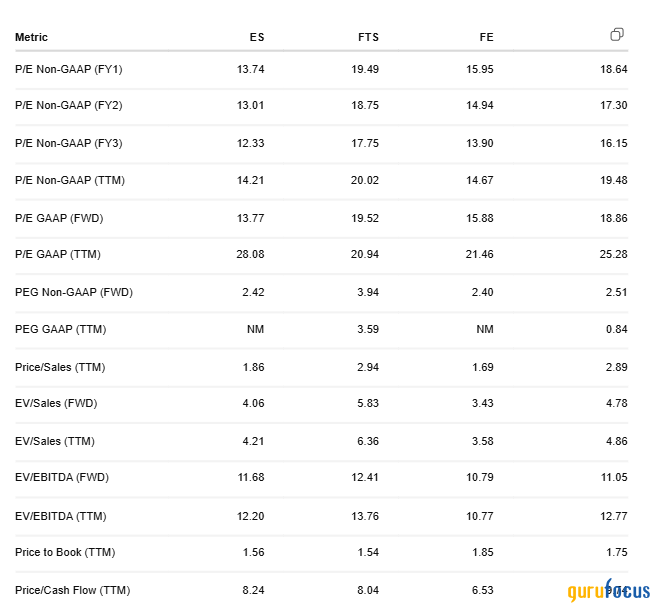

Source: Valuation Metrics - ES vs. peers (Author generated based on data)

Such a gap is not normal for a regulated utility with predictable cash flows. Fortis (19.2x), PPL (18.7x) and FirstEnergy (16.1x) are all trading at higher multiples. Although some of these premiums may be explained by geographic or financial factors, the discount that Eversource gives is a bit too much, given its apparent regulated growth pipeline.

Looking further, the market looks a little too cautious even on a top-line basis. ES is currently trading at 4.22x EV/Sales, nearly fair to the sector, but 8% below its 5-year average. That is a considerable discount, considering that utility revenues are usually steady and predictable. Not only does EV/EBITDA show ES at 11.76x, but it is right in the middle of its peers, FirstEnergy (10.84) and Fortis (12.27) yet, 10% undervalued than its average. That suggests there is room for upside if the mood of investors changes even marginally.

Next, there is the price-to-book ratio which is usually a forgotten one but still applies in the case of asset-intensive industries such as utilities. ES at 1.57x is trading currently at 15% below the industry average and 12% below its historical level.

Simply put, the valuation of Eversource indicates a disconnect in the market and provides a solid case for re-rating.

Eversource builds the base for a potential rebound

The shares of Eversource have found solid support at the price of between $56 and $58 by the beginning of 2025. The price in recent days has been stabilizing and slightly recovering as it has crawled up to the range of $61-$63 once again. This is a type of recovery close to a historically good support level which is an indication that the selling pressure could be abating. There is close resistance at the level of approximately $65, and the long-term ceiling is at approximately $70. The price action at present is at a consolidation stage.

In addition, analysts are somewhat positive. Among the 20 brokerage firms, the consensus rating is 2.5, which represents an ‘Outperform' sentiment. This midway bullish tendency is supported by a good distribution of opinions including 4 Buy, 6 Outperform, and 8 Hold ratings. It suggests an increasing confidence, but not too much excitement.

With the more extended forecast range, the high end of the target at $85 implies a possible upside of almost 29% and the low end of the target at $47 seems to be getting less and less plausible in light of the technical support and strengthening price action. The fact that the market is currently going through a consolidation period and that analyst confidence is back means that the realistic goal is the $72-$75 range.

With such a technical foundation and solid fundamentals of the company, it is likely to see recovery to $72-75 in the next 12 months. It would mean an 18%-22% upward re-rating from current levels and indicate a re-rating of the company to sector-average valuation multiples. Altogether, Eversource Energy seems to be in a good place to recover gradually.

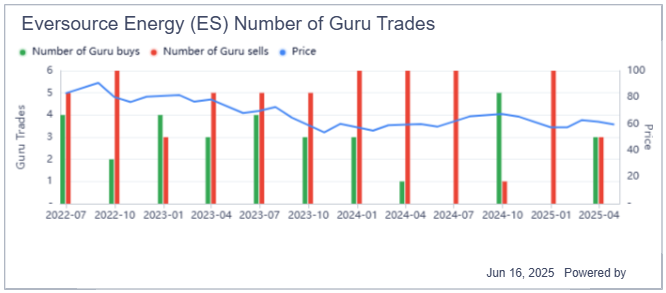

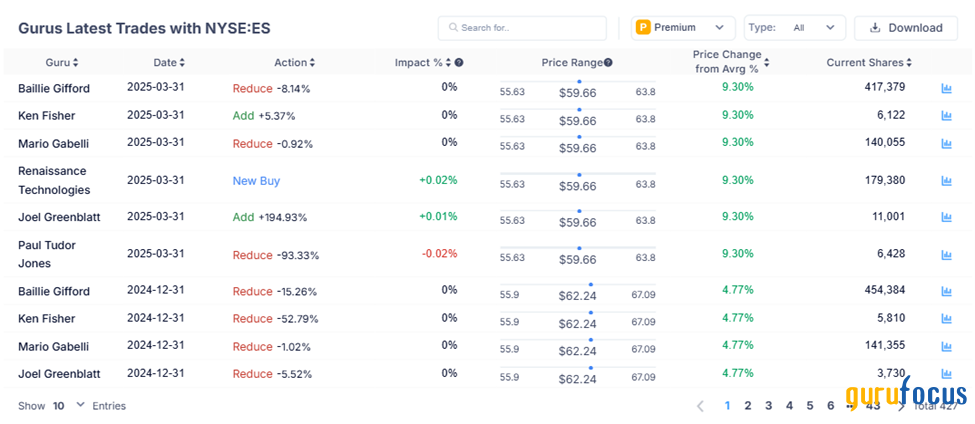

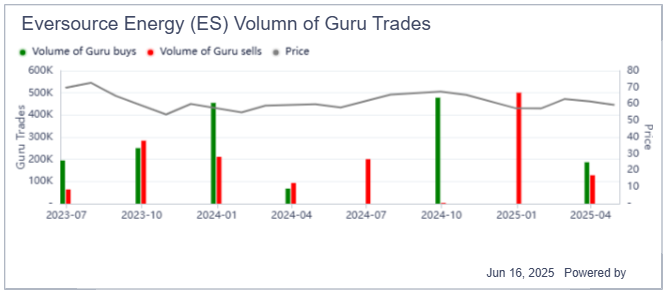

Gurus take opposite bets on Eversource

Eversource Energy has had a significant amount of guru activity over the last 12 months. The gurus have had divergent views on the stock. Q1 2025 saw a massive amount of selling by Paul Tudor Jones (Trades, Portfolio) (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio) (Trades, Portfolio) who sold their positions by more than 93.3% and 8.14% respectively. These notable declines were in the same trend as Q4 2024 when both funds had already cut their holdings.

That said, Ken Fisher (Trades, Portfolio) committed a rather small addition of 5.37% to his holding and Renaissance Technologies (Trades, Portfolio) started a fresh buy in the same quarter. However, what is most notable is that Joel Greenblatt (Trades, Portfolio) strongly increased his position by a whopping 195%.

Source: Guru trades (Guru Focus)

The interesting point is that the stock has steadily increased above the average trading price irrespective of whether gurus were buyers or sellers. In all of the mentioned cases, the ES is currently trading at approximately a 10.44% premium to the average entry or exit price. That means the gurus who got out might have done so at the time they were gaining short-term profits.

Considering the volume patterns, the selling pressure was intense at the beginning of 2025, but with the fresh purchases of significant quantity, including 179,380 shares bought by Renaissance Technologies (Trades, Portfolio), it seems that the stock still enjoys institutional trust in spite of the split emotions.

As the price has now moved into the upper $63.80s, well above any of the historical trading ranges, ES seems to be weathering the rotation fairly well.

Rating and Regulatory Risks

Eversource faces certain risks that could deteriorate its re-rating.

Even though Eversource is based in states that have had constructive oversight in the past, the rising political oversight, particularly in Connecticut, may result in stricter return provisions or slow cost recovery.

The most current and seen example is the Eversource multi-year rate increase plan proposal of $3.2 billion in Connecticut, filed in early 2024. As the company claims the rises are necessary to recoup infrastructure investments and ensure reliability, the Public Utilities Regulatory Authority (PURA) is on the contrary cautious. It has voiced fears of affordability by the consumer and indicated a possible reduction in the suggested changes. If the decision made by PURA at the end of the process ends up being lower than expected on the approved rates, then there would be a direct effect on the near-term earnings and it would cause a slackening of the rate base growth which is the basis of the 5-7% EPS growth rates out in the company. The result will probably influence how investors feel about Eversource, and whether it will get the re-rating its fundamentals appear to justify.

Furthermore, among the interesting dynamics is the fact that in April 2024, S&P downgraded the credit rating of Eversource to BBB+ from A- because the company had excessive leverage and huge capital demands. Despite staying within the investment-grade rating, the downgrade has taken Eversource near the tail end of investment-grade credit. This could raise the cost of borrowing in the future and lower financial flexibility, which is vital considering the company intends to spend more than 24.2 billion on capital in the coming years. It could also quash investor appetite for a valuation re-rating as some funds will not buy lower-tier credit, or need a significantly elevated yield to cover any perceived risk.

Additionally, the balance sheet or financial flexibility could be undermined by delays in monetizing the proceeds, proceeds that fall below expectations or unexpected tax effects.

Last but not least, sales of assets, rising depreciation and interest expense could put pressure on short-term results, slowing the appreciation of the company's fundamentals by the market.

Your Takeaway

The Q1 2025 performance of Eversource demonstrates the company as a rate-regulated company with a solid long-term plan. It still aims at 5-7% growth in EPS, which will be backed by a $24.2 billion capex program, an escalating rate base and an excellent dividend track record. Meanwhile, investors should keep in mind the main overhangs that still exist, such as the regulatory resistance in Connecticut, high capex requirements, and the recent S&P downgrade to BBB+, which may lead to an increase in borrowing costs and limit the sharp recovery of valuation. Even so, given the stock is trading at a pronounced discount to its history and to its peers on P/E, EV/EBITDA and price-to-book ratios, the market has already discounted a good deal of near-term uncertainty. It is also notable that the guru investors appear divided with some reducing holdings in the face of macro headwinds and others doing the reverse pointing out a question about timing and long-term value. The present consolidation at $61-$63 is a very good entry point for a long-term investor to begin accumulating the stock. Eversource also stands a good chance of being gradually acquired at present valuation given its upside potential.