Following a recent proxy battle and boardroom fight, activist investor Elliott Management is well on its way to oversee an unlocking of substantial value trapped by Phillips 66's (PSX, Financial) conglomerate structure. This article will look at what has happened between Phillips 66 and Elliott Management and what I expect to happen going forward.

Phillips 66, which was spun off from ConocoPhillips (COP) in 2012 is operates in the Oil & Gas Refining & Marketing sector. The term “Refining & Marketing” can also be known as “Downstream” in the oil and gas

industry. As at the end of Q1 2025, Phillips 66 had five operating segments: Midstream, Chemicals, Refining, Marketing and Specialities, and Renewable Fuels.

By contrast, larger peer Marathon Petroleum (MPC, Financial) has three operating segments: Refining & Marketing, Midstream, and Renewable Diesel. Its midstream operations are primarily conducted through MPLX (MPLX), a master limited partnership listed on the New York Stock Exchange under the ticker MPLX. Marathon Petroleum owns the general partner and a majority limited partner interest in MPLX.

Valero Energy (VLO, Financial), another PSX peer also has just three operating segments: Refining, Renewable Diesel, and Ethanol.

If we look at ExxonMobil's (XOM) downstream business, which Exxon calls Product Solutions, it consists also of three segments: Energy Products, Chemical Products, and Specialty Products.

Midstream companies tend to run as separate entities, operating in the Oil & Gas Storage & Transportation sub-sector. Examples would include MPLX, or Kinder Morgan (KMI), or Williams (WMB).

So, a very simplistic view would suggest Phillips 66 operates in an unwieldy manner. This typically causes a conglomerate discount, which activist investor Elliott is known for attacking.

Background of Elliott's involvement

According to Elliott's April 28, 2025 presentation titled Streamline 66: Elliott's Perspectives on Value Creation

In September 2023, Elliott approached Phillips 66 with a clear message: its assets were significantly undervalued and underperforming. Initially, the Company acknowledged challenges, particularly in refining, reaffirmed its $14 billion mid-cycle EBITDA target and the Executive Chairman announced his retirement. Elliott released a statement stating the Company leadership deserved investor support so long as they demonstrated meaningful progress against their targets over the following year, but if performance did not improve more change would be needed.

To support long-term value creation, Elliott sought to enhance the Board by adding two directors with relevant industry expertise. Yet cooperation quickly stalled. Despite the quality of the candidates proposed, Phillips 66 was slow to act and ultimately rejected several well-qualified individuals. Only after Elliott formally submitted nominations did the Company appoint Bob Pease to the Board in February 2024. In addition, throughout 2024 the Company's operating performance deteriorated and the Company continues to be woefully short of its EBITDA target.

Since February 2025, Elliott has been more public about its

position, with a campaign called Streamline 66. Its goals, according to the Perspectives

on Value Creation presentation, were fourfold:

- Improve accountability of Phillips 66's management by adding credible directors with a mandate for change

- Unlock substantial value trapped by Phillips 66's conglomerate structure

- Refocus the Company on operational excellence by adding deep industry expertise to the Board

- Instill a culture of ambition where Phillips 66 aims to be the top performing refining company in the world

Elliott's core idea is that Midstream should trade at about 9-12x EBITDA, while Refining and Chemicals should trade at 6-7x EBITDA. Elliott notes that PSX trades like a refiner, therefore undervaluing the Midstream

business, due to a large conglomerate discount. Elliott is also saying that PSX's refining profitability dramatically lags peers. According to the Perspectives on Value Creation presentation, Elliott also used a third-party refining industry analytics firm, Baker & O'Brien and its PRISM Model “to help understand the intrinsic profitability” of Phillips 66's refinery assets relative to its actual results and peers.

Before I came a full-time investor, I used to work in oil trading, and Baker & O'Brien PRISM Model was a sophisticated tool to understand how refineries could optimize their performance. So, it is quite impressive that Elliott has utilized this in their analysis of PSX's refining business. The Perspectives on Value Creation presentation slides 80 through 87 analyse PSX's regional competitiveness and concludes that PSX's refining assets are “comparable to peers Marathon and Valero – its underperformance is primarily driven by poor

operational execution, rather than the quality of the assets.”

Elliott's track record

But why should we care about what Elliott thinks? Well, Elliott has recent form in Refining & Marketing where it started an engagement with Marathon Petroleum in 2019 which resulted in a new executive leadership, the sale

of Speedway to 7-Eleven for about $17 billion, and improved operating performance with proceeds used to repurchase its own shares. The stock has risen dramatically in the last five years.

Elliott also pushed other large companies to realize value from their conglomerate discounts. Two recent examples I have followed include GSK plc (GSK) where in 2021 it called for a full separation of its Biopharma

and Consumer Health businesses, resulting ultimately in Haleon plc (HLN) being spun out into an independent Consumer Health business.

In 2017 Elliott began pushing for BHP plc (BHP) to unify its dual-listed structure and for the metals and mining company to exit its petroleum business. By 2021, BHP moved its primary listing to Sydney, removing its complex dual-listed structure, and became a more streamlined and focused mining company, returning substantial funds to shareholders.

Elliott's Proxy Drive

Following more than a year of apparently contentious engagement, Elliott started a proxy fight to replace four board members at the 2025 shareholder meeting. While the campaign was backed by the three main proxy

advisory firms ISS, Glass Lewis and Egan-Jones, Phillips 66's largest passive investors (BlackRock, Vanguard, State Street), who sided with the company. This is likely because many of the shares held by BlackRock, Vanguard, State Street are in index tracking vehicles – PSX is a S&P 500 constituent – and they don't tend to ever vote against managements.

In my opinion each of the four board members Elliott was proposing were highly qualified to sit on the board of a Refining & Marketing company.

Voting Results

On May 21, 2025, the proxy contest concluded with a split result. Elliott won two board seats for Sigmund Cornelius and Michael Heim and PSX won the other two seats, for Bob Pease and Nigel Hearne.

The case of Bob Pease is interesting. He was originally blessed by Elliott joining PSX's board in February 2024, but a year later, Elliott wanted him replaced. In a letter to shareholders Mr Pease said “I do not know why Elliott now wants me off the Board”. But Elliott wrote in its Perspectives on Value Creation presentation that “Mr. Pease has failed to acknowledge Phillips' clear performance issues and has adopted the Company's empty,

self-congratulatory rhetoric.”

GuruFocus News also noted that a proposal to "declassify the Board of Directors over a three-year period was not approved" by the shareholders. Also, a “non-binding shareholder proposal requesting the Board to

adopt a policy requiring directors to submit a resignation letter effective at the next annual meeting” was not approved.

Elliott wanted PSX to have board membership voted on each year, as is best practise for corporate governance but this was rejected in the vote.

Elliott in a press release following the vote said it “will continue to actively engage with the Company while holding management and the Board accountable for delivering on their commitment to improve shareholder

value.”

Governance

As we have seen before, Elliott is a patient activist investor. The two board members they have managed to get on the board Sigmund Cornelius and Michael Heim are industry veterans.

Cornelius is a former Chief Financial Officer of ConocoPhillips, and was previously on the board of Chevron Phillips Chemical Company, now a PSX joint venture with Chevron (CVX) which Elliott wants PSX to divest. Cornelius in an Elliott presentation said of his priorities upon joining the board: “It's a different structure than Marathon or Valero – and they have been the better performers. I will insist that we take a harder look at this structure.”

Heim is one of the founders and former President and Chief Operating Officer of Targa Resources (TRGP) which is an important midstream company and one of the New York Stock Exchange's largest stocks in the Oil & Gas Storage & Transportation subsector. Heim served in “numerous executive leadership roles over the course of over 16 years” at Targa and said in an Elliott presentation “Midstream businesses can be growth engines, but they need the right structure to compete. Phillips' midstream business is constrained in so many ways in the current structure. I think people will be amazed at what is possible with these assets.”

Valuation

So, it's clear to me that Elliott will still push hard for a separation of PSX's midstream segment. With a consensus Midstream segment EBITDA of about $4.1 billion, and at a 9.7x multiple Elliott sees Midstream achieving gross proceeds of about $39.5 billion.

The TEV/EBITDA multiple of 9.7x is based on an average of Midstream peers Enterprise Products Partners (EPD), MPLX, ONEOK, Inc (OKE), and Targa Resources.

It also sees a sale of CPChem grossing $13 billion, which is derived as a mid-cycle EBITDA of $1.9 billion at a TEV/EBITDA multiple of 6.4x using Dow Inc (DOW) and LyondellBasell Industries (LYB) as peers, plus $750 million in saved outlay on capex for a CPChem expansion project.

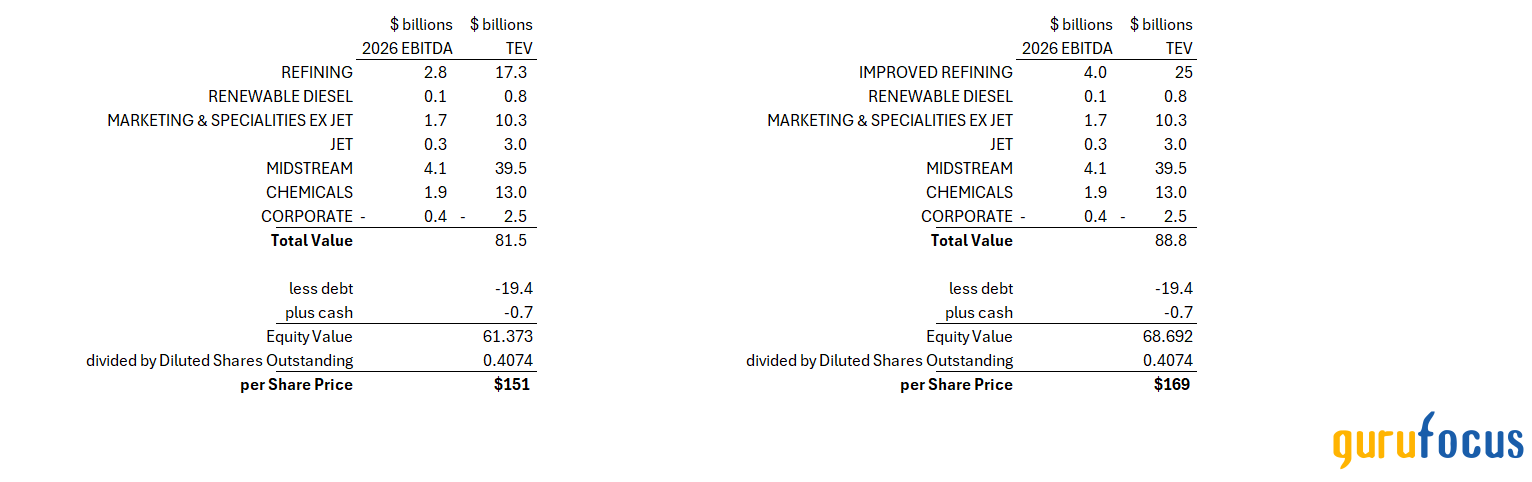

On Elliott's calculations (slide 133 of Perspectives on Value Creation) PSX could be worth between $151 and $169 per share in the near term, based on a sum of the parts valuation:

Source: Elliott's Perspectives on Value Creation, April 28, 2025 / The City Letter

Note that PSX announced in May it is selling JET business in Germany and Austria $2.8 billion enterprise value, which is close enough to Elliott's $3.0 billion enterprise value assumption. This sale is an indication that PSX is already taking on board some of Elliott's demands.

Refining

Assuming PSX spins Midstream at $39-40 billion, then the key for the $169 price target is if PSX can achieve refining EBITDA per barrel at parity with Valero, based on 2026 expected throughput. The Baker & O'Brien refining assets analysis suggests that "the kit", the refinery systems themselves, can do this. It's now just a question of management ambition. It may have been better had Brian Coffman been nominated to the board, given his refining expertise, but I expect Elliott will monitor this and revisit it in the future if improvements don't start coming through.

What is Phillips 66 GF Score? How about the Moat?

Phillips 66 has the GF Score of 72, which implies that the company is “Likely to have average performance”. Without Elliott shaking things up, that's probably what could be expected going forward.

Meanwhile Marathon Petroleum has a GF Score of 80 and Valero Energy has a GF Value score of 78. PSX underperforms mainly because it scores a Growth Rank of 2/10. The Growth Rank is scored through revenue growth and EBITDA growth. PSX's lower growth rank aligns with Elliott's point that PSX has been underperforming and could do better with renewed management drive and better refining performance.

Like Marathon Petroleum, PSX has a Moat score of 7, which means “Entry-level wide moat, clearly possessing durable advantages” This also confirms Elliott's thesis that PSX has a lot of potential if management can be

shaken up.

Risks

As minority investors, we can almost freeride on the back of Elliott. The only things to note are that Elliott could walk away at any time, although I think that is unlikely and that Elliott may have some macro hedges in place – founder Paul Singer told the In Good Company podcast earlier this year that that is usually the case in their investments. This means Elliott may be less exposed to the macro risks that are inherent in PSX: refining and chemical margins and midstream volumes. So, any standalone investment, without hedges, would incur these risks. In my opinion, as part of a diversified portfolio, a minority investor can bear these risks and look to

realize the significant upside that Elliott is looking to squeeze out, which at the time of writing is about 30%.

Conclusion

Elliott has a strong track record of patiently encouraging and sometimes forcing companies to rid their conglomerate discount through business spin-offs and changes at the board and executive management level.

The May 2025 annual shareholder vote was a partial victory for Elliott and I expect the new board members Sigmund Cornelius and Michael Heim to put forth the case to spin out the PSX Midstream business, which may take 12-18 months to fully execute.

Investors can afford to wait for this value to be realized over time. PSX has an Altman Z-score of 3.43 which is strong and means there is no immediate financial danger.