Dime Community (DCOM, Financial) Bancshares has secured the necessary approvals to proceed with a new branch in Lakewood, New Jersey. The New Jersey Department of Banking and Insurance has given its consent for the branch location at 500 Boulevard of Americas. This follows prior approvals from the Federal Reserve Bank of New York and the New York State Department of Financial Services.

Construction of the new branch is anticipated to begin in the latter half of 2025, with the goal of opening its doors to customers by early 2026. This strategic expansion marks a significant development for DCOM as it continues to broaden its presence and services.

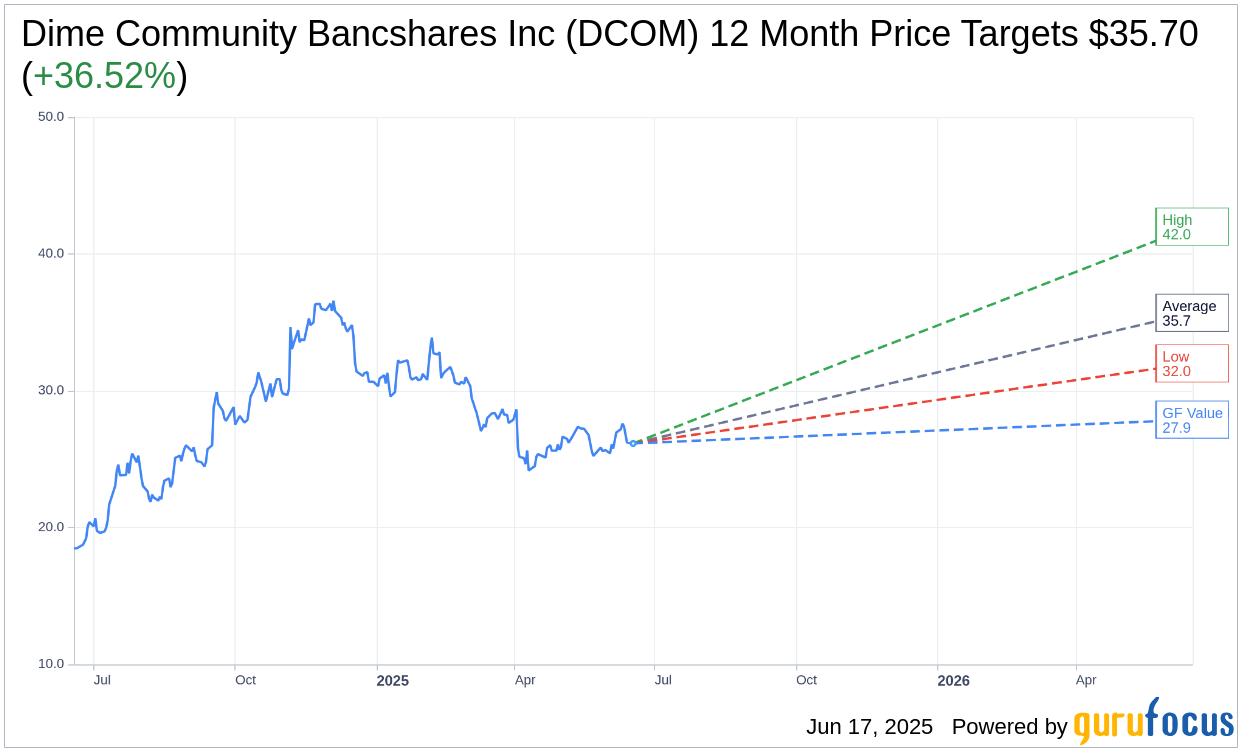

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Dime Community Bancshares Inc (DCOM, Financial) is $35.70 with a high estimate of $42.00 and a low estimate of $32.00. The average target implies an upside of 36.52% from the current price of $26.15. More detailed estimate data can be found on the Dime Community Bancshares Inc (DCOM) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Dime Community Bancshares Inc's (DCOM, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Dime Community Bancshares Inc (DCOM, Financial) in one year is $27.89, suggesting a upside of 6.65% from the current price of $26.15. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Dime Community Bancshares Inc (DCOM) Summary page.

DCOM Key Business Developments

Release Date: April 22, 2025

- Core Deposits: Increased by $1.3 billion year-over-year.

- Cost of Deposits: Reduced to 2.09% in the first quarter.

- Net Interest Margin (NIM): Increased to 2.94%, excluding purchase accounting accretion.

- Business Loans Growth: Increased by over $60 million in the first quarter and over $400 million year-over-year.

- Loan Pipeline: Stands at approximately $1.1 billion with an average yield of 7.22%.

- Core Pre-Tax Provision Income: $46 million in the first quarter, up from $28 million a year ago.

- Adjusted EPS: $0.57 per share, a 36% increase from the previous quarter and a 50% increase year-over-year.

- Non-Interest Income: $9.6 million for the first quarter.

- Credit Loss Provision: $9.6 million for the quarter.

- Net Charge-Offs to Average Loans: Decreased to 26 basis points.

- Allowance to Loans: Increased to 83 basis points.

- Common Equity Tier 1 Ratio: Increased to 11.1%.

- Total Capital Ratio: Grew to 15.7%.

- Core Cash Operating Expenses: $57.9 million for the first quarter, excluding intangible amortization.

- Full Year Core Cash Non-Interest Expense Guidance: Increased to $236.5 million to $237.5 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Core deposits increased by $1.3 billion year-over-year, enhancing the bank's funding position.

- Net interest margin (NIM) improved for the fourth consecutive quarter, reaching 2.9%, with potential for further growth.

- Business loans grew by over $60 million in the first quarter and $400 million year-over-year, indicating strong loan growth.

- Core pre-tax provision income increased significantly to $46 million, translating to a core ROA of 77 basis points.

- The company has successfully recruited new talent, enhancing its ability to grow both deposits and loans.

Negative Points

- The cost of deposits remains relatively high at 2.09%, which could pressure margins if not managed effectively.

- Non-core expenses included a $7 million charge related to a legacy pension plan termination, impacting overall expenses.

- Loan growth was flat in the first quarter, with expectations for growth only in the latter half of the year.

- The company faces a competitive deposit market, which could challenge efforts to maintain low-cost funding.

- There is uncertainty regarding the impact of potential Federal Reserve rate cuts on the bank's financial performance.