June 17 - Dell Technologies (DELL, Financial) is quietly cementing its role as a key AI infrastructure supplier, with early fiscal 2026 results highlighting a sharp acceleration in enterprise demand. The company reported $12.1 billion in AI server orders during Q1, more than all of last year's, and closed the quarter with a $14.4 billion backlog, a figure that may only scratch the surface of future demand.

What's driving this surge? Dell's Infrastructure Solutions Group (ISG), which includes AI-optimized servers and proprietary storage systems, posted 12% revenue growth year over year, with operating income up 36%. This strength offset ongoing weakness in its Client Solutions Group, where consumer sales fell 16%.

Dell's AI strategy is focused on tailored enterprise solutions, from liquid-cooled server racks supporting hundreds of NVIDIA (NVDA, Financial) GPUs to storage tools optimized for unstructured data. Attach rates are improving, suggesting customers are increasingly bundling networking and storage with their AI server purchases, a positive signal for margins and customer retention.

Management reaffirmed full-year guidance, projecting $15+ billion in AI server shipments, a 50% jump from fiscal 2025. Q2 revenue is expected to rise about 16% YoY at the midpoint.

The company also returned $2.4 billion to shareholders in Q1 and continues to convert over 100% of net income into free cash flow. But rising debt and cautious IT spending among legacy customers remain headwinds.

Still, with partnerships spanning AMD (AMD, Financial), Google (GOOGL, Financial), and NVIDIA, Dell's AI pipeline suggests it's evolving into more than just a legacy PC brand, it's fast becoming an enterprise backbone for the AI era.

Is Dell a Buy Now?

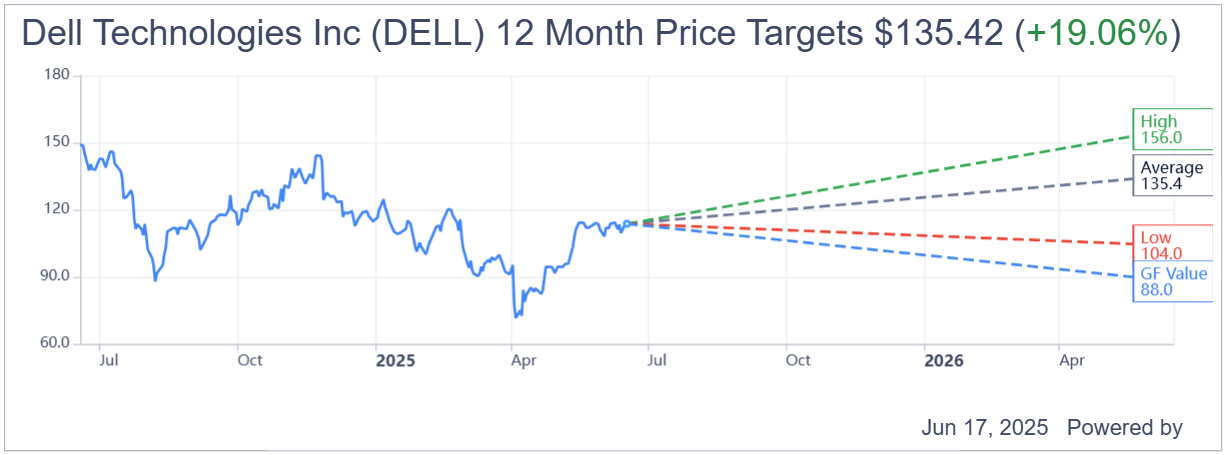

Based on the one year price targets offered by 20 analysts, the average target price for Dell Technologies Inc is $135.42 with a high estimate of $156.00 and a low estimate of $104.00. The average target implies a upside of +19.06% from the current price of $113.74.

Based on GuruFocus estimates, the estimated GF Value for Dell Technologies Inc in one year is $88.03, suggesting a downside of -22.60% from the current price of $113.74