Market Recap

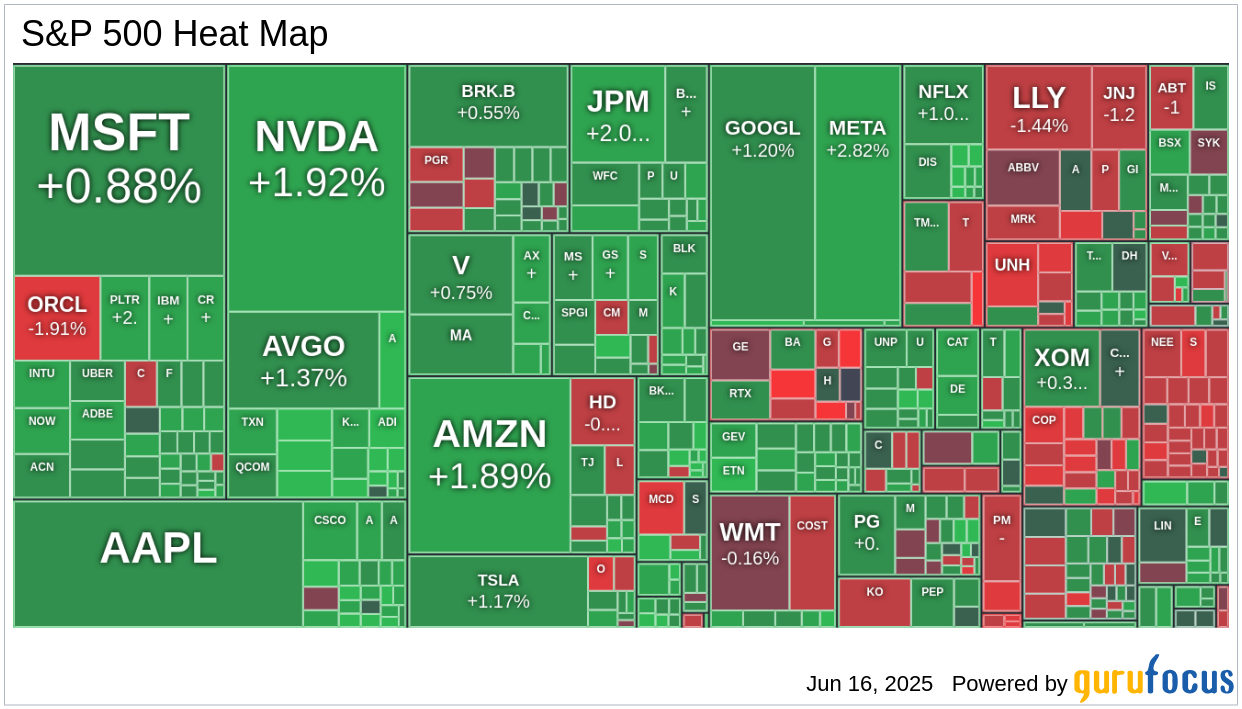

- Today, the stock market recovered some losses incurred last Friday, buoyed by a relatively contained Israel-Iran conflict that hasn't disrupted oil supplies significantly.

- Reports indicate Iran is seeking a ceasefire with Israel through diplomatic channels, although Israel hasn't reciprocated. This situation contributed to a positive market sentiment, particularly at the opening.

- The S&P 500 reached an early high of 6,050, but indices gradually declined through the day, still ending above unchanged levels.

- Mega-cap stocks led gains, with notable performances in information technology (+1.5%), communication services (+1.5%), and consumer discretionary (+1.2%) sectors.

- The Vanguard Mega-Cap Growth ETF (MGK) rose by 1.3%, compared to the S&P 500's 0.9% gain.

Sector and Index Highlights

- Semiconductor stocks excelled, led by Advanced Micro Devices (AMD) surging 8.82% on news of a potential GPU deal with Amazon (AMZN, Financial), pushing the Philadelphia Semiconductor Index up by 3% for the day and 23.3% for the quarter.

- Conversely, defense and energy stocks fell from their previous leadership roles as market concerns about the Israel-Iran conflict eased. The S&P 500 energy sector decreased by 0.3%, mirroring a drop in WTI crude futures.

- Utilities (-0.5%), health care (-0.4%), and consumer staples (+0.02%) sectors also showed relative weakness.

- Advancers outpaced decliners by less than a 2-to-1 margin on the NYSE and Nasdaq, with this margin narrowing as the day progressed.

Global Markets and Commodities

- European indices showed gains, with the DAX up 0.8%, FTSE up 0.32%, and CAC up 0.8%.

- Asian markets experienced increases as well, with the Nikkei rising 1.3%, Hang Seng 0.7%, and Shanghai 0.4%.

- Commodities saw varied movements: Crude oil decreased by $1.33 to $71.83, while natural gas increased to $3.75, gold rose to $3,417.20, silver to $36.46, and copper to $4.84.

Economic Data Review

- The Empire State Manufacturing Survey indicated a weaker-than-expected outcome at -16.0, falling from the previous -9.2 and below the consensus of -6.6. Despite consistent declines in manufacturing activity, firms remained optimistic about the next six months.

AMD,AMZN,MGK

Guru Stock Picks

Vanguard Health Care Fund has made the following transactions:

Stock News

● Santos (OTCPK:STOSF) (OTCPK:SSLZY) received a non-binding takeover proposal from a consortium led by ADNOC, valuing the company at $18.72 billion. The offer of A$8.89 per share marks an increase from previous proposals. Santos, a major oil and gas producer, is on the verge of launching its Barossa project, which will supply LNG to Asia.

● Airbus (OTCPK:EADSF) (OTCPK:EADSY) secured significant orders worth up to $17 billion from Saudi Arabian buyers at the Paris Air Show, overshadowing Boeing's presence. The deals include commitments for A321 and A350 aircraft, reinforcing Airbus's momentum and Saudi Arabia's aviation ambitions.

● Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) faces DOJ scrutiny over its $32 billion acquisition of cybersecurity firm Wiz. The antitrust review could impact the deal's approval, which aims to integrate Wiz into Google's cloud services. The acquisition is part of Alphabet's strategy to enhance its cybersecurity offerings.

● Eve Air Mobility (NYSE:EVEX) (EVEXW, Financial) signed a $250 million contract with Revo for up to 50 eVTOL aircraft. This agreement marks Eve's transition from development to execution, positioning it as a leader in urban air mobility solutions.

● Amazon (NASDAQ:AMZN) and Roku (NASDAQ:ROKU) announced a partnership to create the largest authenticated CTV advertising footprint in the U.S. The integration allows advertisers to reach 80 million U.S. CTV households, enhancing addressability across major streaming platforms.

● Eaton (NYSE:ETN) agreed to acquire Ultra PCS for $1.55 billion. The acquisition will enhance Eaton's aerospace portfolio, with Ultra PCS's innovative solutions expected to be accretive to Eaton's growth and margins.

● Baker Hughes (NASDAQ:BKR) will acquire Continental Disc for $540 million, expanding its pressure management solutions. The acquisition aligns with Baker Hughes's strategy to optimize its portfolio and enhance earnings and cash flow.

● Cantaloupe (NASDAQ:CTLP) agreed to be acquired by 365 Retail Markets for $11.20 per share, valuing the transaction at $848 million. The deal offers a 34% premium to Cantaloupe's stock price and is expected to close in the second half of 2025.

● Supernus Pharmaceuticals (NASDAQ:SUPN) will acquire Sage Therapeutics (NASDAQ:SAGE) for up to $795 million. The acquisition includes a tender offer and contingent value rights, with Sage's depression therapy Zurzuvae being a key asset.

● Nissan (OTCPK:NSANY) plans to reduce its stake in Renault (OTCPK:RNSDF) by 5%, generating approximately $640 million for new vehicle development. Despite the stake reduction, Nissan emphasizes strong partnerships with Renault and Mitsubishi.

● Apple (NASDAQ:AAPL) may face a new charge sheet from the EU over App Store rules unless it addresses alleged violations. The European Commission's ultimatum could lead to further fines if Apple fails to comply with the Digital Markets Act.

● Scale AI's largest customer, Google (NASDAQ:GOOG) (NASDAQ:GOOGL), plans to part ways following Meta's (NASDAQ:META) investment in Scale. The move reflects concerns over data sharing with a competitor, as Meta acquires a significant stake in Scale.

● Victoria's Secret (NYSE:VSCO) faces pressure from activist investor Barington Capital Group to overhaul its board and improve stock performance. Barington calls for strategic changes and sees potential in the company's beauty business.

● Frontier Airlines (NASDAQ:ULCC) selected RTX's (NYSE:RTX) Pratt & Whitney GTF engines for 91 Airbus A321neo aircraft. The order includes a long-term maintenance agreement, expanding Frontier's commitment to GTF-powered aircraft.

● Commerce Bancshares (NASDAQ:CBSH) will acquire FineMark Holdings (OTCQX:FNBT) in a $585 million all-stock deal. The acquisition will expand Commerce's footprint, adding significant assets and wealth management capabilities.

● Freedom Holding (NASDAQ:FRHC) reported FY GAAP EPS of $1.40 and revenue of $2.05 billion, marking a 22.8% increase year-over-year. The company saw significant growth in brokerage and bank accounts, reflecting strong demand for financial services.

● Cisco Systems (NASDAQ:CSCO) shares rose 2% after Deutsche Bank upgraded the stock to Buy, citing improved growth visibility and favorable competitive dynamics. Cisco's valuation remains attractive, with potential for enhanced revenue and earnings growth.

● Southwest Airlines (NYSE:LUV) is equipping its fleet with Honeywell-designed cockpit alert software to enhance runway safety. The software provides pilots with situational awareness, supporting Southwest's commitment to operational safety.

● Meta Platforms (NASDAQ:META) appointed Arun Srinivas as head of its India operations, a key market for the company. Srinivas will focus on driving Meta's strategy and operations amid regulatory challenges in the region.

● NexMetals Mining (OTCQX:PRMLF) appointed Brett MacKay as CFO, succeeding Peter Rawlins. MacKay's appointment is part of NexMetals' strategic leadership changes to support its growth and financial planning.

GuruFocus Stock Analysis

- Meta Brings Ads to WhatsApp Updates Tab by Undercovered Deep Insights

- AMD Shares Rally on GPU Snapback Outlook by Undercovered Deep Insights

- AMD, Palantir Soar as Tech Rebounds on Iran De-Escalation by Nauman khan

- UBS Sees iPhone Demand Pull-Forward, Outlook Softens by Undercovered Deep Insights

- Meta takes 49% of Scale in $14.3 Billion AI deal by Undercovered Deep Insights