Streamline Health Solutions (STRM, Financial) has announced its financial results for the first quarter, revealing an increase in revenue to $4.81 million, up from $4.33 million during the same period last year. However, the company's cash and cash equivalents saw a decline, dropping to $1.4 million as of April 30, from $2.2 million recorded on January 31.

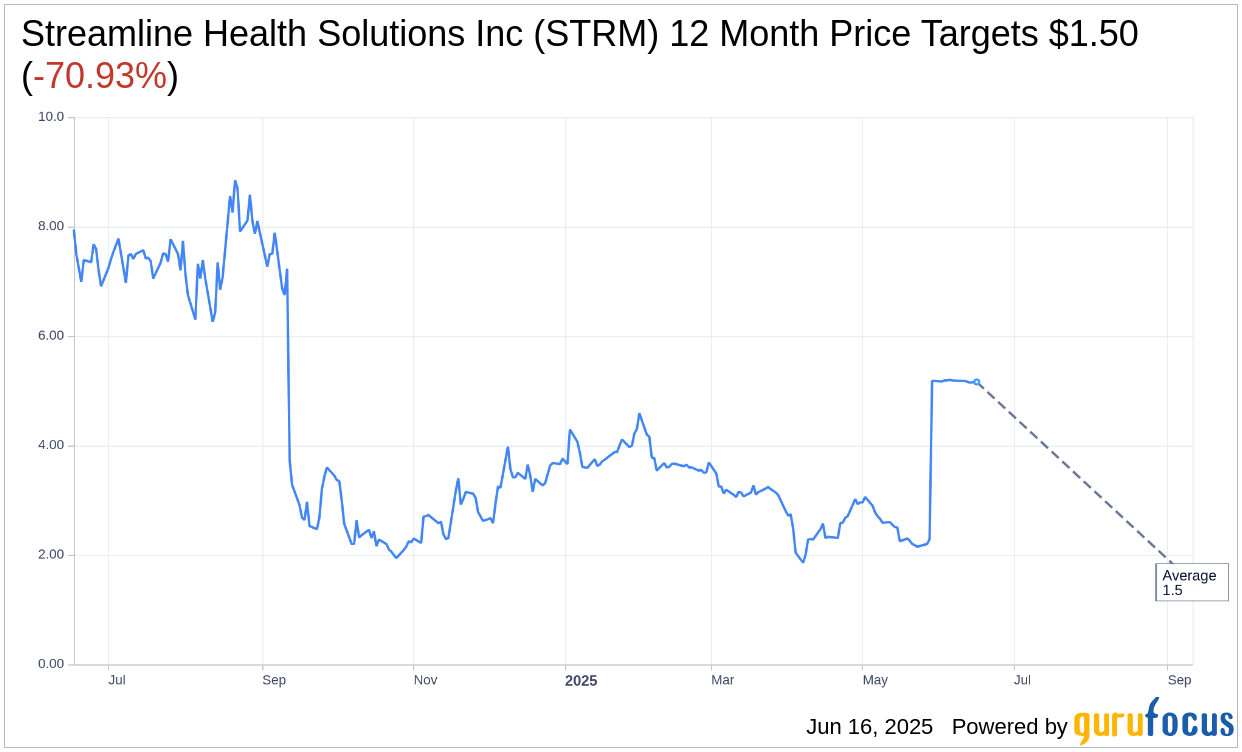

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Streamline Health Solutions Inc (STRM, Financial) is $1.50 with a high estimate of $1.50 and a low estimate of $1.50. The average target implies an downside of 70.93% from the current price of $5.16. More detailed estimate data can be found on the Streamline Health Solutions Inc (STRM) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Streamline Health Solutions Inc's (STRM, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Streamline Health Solutions Inc (STRM, Financial) in one year is $11.17, suggesting a upside of 116.47% from the current price of $5.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Streamline Health Solutions Inc (STRM) Summary page.

STRM Key Business Developments

Release Date: May 02, 2025

- Total Revenue (Q4 2024): $4.7 million, down from $5.4 million in Q4 2023.

- Total Revenue (Fiscal Year 2024): $17.9 million, down from $22.6 million in Fiscal Year 2023.

- SaaS Revenue (Q4 2024): $3.1 million, 66% of total revenue, compared to $3.4 million, 64% of total revenue in Q4 2023.

- SaaS Revenue (Fiscal Year 2024): $11.8 million, 66% of total revenue, compared to $14.1 million, 62% of total revenue in Fiscal Year 2023.

- Net Loss (Q4 2024): $2.1 million, compared to $1.4 million in Q4 2023.

- Net Loss (Fiscal Year 2024): $10.2 million, compared to $18.7 million in Fiscal Year 2023.

- Cash and Cash Equivalents (January 31, 2025): $2.2 million, compared to $3.2 million as of January 31, 2024.

- Booked SaaS ACV (January 31, 2025): $14 million, increasing to $14.6 million by April 30, 2025.

- Outstanding Balance on Revolving Credit Facility (January 31, 2025): $1 million, compared to $1.5 million as of January 31, 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Streamline Health Solutions Inc (STRM, Financial) reported an annualized financial impact of more than $210 million across its client base, showcasing the effectiveness of its solutions.

- The company achieved a Booked SaaS ACV of $14.6 million as of April 30, 2025, with $13.1 million already implemented, indicating strong growth in its SaaS offerings.

- Streamline Health Solutions Inc (STRM) introduced new denial prevention functionality within its evaluator platform, expected to expand inpatient financial impact by more than 15% and potentially double the impact on outpatient cases.

- The company has significantly reduced implementation timelines, with recent evaluator go-lives completed in as little as 42 days, enhancing client satisfaction and operational efficiency.

- Streamline Health Solutions Inc (STRM) is leveraging client success stories and peer-to-peer marketing to drive increased bookings and strengthen its market presence.

Negative Points

- Total revenue for the fourth quarter of fiscal 2024 decreased to $4.7 million from $5.4 million in the same quarter of fiscal 2023, indicating a decline in overall revenue.

- The company reported a net loss of $2.1 million for the fourth quarter of fiscal 2024, compared to a net loss of $1.4 million in the fourth quarter of fiscal 2023, reflecting increased financial challenges.

- Cash and cash equivalents decreased to $2.2 million as of January 31, 2025, from $3.2 million a year earlier, highlighting potential liquidity concerns.

- Streamline Health Solutions Inc (STRM) experienced $700,000 in churn, primarily due to the loss of two clients following acquisitions, impacting its SaaS ACV growth.

- The company discontinued selling its quality module as an independent unit due to unmet booking expectations, indicating challenges in product market fit and resource allocation.