- CareTrust REIT (CTRE, Financial) continues its attractive quarterly dividends with a 4.77% yield.

- Analysts suggest significant potential for price appreciation with an average target implying a 15.30% upside.

- Despite an "Outperform" rating, GuruFocus estimates indicate a possible 22.14% downside.

CareTrust REIT (CTRE) has declared its regular quarterly dividend of $0.335 per share, maintaining steady payout levels. This dividend reflects a forward yield of 4.77% and is scheduled for payment on July 15, with June 30 established as both the record and ex-dividend date. Investors looking for reliable income streams might find this yield attractive.

Wall Street Analysts' Forecast

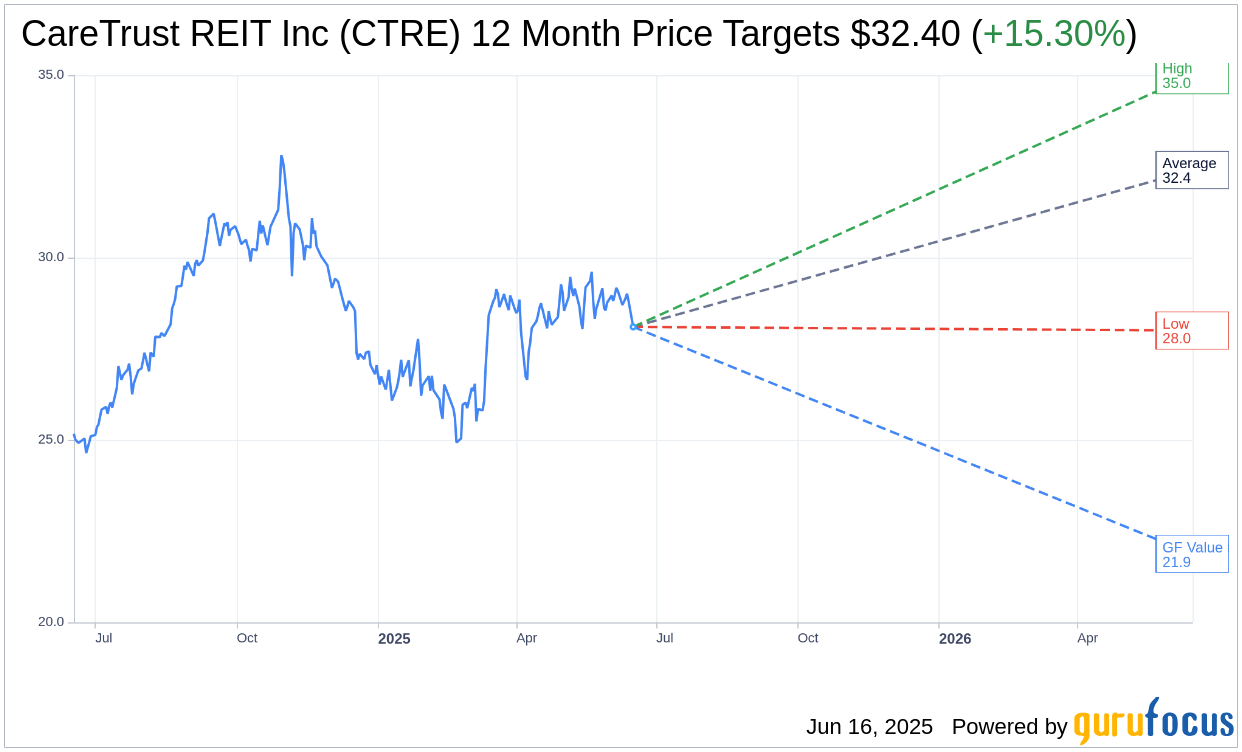

Delving into the opinions of financial analysts, 10 experts have put forth a one-year price target for CareTrust REIT Inc (CTRE, Financial). The average target price stands at $32.40, with projections spanning from a high of $35.00 to a low of $28.00. The consensus target price suggests a potential upside of 15.30% from the current trading price of $28.10, underscoring a promising outlook. For further insights, explore detailed estimates on the CareTrust REIT Inc (CTRE) Forecast page.

Brokerage Recommendations

Current evaluations from 10 brokerage firms place CareTrust REIT Inc (CTRE, Financial) at an average recommendation of 2.0, placing it in the "Outperform" category. The brokerage rating scale ranges from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell recommendation, suggesting a favorable outlook for the stock.

GuruFocus Valuation Insights

According to GuruFocus estimates, the projected GF Value for CareTrust REIT Inc (CTRE, Financial) in one year is $21.88. This indicates a potential downside of 22.14% from its current price of $28.10. The GF Value represents GuruFocus' assessment of the fair market value, taking into account historical trading multiples, prior business growth, and future performance projections. For more in-depth data, visit the CareTrust REIT Inc (CTRE) Summary page.