Dyne Therapeutics (DYN, Financial) recently made a strategic move in its clinical trial for DYNE-101, targeting myotonic dystrophy type 1 (DM1). Following a Type C meeting with the FDA, the company decided to shift the primary endpoint of its registrational cohort study. Previously focused on splicing, the new primary measure will be the change from baseline in middle finger myotonia, assessed using vHOT over a six-month period.

This adjustment represents a significant change in their clinical approach and has sparked debate among investors, as noted by analyst Paul Matteis. While the shift has raised some questions, it could potentially simplify the path forward for the company. Despite maintaining a positive outlook with a Buy rating on Dyne shares, the stock experienced a decline, falling $2.69, or 19%, to $11.13 in pre-market trading. The market's reaction underscores the unexpected nature of this development and the cautious stance investors are taking.

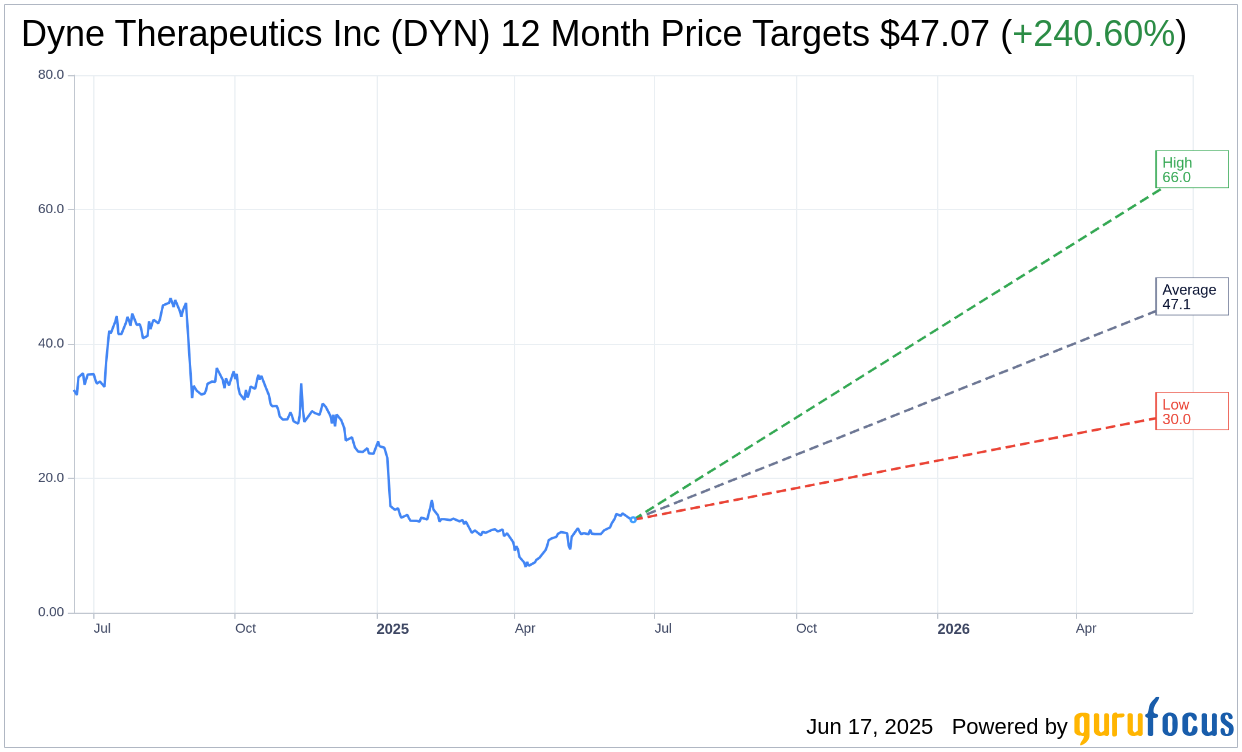

Wall Street Analysts Forecast

Based on the one-year price targets offered by 14 analysts, the average target price for Dyne Therapeutics Inc (DYN, Financial) is $47.07 with a high estimate of $66.00 and a low estimate of $30.00. The average target implies an upside of 240.60% from the current price of $13.82. More detailed estimate data can be found on the Dyne Therapeutics Inc (DYN) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Dyne Therapeutics Inc's (DYN, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.