Significant bullish option activity has been observed in Frontline (FRO, Financial), as approximately 9,966 call options changed hands, marking four times the anticipated level. The implied volatility has risen nearly 9 percentage points, reaching 50.84%. Particularly active are the June 2025 $21 calls and the July 2025 $20 calls, with combined volumes nearing 5,100 contracts for these two strikes. The Put/Call Ratio stands at a low 0.03, indicating a pronounced preference for call options. Investors are looking ahead to the company's earnings announcement scheduled for August 29th.

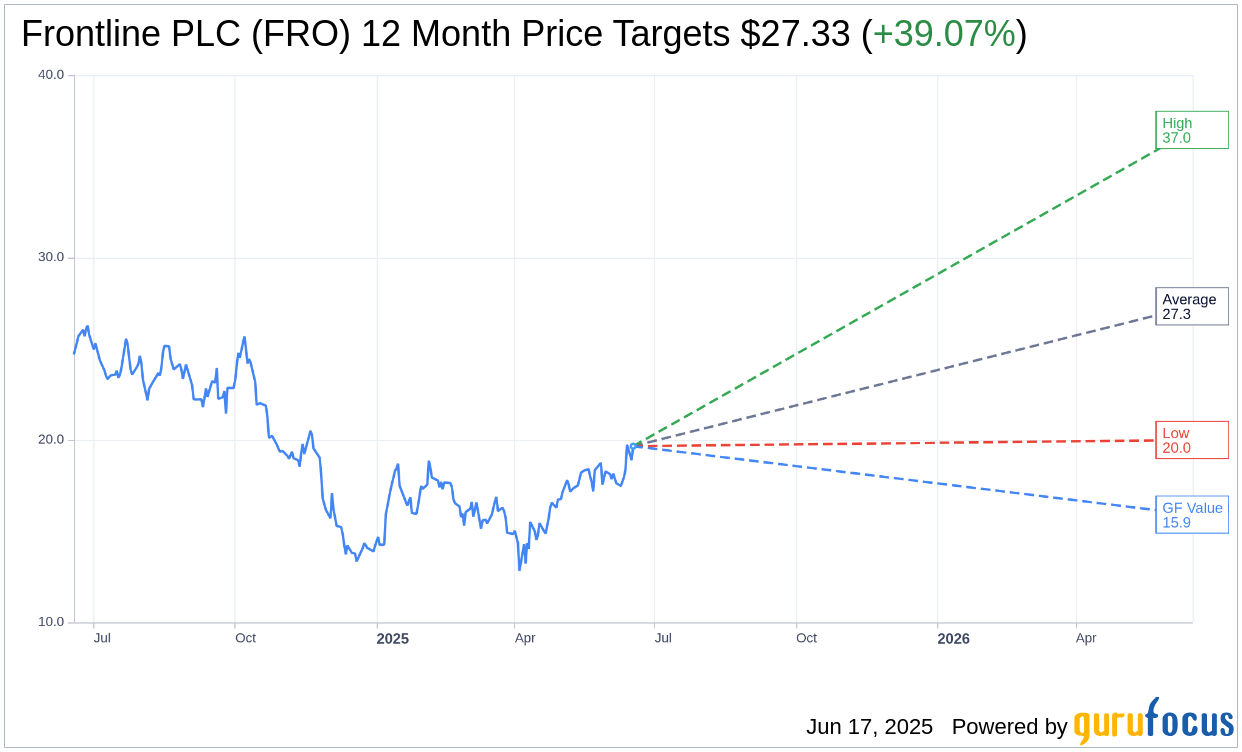

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Frontline PLC (FRO, Financial) is $27.33 with a high estimate of $37.00 and a low estimate of $20.00. The average target implies an upside of 39.07% from the current price of $19.66. More detailed estimate data can be found on the Frontline PLC (FRO) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Frontline PLC's (FRO, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Frontline PLC (FRO, Financial) in one year is $15.91, suggesting a downside of 19.05% from the current price of $19.655. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Frontline PLC (FRO) Summary page.

FRO Key Business Developments

Release Date: May 23, 2025

- VLCC TCE Rates: $37,200 per day in Q1 2025; 68% booked at $56,400 per day for Q2.

- Suezmax TCE Rates: $31,200 per day in Q1 2025; 69% booked at $44,900 per day for Q2.

- LR2/Aframax TCE Rates: $22,300 per day in Q1 2025; 66% booked at $36,100 per day for Q2.

- Profit: $33.3 million or $0.15 per share in Q1 2025.

- Adjusted Profit: $40.4 million or $0.18 per share in Q1 2025.

- Time Charter Earnings: Decreased from $249 million in the previous quarter to $241 million in Q1 2025.

- Cash and Liquidity: $805 million in cash and cash equivalents as of March 31, 2025.

- Fleet Composition: 41 VLCCs, 22 Suezmax tankers, 18 LR2 tankers; average age 6.8 years.

- Cash Breakeven Rates: $29,700 per day for VLCCs, $24,300 per day for Suezmax, $23,300 per day for LR2s.

- OpEx Expenses: $8,400 per day for VLCCs, $8,000 per day for Suezmax, $8,200 per day for LR2s; Q1 fleet average $8,300 per day.

- Cash Generation Potential: $332 million or $1.49 per share, with a 30% increase from current spot market potentially doubling cash generation.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Frontline PLC (FRO, Financial) achieved strong TCE rates in Q1 2025, with VLCCs at $37,200 per day, Suezmax at $31,200 per day, and LR2/Aframax at $22,300 per day.

- The company has a solid balance sheet with $805 million in cash and cash equivalents, and no significant debt maturities until 2030.

- Frontline PLC (FRO) operates a modern fleet with an average age of 6.8 years, consisting of 99% ECO vessels, enhancing operational efficiency.

- The company has substantial cash generation potential, with a projected $332 million or $1.49 per share, which could increase by 100% with a 30% spot market rise.

- Frontline PLC (FRO) benefits from a growing demand for compliant tonnage as sanctions widen, potentially increasing market opportunities.

Negative Points

- Adjusted profit in Q1 2025 decreased by $4.7 million compared to the previous quarter, primarily due to lower TCE rates.

- Operating expenses increased, with ship operating expenses at $60.3 million, reflecting higher costs compared to previous quarters.

- The tanker market faces uncertainties due to geopolitical tensions, including potential impacts from US policy changes and sanctions.

- Frontline PLC (FRO) is trading at a discount to NAV, indicating potential undervaluation despite a positive industry outlook.

- The company faces challenges in monetizing older vessels due to market dynamics and compliance concerns, limiting asset sales opportunities.