Key Takeaways:

- RF Industries (RFIL, Financial) delivered a strong Q2 performance, with earnings and revenue exceeding analyst expectations.

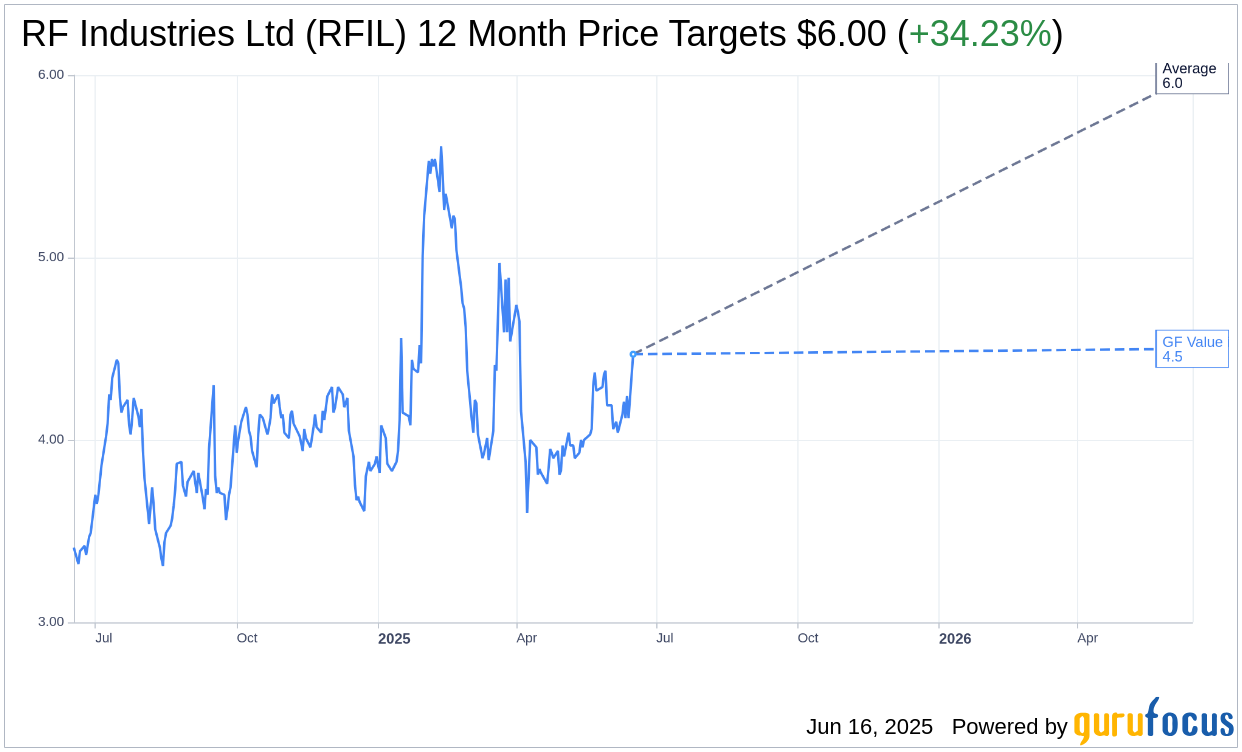

- Analyst projections indicate a significant potential upside, with a price target of $6.00.

- RFIL's current valuation shows a slight upside based on GuruFocus' GF Value estimate.

Robust Q2 Results Propel RF Industries Forward

RF Industries (RFIL) has captured the attention of investors with its impressive second-quarter performance. The company reported a Non-GAAP EPS of $0.07, outpacing expectations by $0.03. Additionally, RFIL achieved a remarkable 17.5% year-over-year revenue increase, reaching $18.91 million, which surpassed estimates by $1.67 million. This financial success has led to a 5.15% increase in RFIL's share price.

Wall Street Analysts' Insights and Projections

The analysis from Wall Street offers a promising outlook for RF Industries Ltd (RFIL, Financial). With projections from one analyst, the average price target for the stock stands at $6.00, uniformly predicted as the high and low estimate. This suggests a notable upside of 34.23% from RFIL's current trading price of $4.47. For more in-depth estimate data, visit the RF Industries Ltd (RFIL) Forecast page.

The consensus recommendation from one brokerage firm positions RF Industries Ltd (RFIL, Financial) at an average brokerage rating of 2.0, indicating an "Outperform" status. On this rating scale, 1 signifies a Strong Buy, and 5 denotes a Sell recommendation.

Assessing RFIL's Valuation with GF Value

Based on GuruFocus' estimates, the projected GF Value for RF Industries Ltd (RFIL, Financial) in one year is $4.50, suggesting a marginal upside of 0.67% from the current price of $4.47. The GF Value is an insightful metric, representing GuruFocus' estimation of the stock's fair trading value. It is calculated using historical trading multiples, past business growth, and future business performance forecasts. For more comprehensive insights, visit the RF Industries Ltd (RFIL) Summary page.